Search results

79 results found.

79 results found.

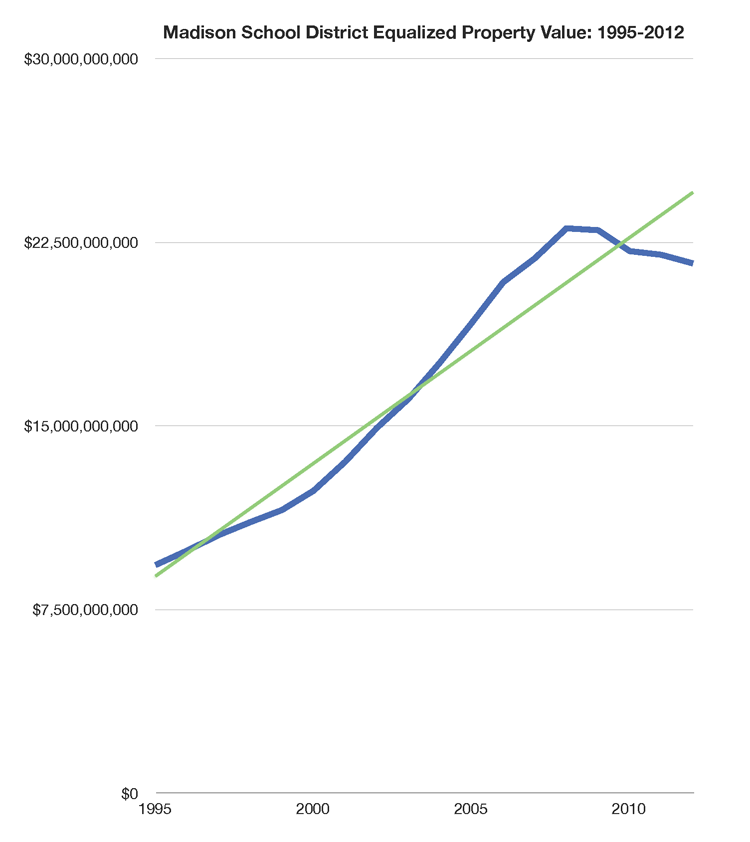

The Madison School District is considering another property tax increase referendum for the upcoming November election.

We’ve long spent more than most districts (“plenty of resources”), despite challenging academic outcomes. I thought it might be useful to revisit the choices homeowners and parents make. I’ve compared two properties, one in Middleton (2015 assessment: $257,500.00) and the other in Madison (2015 assessment slightly less: $249,300.00).

A Middleton parent/homeowner pays less over the years, with the difference growing significantly in recent times (note that my example Madison property features a 3.2% lower assessed value).

Tap to view a larger version of these images.

It is useful to review the assumptions in the District’s limited 2017-2019 budget disclosure document (lacks total spending….) 900K PDF. Related memo and proposed language.

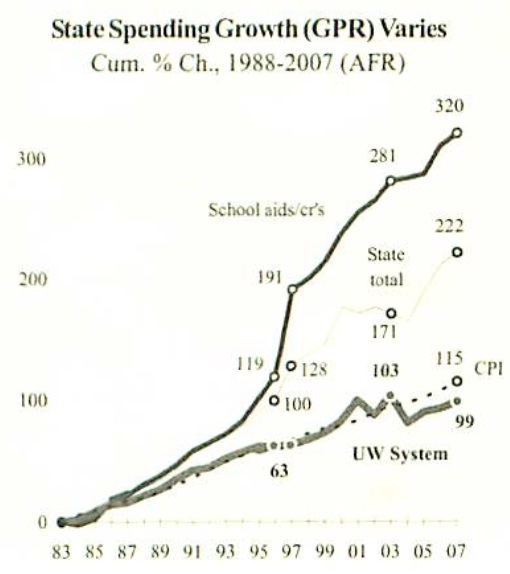

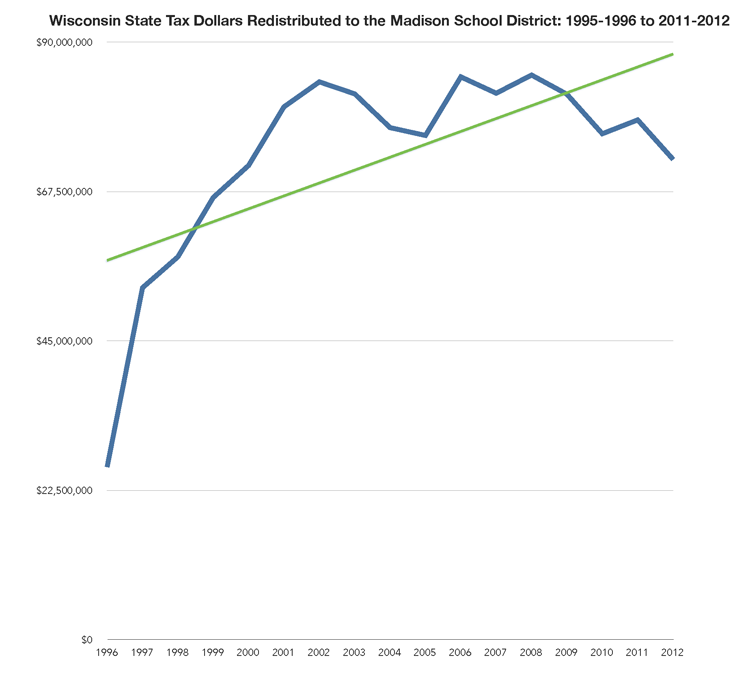

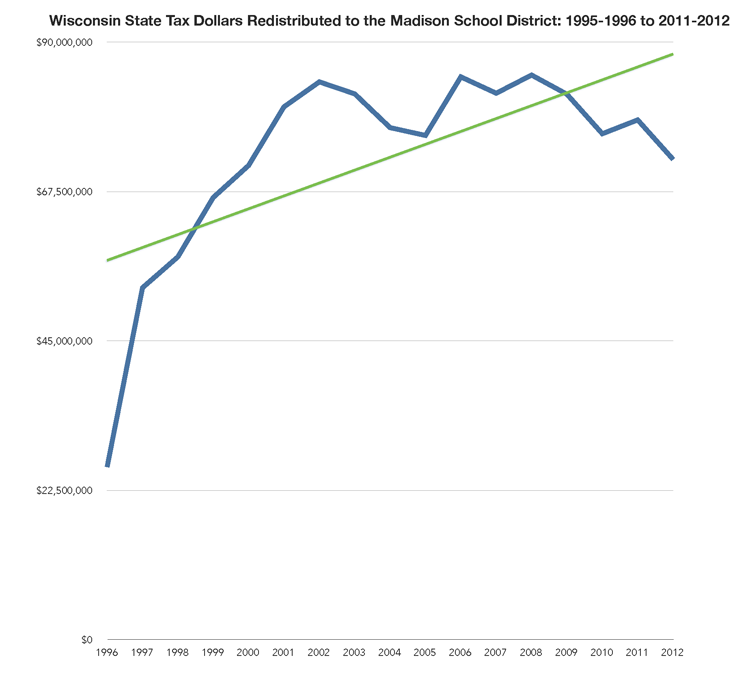

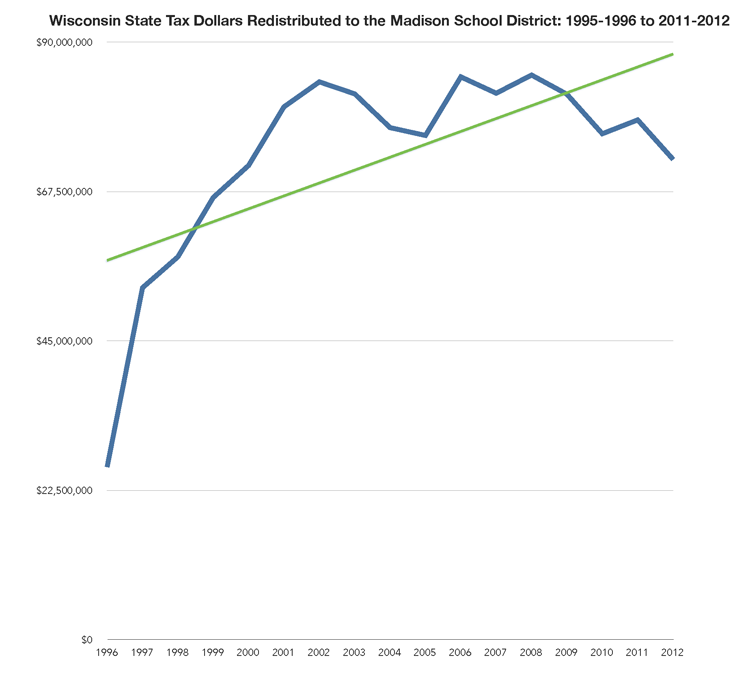

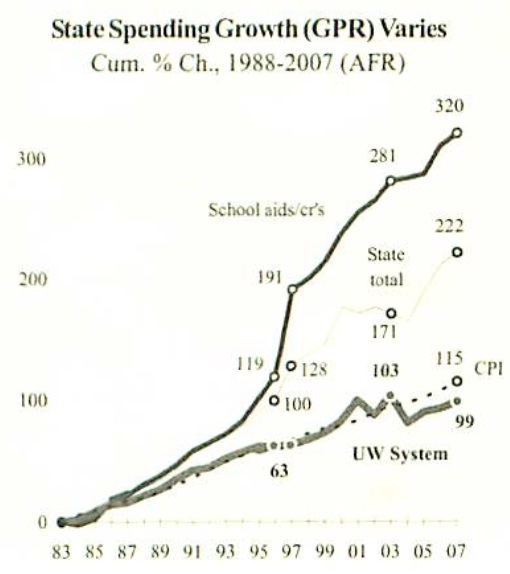

Wisconsin redistributed taxpayer K-12 (and higher ed) spending: 2004-2014. Details below:

Tap for a larger version. Excel or Numbers versions.

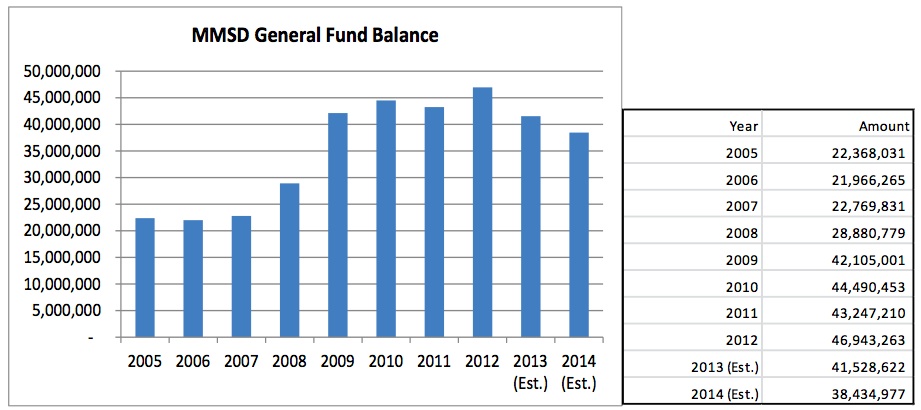

Madison Schools’ 2013-2014 budget, charts, documents, links, background and missing numbers:

Where have all the students gone?

In closing, I’ve found that full budget information is much easier to find and review from Boston (spends more, but has lots of student choice) and Long Beach (spends quite a bit less per student, but offers more student choice).

Superintendent Jennifer Cheatham mentioned Boston and Long Beach as urban districts that have narrowed the achievement gap. Both districts offer a variety of school governance models, which is quite different than Madison’s long-time “one size fits all approach”.

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Related links: Madison’s taxpayer supported K-12 tax and spending history. Madison spends around 18.5 to 20K per student, depending on the district documents reviewed (some include all referendum spending).

Middleton taxpayers spent $90,989,198 for 7,437 students during the 2018-2019 school year or $12,239 per student. Madison spends at least 50% more per student. Yet.

I pondered this while considering Chicago’s property tax growth problems.

Sources:

Department of Numbers.

City of Madison Assessor Reports

Related:

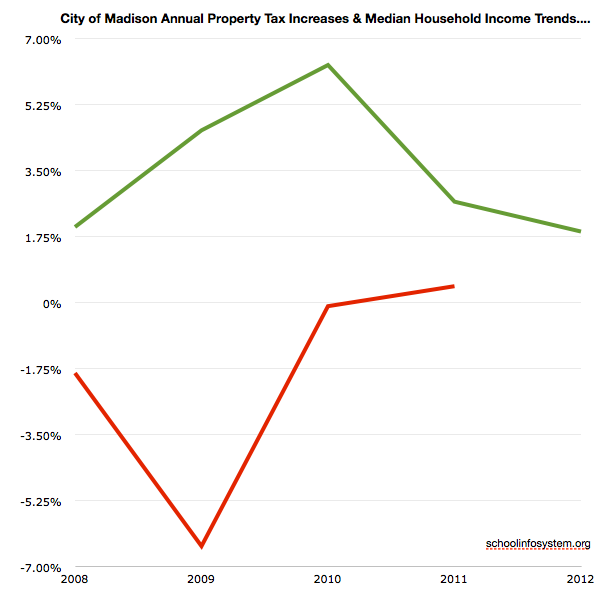

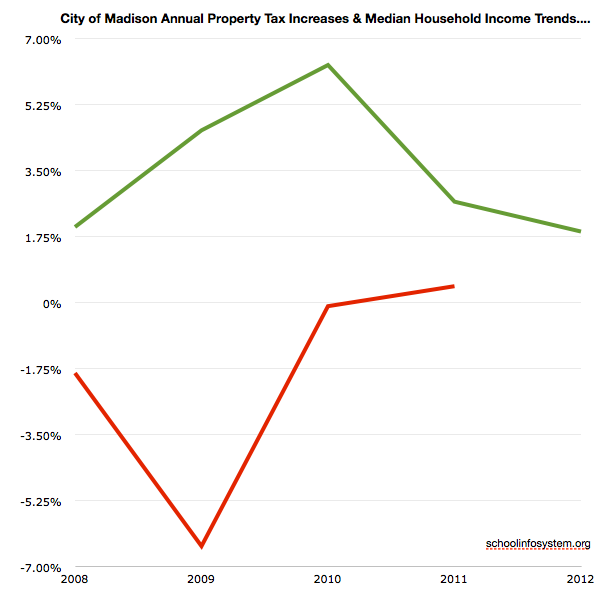

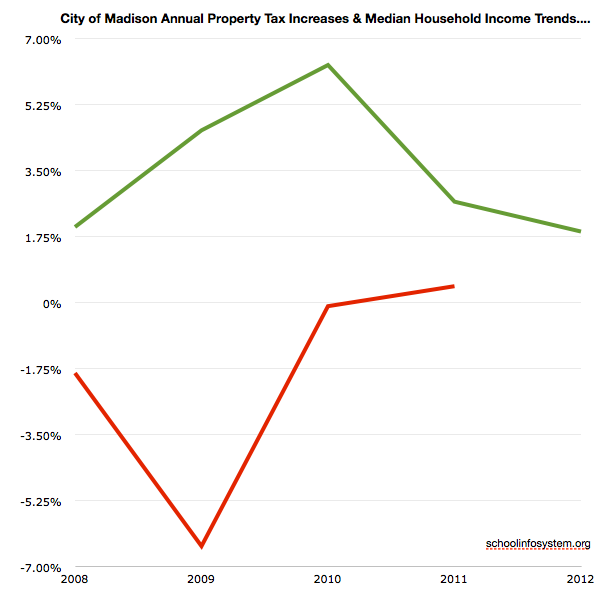

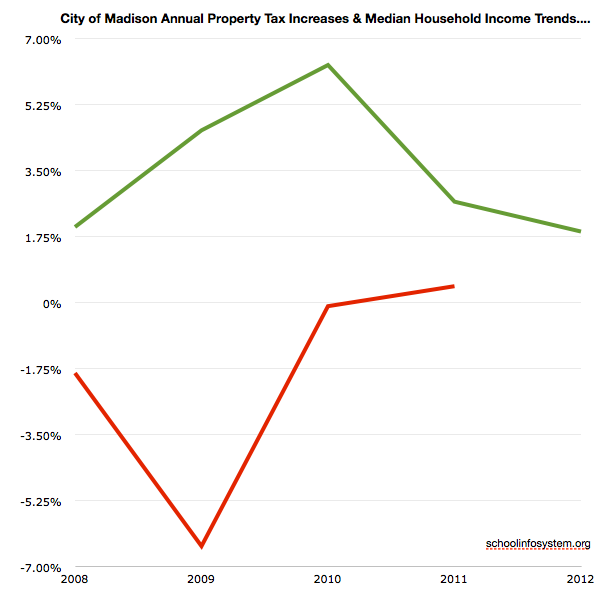

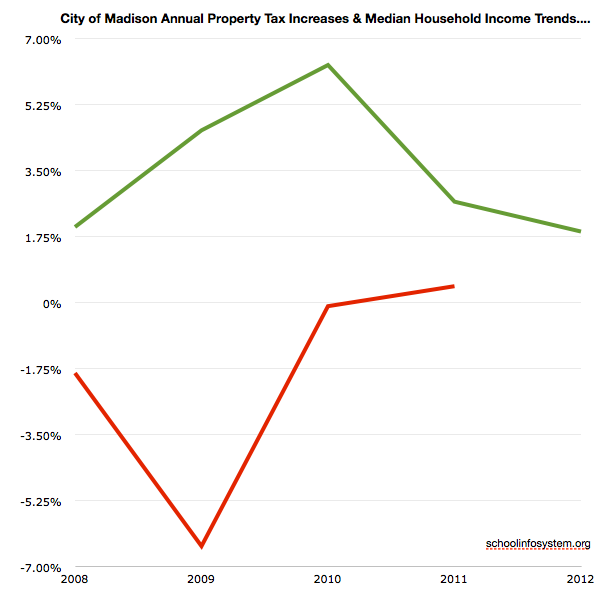

August, 2006 (Deja-vu): Property Taxes Outstrip Income.

Budget Cuts: We Won’t Be as Bold and Innovative as Oconomowoc, and That’s Okay.

Madison Schools’ 2013-2014 Budget Charts, Documents, Links, Background & Missing Numbers.

Madison’s long-term disastrous reading results.

The Hated Property Tax: Salience, Tax Rates, and Tax Revolts.

Levying the Land.

Revenue Potential and Implementation

Challenges (IMF PDF).

Tax Policy Reform and Economic Growth (OECD).

Stagnant School Governance; Tax & Spending Growth and the “NSA’s European Adventure”.

Analysis: Madison School District has resources to close achievement gap.

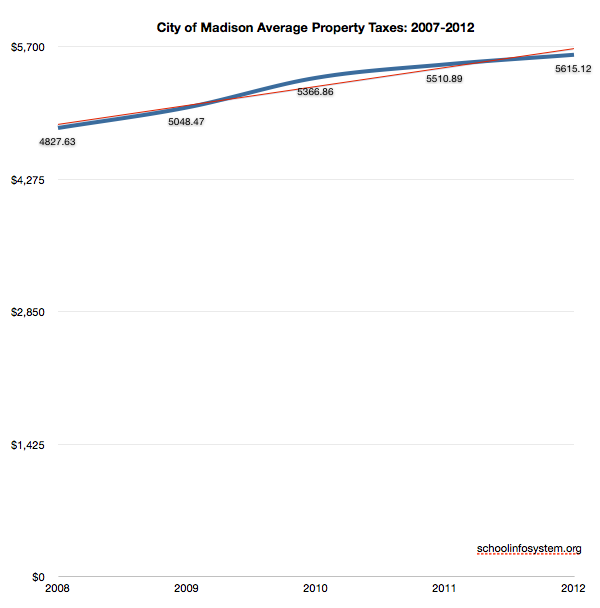

A Middleton home paid $4,648.16 in 2012 while a Madison home paid 16% more, or $5,408.38. Local efforts to significantly increase property taxes may grow the gap with Middleton..

Madison School Board Member Ed Hughes:

Here in Madison, our attention is primarily focused on our troubling achievement gaps, and those gaps are achingly apparent in the new WKCE scores. Under new superintendent Jen Cheatham’s leadership, we’ll continue to pursue the most promising steps to accelerate the learning of our African-American, Latino and Hmong students who have fallen behind.

At the same time, we also need to continue to meet the needs of our students who are doing well. I am going to focus on the latter groups of students in this post.

In particular, I want to take a look at how our Madison students stack up against those attending schools in other Dane County school districts under the new WKCE scoring scale. The demographics of our Madison schools are quite a bit different from those of our surrounding school districts. This can skew comparisons. To control for this a bit, I am going to compare the performance of Dane County students who do not fall into the “economically disadvantaged” category. I’ll refer to these students as “non-low income.”

I took a quick look at property taxes in Middleton and Madison on a $230,000 home. A Middleton home paid $4,648.16 in 2012 while a Madison home paid 16% more, or $5,408.38. Local efforts to significantly increase property taxes may grow the gap with Middleton.

Local governments are failing at the basic task of accurately assessing property values, and there is a clear and striking pattern: More expensive properties are undervalued, while less expensive properties are overvalued. The result is that wealthy homeowners get a big tax break, while less affluent homeowners are paying a higher price for the same public services.

Let’s Compare: Madison and Middleton Property Taxes

The police aren’t policing and the teachers aren’t teaching. While many vital services aren’t functioning, the useless machinery of the bureaucracy grinds on with no one to pay for it. Locked down businesses don’t generate revenues and the unemployed aren’t a tax base.

Tax revenues in New York City fell 46% in June. A third of small businesses in the city are likely to shut down for good and sales tax collections are down by a quarter amounting to $1.2 billion.

Statewide, there’s a 37% drop, and Rep. Alexandria Ocasio-Cortez and other lefties are calling for higher taxes on the rich, staging protests outside the homes of billionaires. But the wealthy have the resources to pick up and leave while leaving failing states like New York with nothing.

Nothing except a $14 billion deficit and an 8.2% GDP drop.

“You have 100 billionaires. You will have to tax every billionaire half a billion dollars to make it up. You know what that means? That means you have no billionaires,” Governor Cuomo noted.

But the news is bad everywhere.

State revenue shortfalls are heading toward $200 billion and over $500 billion by 2022 as the wealthy flee urban areas, tourists are banned from even thinking about visiting, and businesses keep going out of business.

“If I stay there, I pay a lower income tax, because they don’t pay the New York City surcharge.”

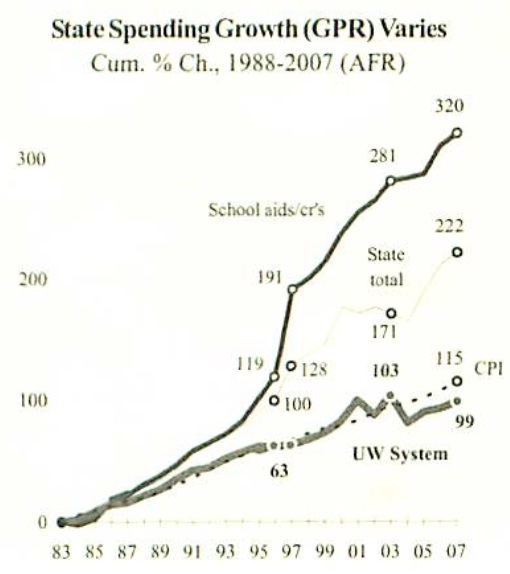

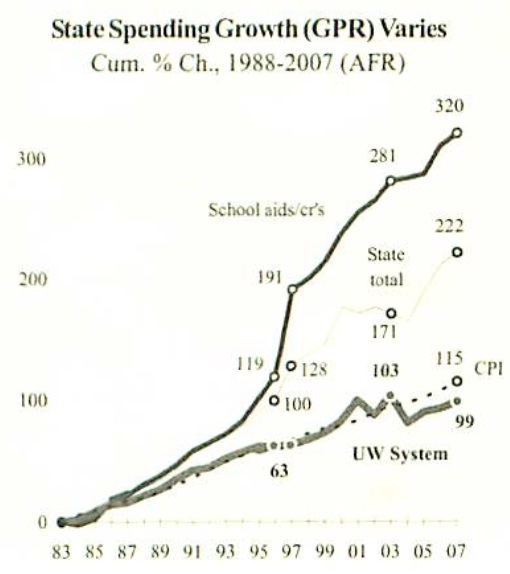

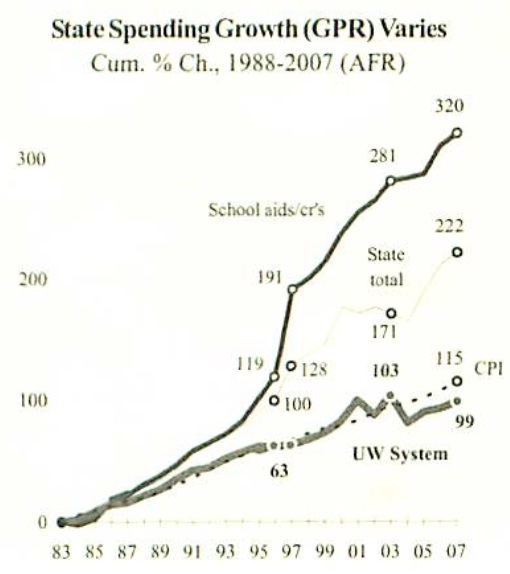

Costs continue to grow for local, state and federal taxpayers in the K-12 space, as well:

Let’s compare: Middleton and Madison Property taxes:

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

Breaking away from Madison’s recent decision to remove police officers from its schools, the Middleton-Cross Plains School Board on Monday voted to extend its contract for school resource officers.

Citing the need for relationship building between officers and students and protection from school shootings, the board voted unanimously to re-approve the contract with the Middleton Police Department. But board members said the district would conduct a “comprehensive evaluation” of the program.

The board had already approved on June 22 contracts with Middleton and the village of Cross Plains to continue stationing officers at Middleton High School and Kromrey and Glacier Creek middle schools. Middleton officers have been at the high school and Kromrey for some 30 and 20 years, respectively.

Let’s compare: Middleton and Madison Property taxes:

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides. (

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

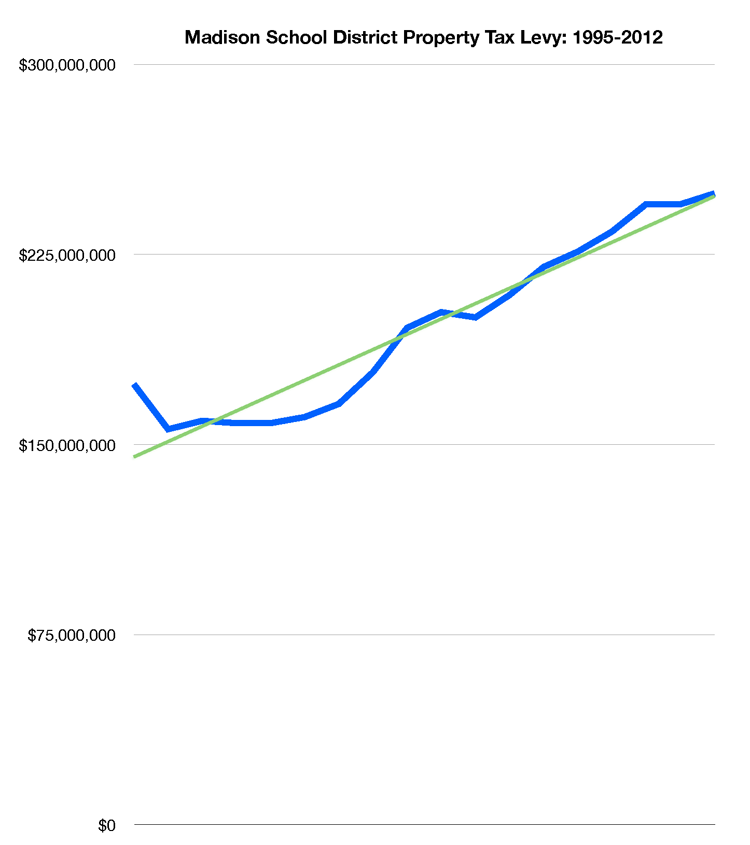

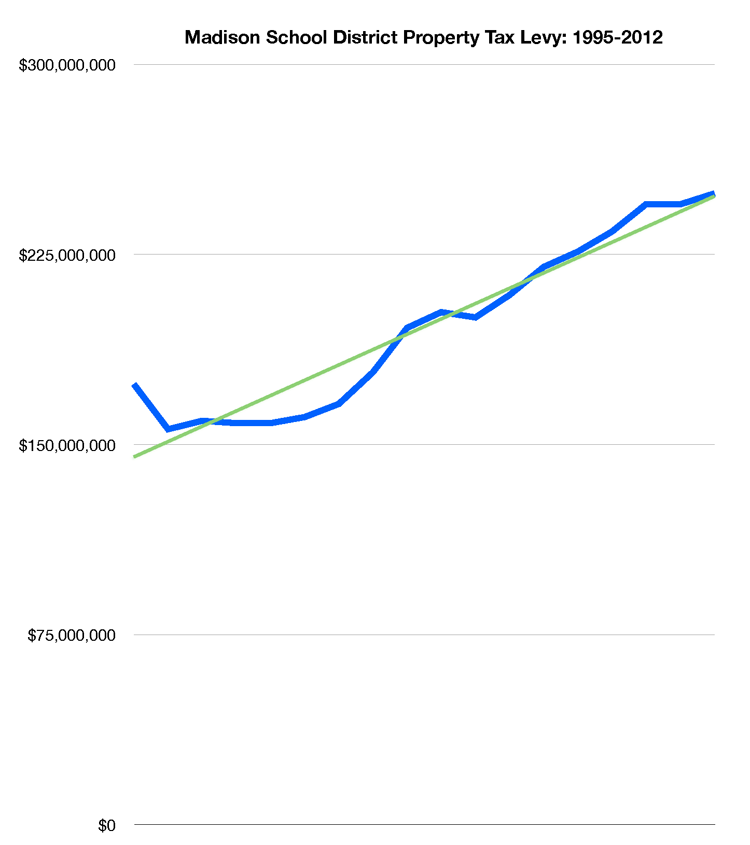

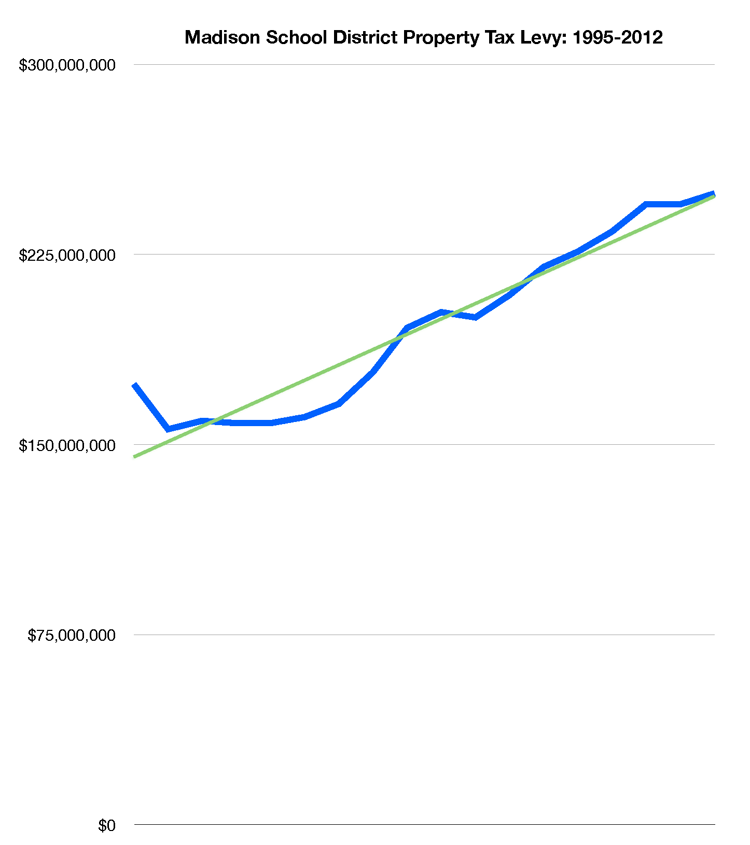

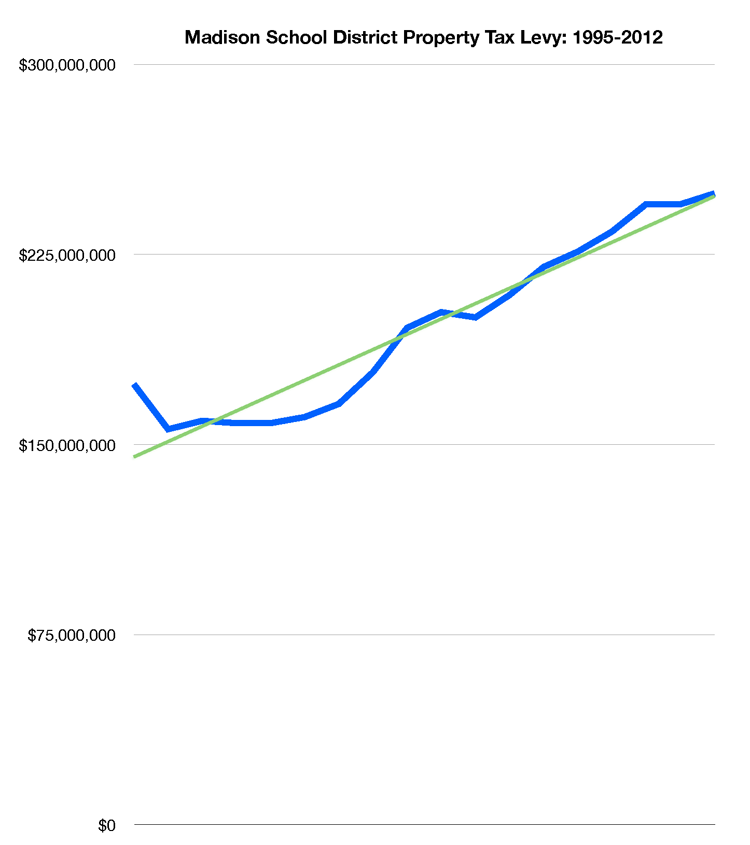

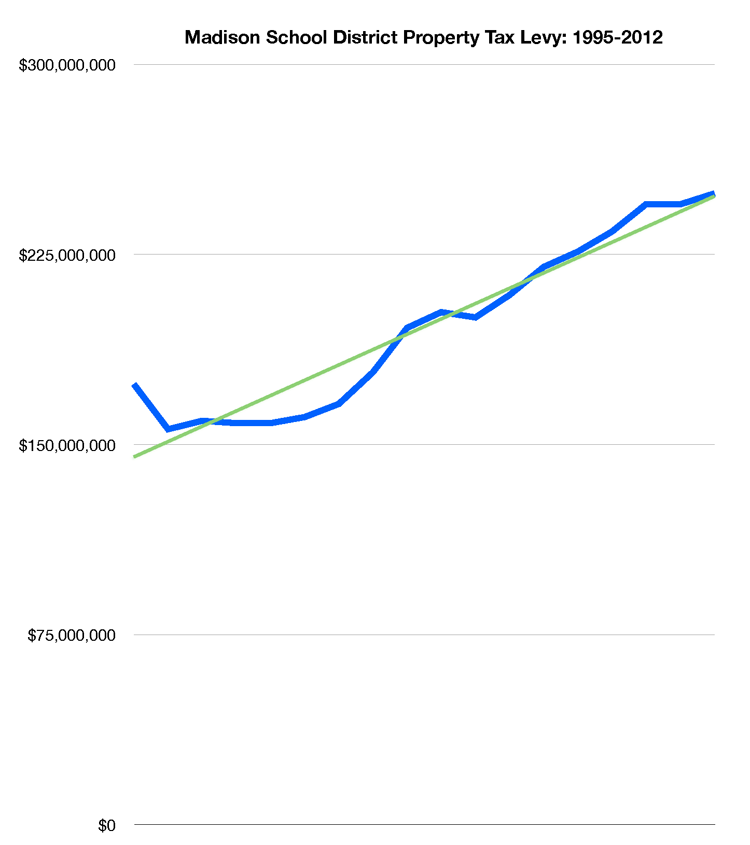

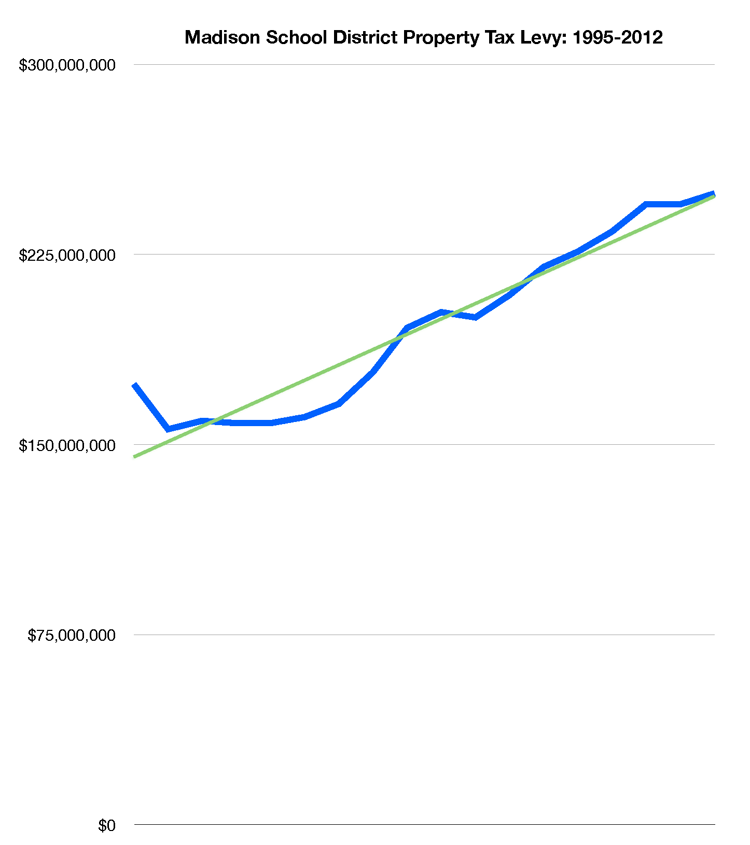

“This level of increase, though absent in recent years, is not new to Wisconsin. School district levies increased by more than 4.5% in eight out of the 10 years from 2000 to 2009,” the report states.

Dane County districts are a major contributor to the increase in dollars, according to the report, with five of the largest in the state: Madison, DeForest, Verona, Sun Prairie and Middleton-Cross Plains.

WPF cautions that the issue “will bear watching in 2020 as well,” given the coming increase in revenue limits and potential referenda in major districts like Madison and Milwaukee.

Madison increases property taxes by 7.2%, despite tolerating long term, disastrous reading results

The Policy Forum report found just eight of the state’s 421 school districts account for more than a third of the $224 million increase in levies this year. Five of those districts with the largest dollar increases in taxes are the Madison, Sun Prairie, Middleton-Cross Plains, DeForest and Verona school districts.

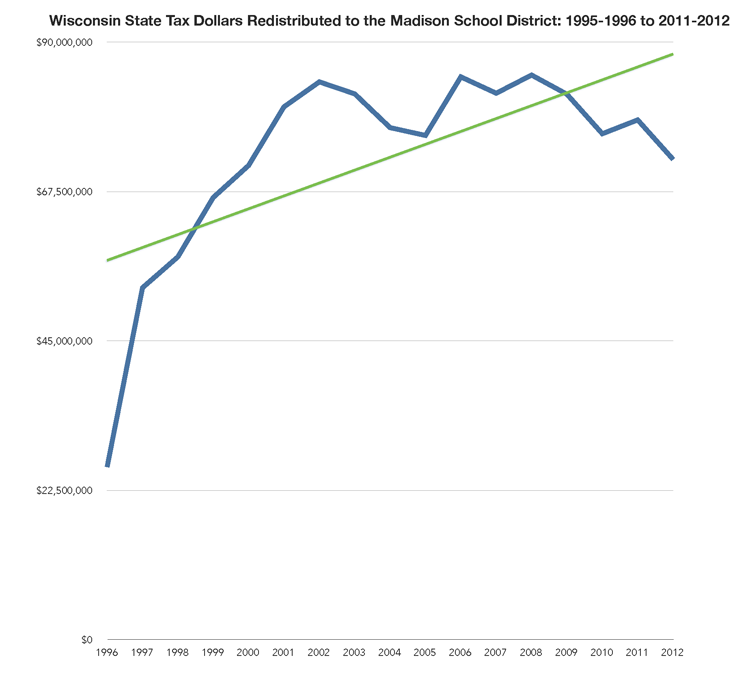

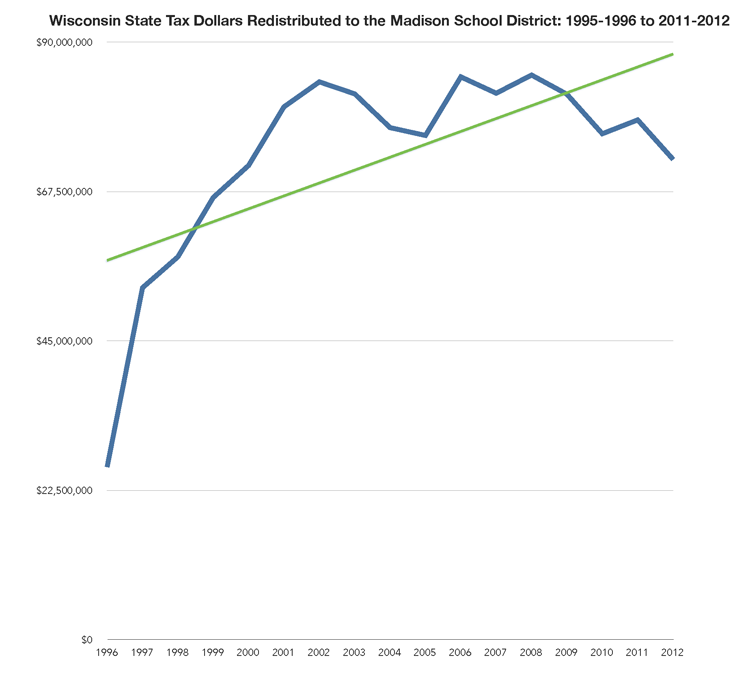

In raw dollars, Madison ($22.1 million) and Milwaukee ($11.6 million) had the biggest increases of any district, which translated into increases of 7.2% and 4.6% respectively. The Legislative Fiscal Bureau reports general state aid to Milwaukee Public Schools is going down by 1.9% and the district’s budget shows a little less than half of the overall property tax increase is going to recreation and community programs and facilities and not to core district operations. In Madison, general school aids are falling by 15% and voters cast ballots to exceed revenue limits in 2016.

Since 1993-94, the state has limited the per pupil revenue that school districts can receive from property taxes and state general aid. Districts cannot exceed the caps without a successful referendum, but if a district’s general aid falls, the school board can increase property taxes to offset the loss.

Madison taxpayers spend far more than most K-12 school districts. Yet, we have long tolerated disastrous reading results.

Madison K-12 administrators are planning a substantial tax & spending increase referendum for 2020.

Madison School District projects loss of 1,100 students over next five years, yet 2020 referendum planning continues.

Madison School Board approves purchase of $4 million building for special ed programs

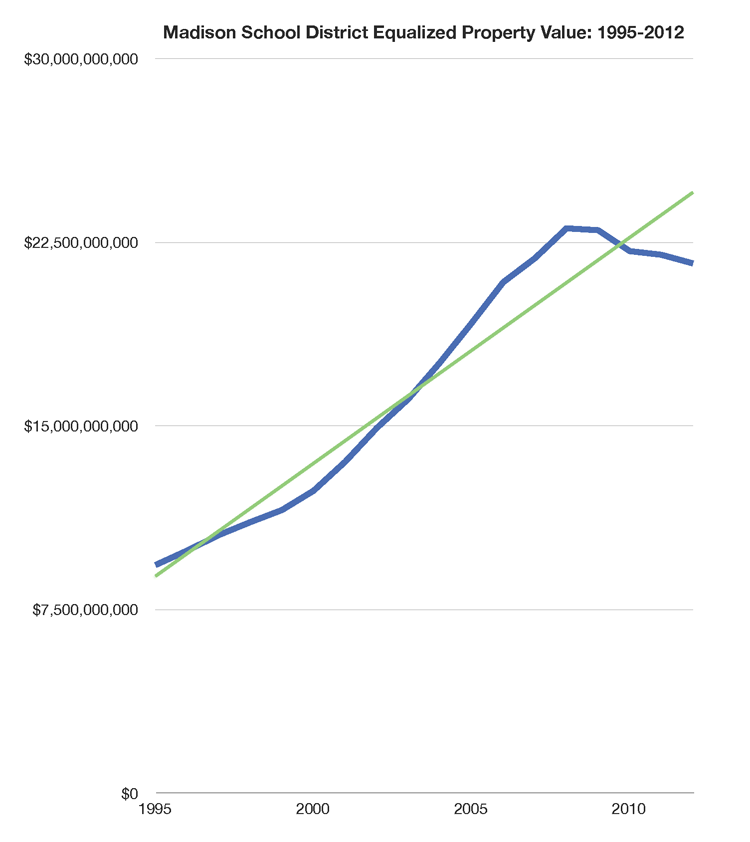

Bryce Hill, research analyst at the independent Illinois Policy think-tank, says that the annual property-tax take in Cook County, which includes Chicago, increased 76 per cent more than median home values between 1996 and 2016.

“Both the city and the state are wrestling with unbalanced budgets, massive amounts of pension debt, and limited solutions,” he says. “As they fight these worsening financial conditions, businesses and homeowners have been saddled with high property taxes that far outpace growth in property values.”

Until last year, homeowners in Chicago could write off property taxes against their taxable income. But President Donald Trump’s 2018 reform establishes a $10,000 cap, leaving many homeowners suddenly forking out huge sums. “It has really put the brakes on sales,” says Nicholas Apostal, a principal broker at Keller Williams in Chicago.

Apostal is listing a fully renovated 19th-century brownstone in Lincoln Park with five bedrooms and four bathrooms. The $1.45m sales tag is far below the pricier markets of New York and San Francisco, but it comes with annual property taxes of just under $22,000 — and no guarantee that they will not increase in years to come.

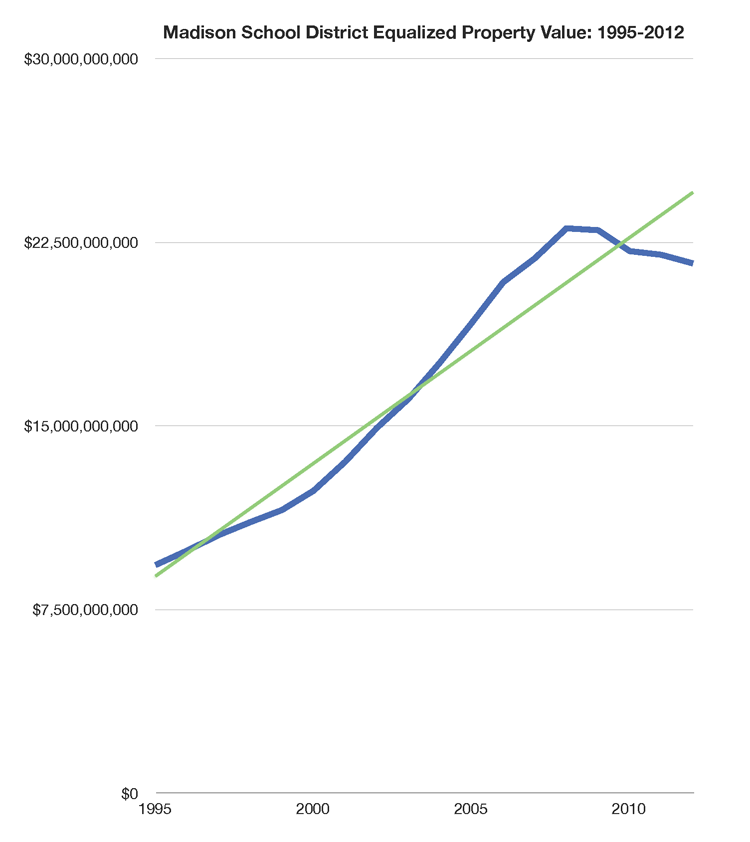

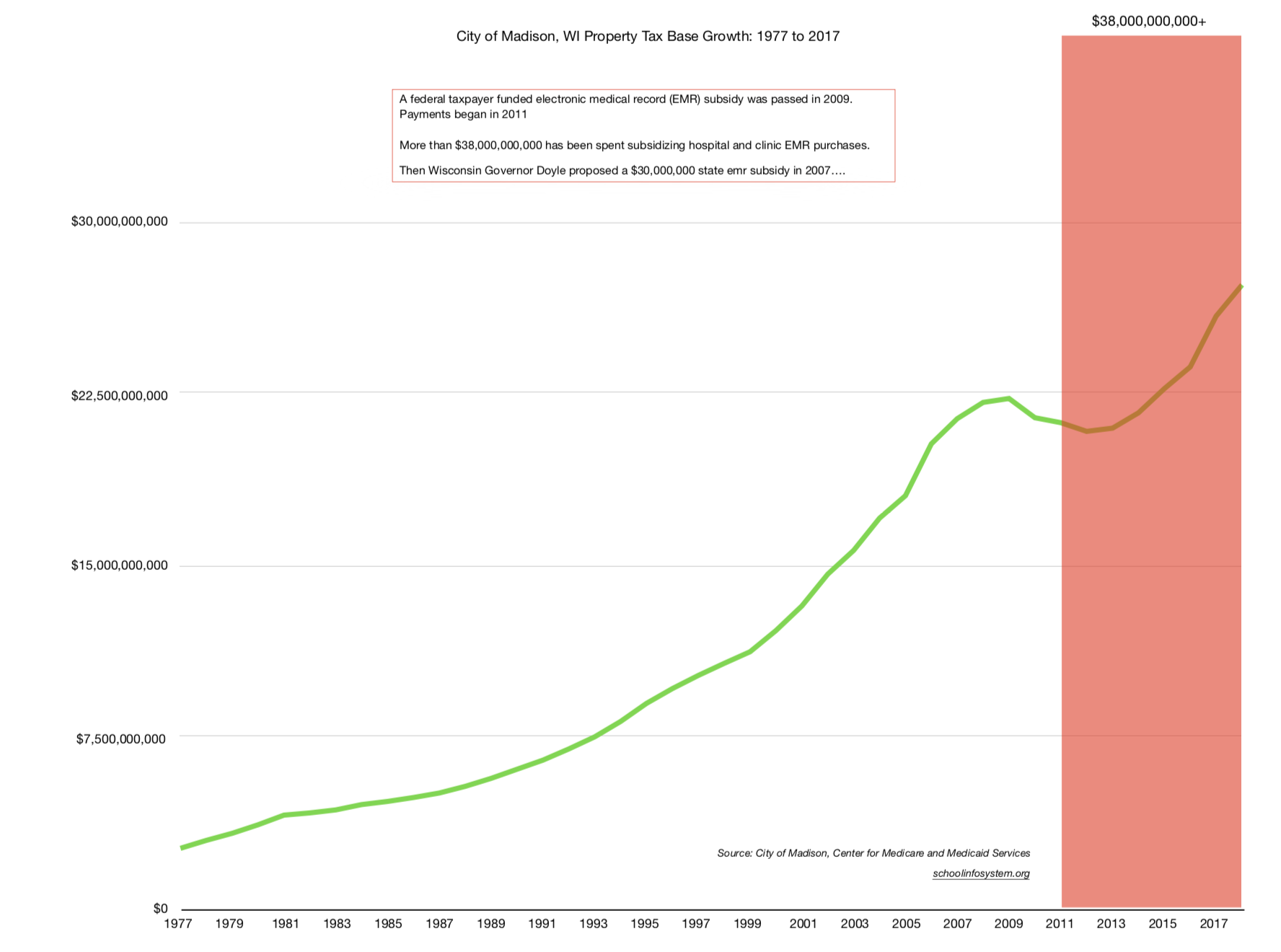

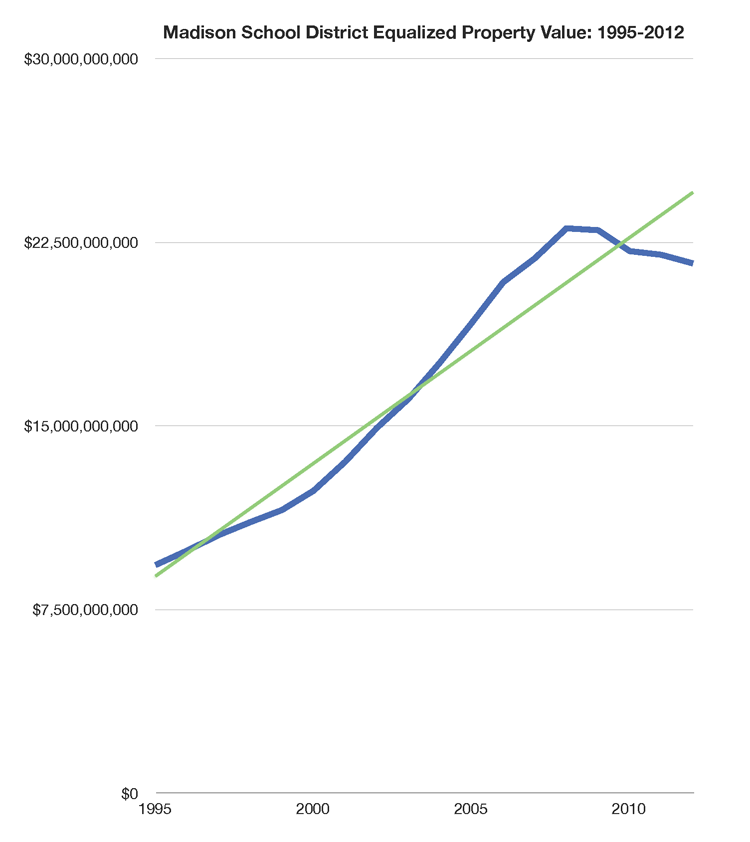

The Madison School Board is considering another property tax and spending boost. This occurs during a time of substantial federal taxpayer subsidized property base growth.

Madison has long spent more than most taxpayer supported K-12 school districts. Yet we have tolerated disastrous reading results.

Related: A look at property taxes.

Let’s compare: Middleton and Madison property taxes: 2018 and 2016.

entry Dear Homeowner: If You’re Paying $260,000 in Property Taxes Over 20 Years, What Exactly Do You “Own”?, I questioned the consequences of high property taxes. Some readers wondered if I was saying all property taxes should be abolished. The short answer is no–what I was questioning is local government reliance on property taxes to the point that owning a home no longer makes financial sense because the property taxes consume any appreciation other than the transitory “wealth” generated by a housing bubble.

Madison residents have long paid high property taxes, despite long term disastrous reading results.

In Madison, the tax bill for a fair market home valued at $200,000 was $4,690. Outside Madison, the tax bill for a fair market home with the same value ranged from $2,815 in the town of Christiana in the Stoughton School District to $4,736 in the village of Brooklyn in the Oregon School District.

The tiny town of Blooming Grove saw average drops in average bills for homes that didn’t change in value between 7.43 percent and 11.47 percent depending on which of four school districts property is located.

The decreases came from savings in an intergovernmental agreement under which the city of Madison is now providing fire and emergency medical service to the town, town administrator-clerk-treasurer Mike Wolf said.

The town had employed three full-time firefighters supplemented by volunteers and interns, but contracting with the city saves $100,000 and makes sense because the town is set to dissolve in 2027, he said.

A similar Middleton home pays 13 to 16% less than a Madison property.

Despite spending more than most school districts (currently $17k/student), Madison has long tolerated disastrous reading results.

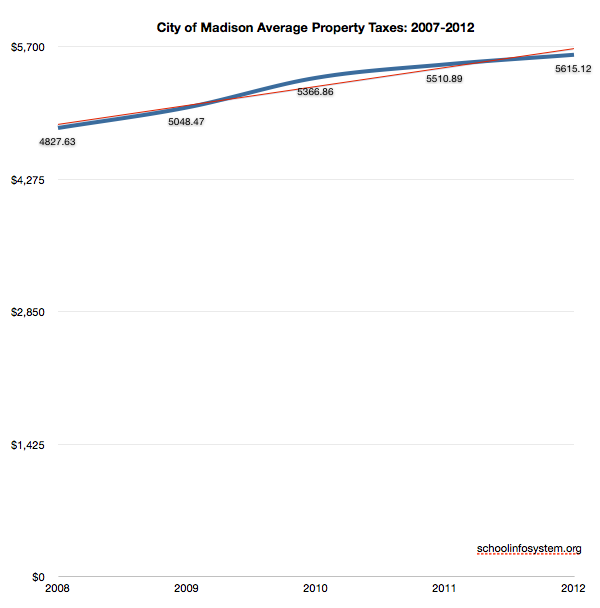

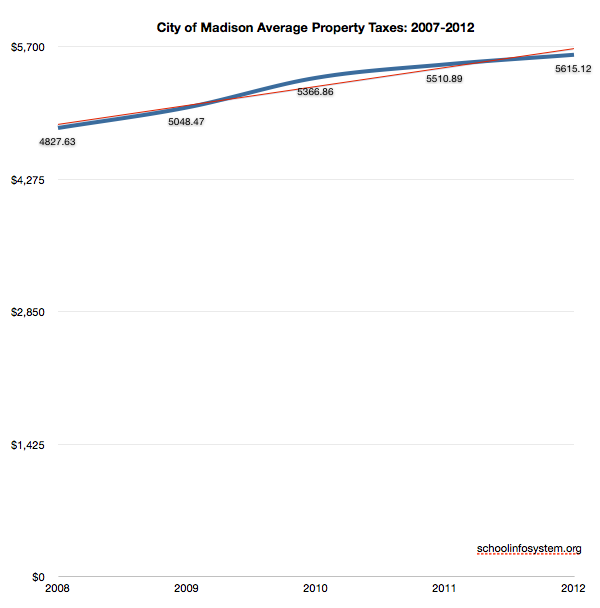

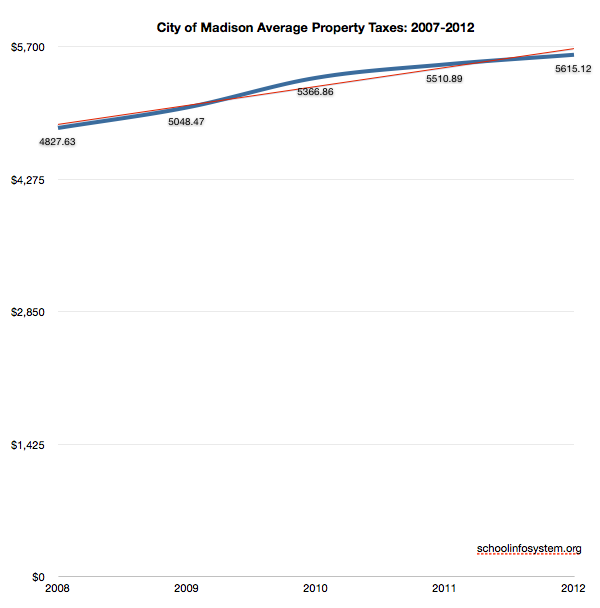

The arrival of Thanksgiving means local homeowners will soon see their annual property tax bills. The chart below compares Madison area homes sold in 2012, ranging in price from $239,900 to $255,000

Tap to view a larger version. Excel. A Middleton home’s property tax burden is about 13% less than a similar property in Madison (based on 2012 sales and 2013 assessments and payments). The Madison home noted in this analysis was assessed $1100 higher than the Middleton property. Taxes, spending growth and academic achievement over time are surely worth a much deeper dive.

SIS notes and links on Madison area property taxes.

Worth reading: Wisconsin Taxpayers Alliance:

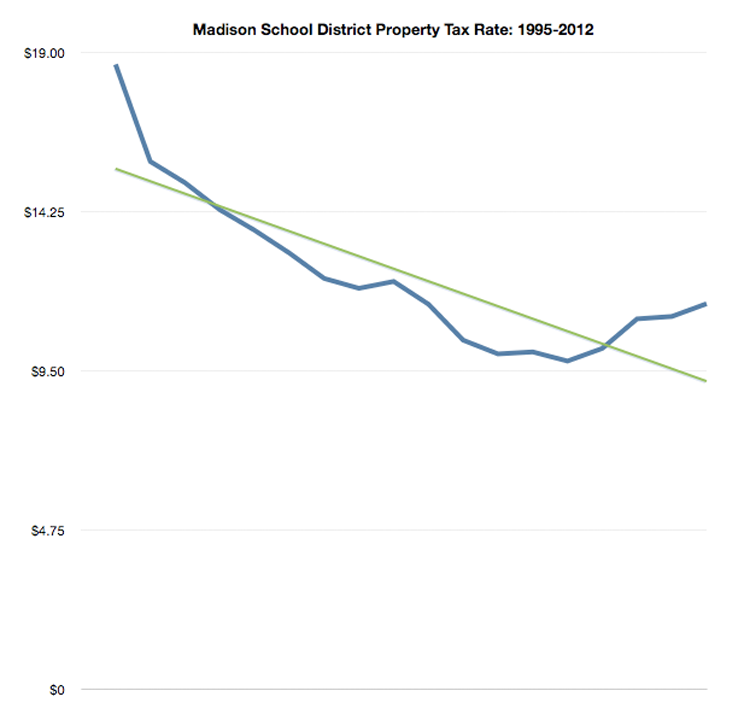

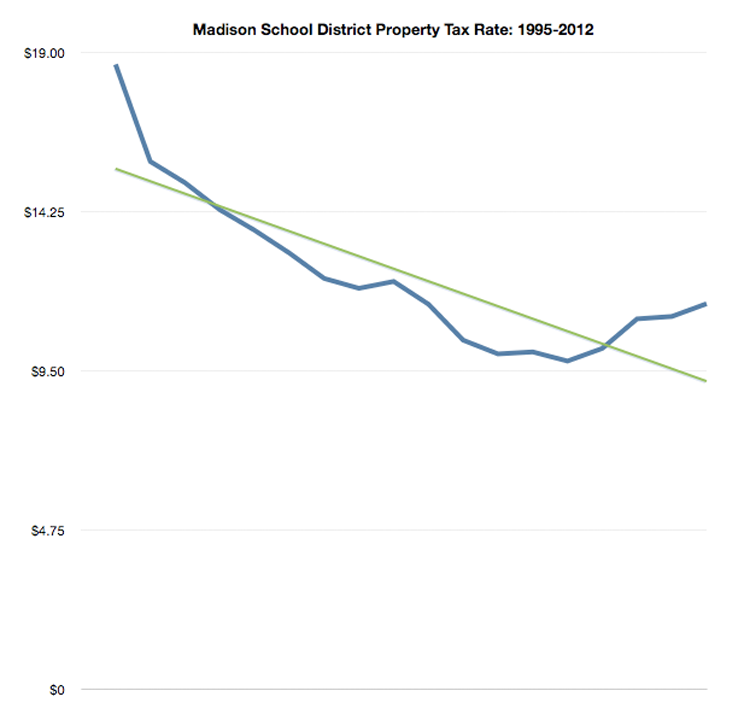

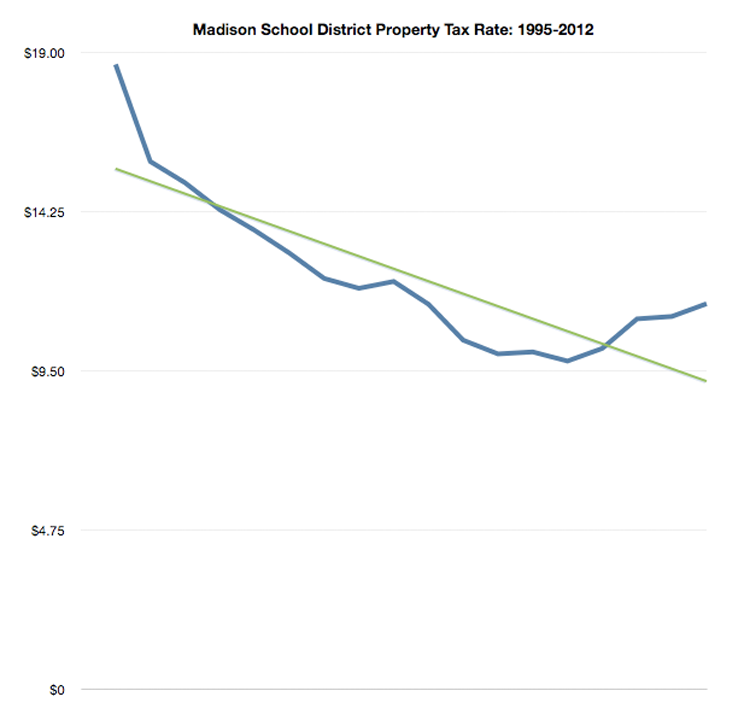

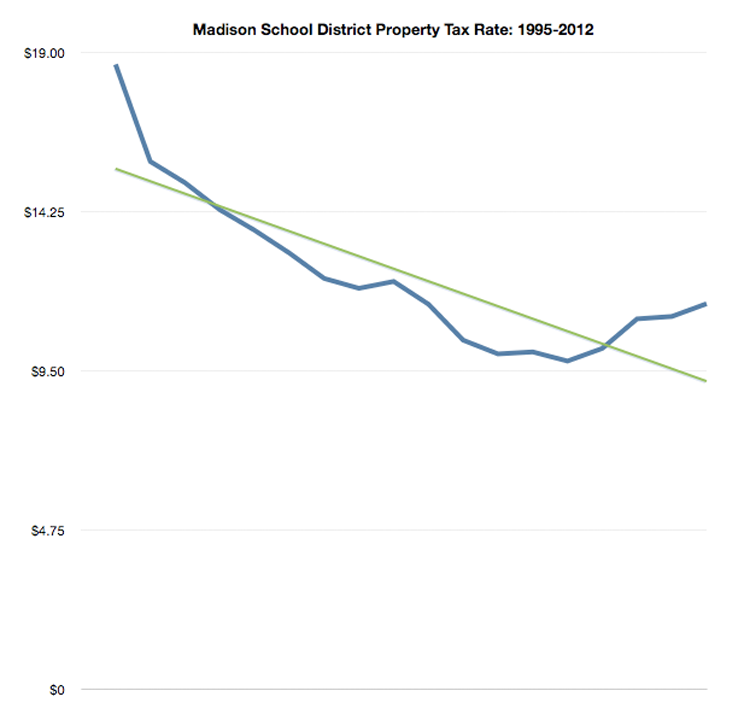

The property tax is Wisconsin’s largest, oldest, and most confusing tax. At least five governments use the tax, and two different methods of valuing property are used to distribute taxes among property owners. One source of confusion arises when tax rates and levies move in opposite directions, a common occurrence over the past 20 years. In addition, property owners are often unaware of how changing property values, both within a municipality and among municipalities, can cause individual property tax bills to rise, even when levies are “frozen.”

Madison Mayor Paul Soglin:”(Property Tax) Delinquencies 30% more than we expect“.

Spending and adult employment.

Property tax growth (along with other tax sources) is a manifestation of the challenges we see in our k-12 school districts.

Madison property owners will soon be able to pay their taxes in four installments, beginning with the 2014 tax bill coming in December.

The Mayor’s Office said on Tuesday the four-payment plan could help taxpayers avoid penalties by spreading out the taxes owed over a seven-month period.

“At the height of the recession, the city’s delinquency rate was over twice the historical average,” said Mayor Paul Soglin in a news release.

“Even today, delinquencies are 30 percent more than what we would expect,” Soglin said. “We hope offering the four installment option will help some of our property owners avoid the considerable penalties incurred when you go delinquent on their taxes.”

Taxpayers up to now had two options in Madison: Pay the full amount by Jan. 31, or in two installments, due Jan. 31 and July 31 (the two installment plan will no longer be used.)

Madison / Dane County property taxes among the highest in Wisconsin.

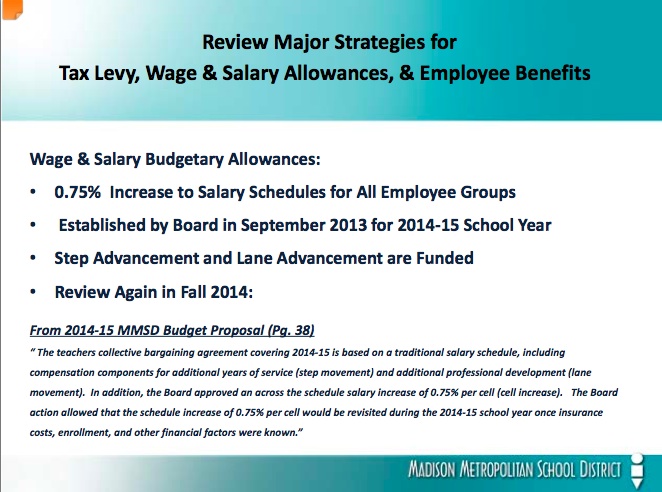

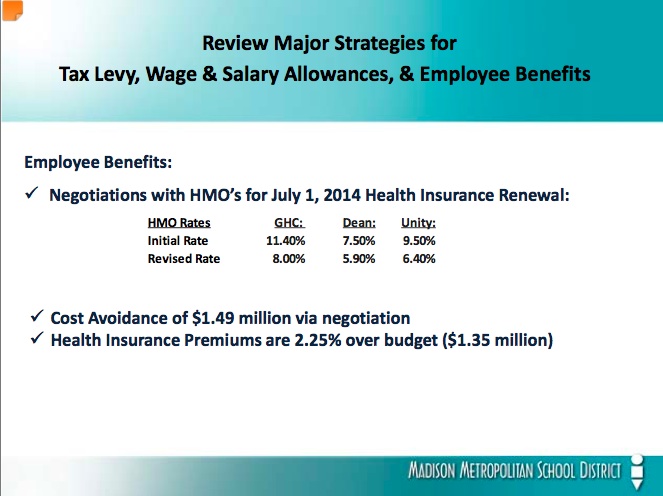

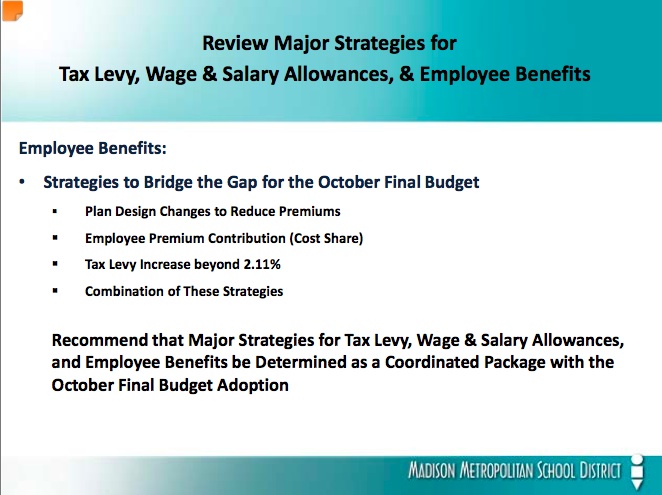

25% of the Madison School District’s 2014-2015 $402,464,374 budget spent on benefits.

Middleton’s property taxes are 16% lower than Madison’s for a similar home.

The Madison School District property tax levy would increase by 4.2 percent under the district’s final budget proposal.

That’s up from a 2 percent increase contained in the district’s preliminary budget approved in June.

The final 2014-15 district budget, which must be adopted by the School Board by Nov. 1, also includes a slight bump in the salary increase district staff were expecting this school year.

If approved, teachers will see a 1 percent raise in their base pay for the 2014-15 school year, a slight increase from the 0.75 percent increase the preliminary district budget included when it was adopted by the School Board in June. The salary increase is in addition to increases staff receive based on their level of education, training and years spent teaching, which brings the total increase to about 2.4 percent, according to assistant superintendent for business services Michael Barry.

Madison spends more than $15k annually per student, about double the national average. Yet, the District has long tolerated disastrous reading results.

A comparable Middleton home’s property taxes are 16% less than Madison.

A variety of notes and links on the planned 2015 Madison School District Property Tax Increase referendum:

Madison Schools’ PDF Slides on the proposed projects. Ironically, Madison has long supported a wide variation in low income distribution across its schools. This further expenditure sustains the substantial variation, from Hamilton’s 18% low income population to Black Hawk’s 70%.

A single data point (!) comparison of Dane County School Districts: Ideally, the District would compare per student spending, operating expenditures on facilities, staffing and achievement rather than one data point.

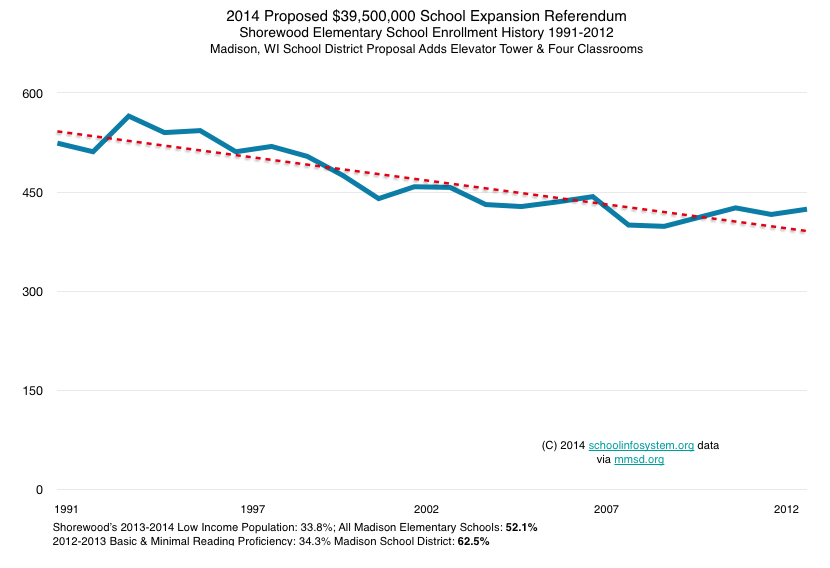

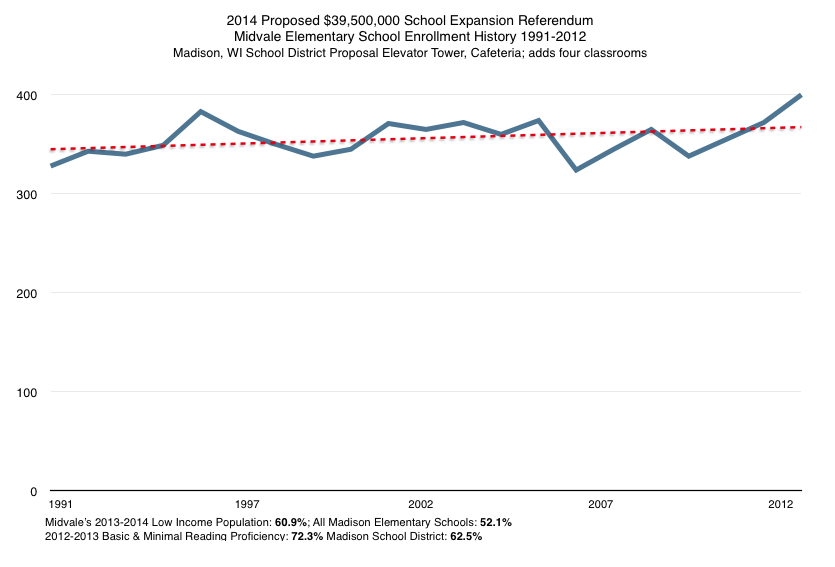

Where have all the students gone? Madison area school district enrollment changes: 1995-2013.

Comments on the school district’s website range from support for the project to concern about the cost and how it was decided which schools would get improvements.

One poster complained about being asked to pay more property taxes when income is not rising. A parent suggested that more space should be added now — rather than later — at west side Hamilton Middle/Van Hise Elementary School, where $2.53 million in improvements would add classrooms and a shared library, allowing current library space to be used for classrooms. Better yet, build a whole new middle school, the parent suggested.

A parent whose children attend Schenk Elementary/Whitehorse Middle school on the east side was disgusted at what were described as inconvenient, even dangerous student drop-off conditions. Another parent at Schenk said overcrowding means kids don’t eat lunch until after 1 p.m.

“It’s hard to concentrate when you’re hungry — why didn’t these schools make the list?” he asked.

Another poster took the Madison school district to task for not routinely maintaining and modernizing buildings to avoid high-ticket renovations like that planned at Mendota.

From the campaign trail:

“I had been in the private sector and I felt like half my paycheck was going to insurance.”

Middleton’s property taxes for a comparable home are 16% less than Madison’s.

Scale, progressivity, and socioeconomic cohesion.

Finally, a number of questions were raised about expenditures from the 2005 maintenance referendum. I’ve not seen any public information on the questions raised several years ago.

Bill Moyers on declining household income.

Using data from the Census Bureau’s American Community Survey, the report’s authors examined residential property taxes in every U.S. county from 2007 to 2011, looking at how much homeowners were paying on average and how that average compared to average home sale prices over the same time period.

The data contained some interesting, though perhaps not surprising, revelations about Wisconsin’s property taxes:

Dane County levied the state’s highest average property tax in dollars — $4,279 — and ranked 61st among all U.S. counties examined in the report.

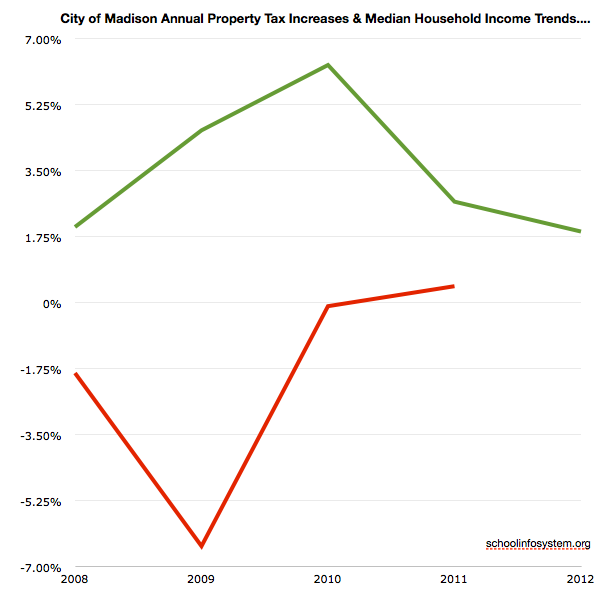

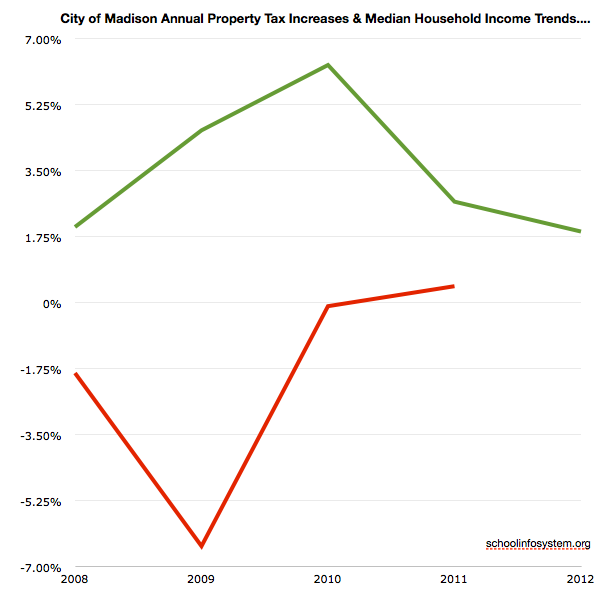

Related: Madison’s 16% property tax increase since 2007 while median household income down 7.6%.

Madison is planning a maintenance referendum for 2015, which will further increase property taxes. Madison spends about double the national average per student, around $15,000 annually.

Considering Madison school district boundaries vis a vis the planned referendum.

Madison taxpayers have supported additional maintenance and operating spending over the years, yet reading results remain disastrous.

There’s been little movement since mid-March when Madison School District Superintendent Jennifer Cheatham proposed asking voters in November for $39.5 million in borrowing to upgrade facilities and address crowding.

The proposed referendum’s annual impact on property taxes on a $200,000 Madison home could range from $32 to $44, according to the district.

After discussing the idea, School Board members said that the always contentious idea of changes to school boundaries would at least have to be publicly vetted as a possible solution to crowding before moving forward with a referendum. There have not been any public discussions on the matter since.

Spending and accounting problems with the last maintenance referendum (2005) lead to a discussion of an audit.

I recently met a young “Epic” husband and wife who are moving from their Madison townhouse to the Middleton/Cross Plains area. I asked them what prompted the move? “Costs and taxes per square foot are quite a bit less” as they begin planning a family. See “Where have all the students gone“.

Their attention to detail is unsurprising, particularly with so many young people supporting enormous student loans.

Madison spends double the national average per student. I hope that District seeks more efficient use of it’s $402,464,374 2014-2015 budget before raising property taxes.

Dive deeper into the charts, here.

Tap the chart to view a larger version.

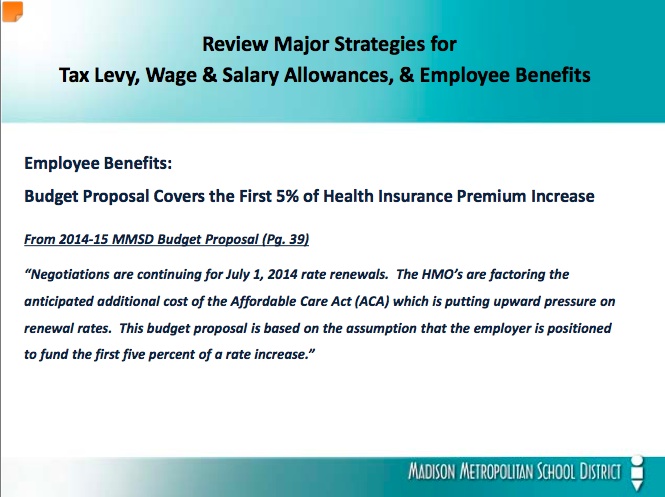

A few slides from the School District’s fourth 2014-2015 budget presentation to the Board:

I am surprised to see Physician’s Plus missing from the healthcare choices, which include: GHC, Unity or Dean.

The slides mention that the “Budget Proposal Covers the First 5% of Health Insurance Premium Increase”.

Madison Schools’ 2014-2015 v4 budget document (PDF).

Deeper dive:

2014-2015 Madison Schools’ Budget

Long term, disastrous reading results.

Healthcare costs have long been a somewhat contentious issue, including decades of expensive WPS coverage.

Questions about recent maintenance referendum spending.

Middleton’s property taxes are about 16% less than Madison’s for a comparable home.

Wisconsin per capita property tax data via the May 30, 2014 WISTAX Focus Newsletter.

The U.S. government has arguably run far afoul of international and national law by torturing terrorism suspects and collecting private citizens’ phone records.

We’re just coming out of a recession caused largely by heretofore respectable banking, real estate and other moneyed interests who played fast and loose with the rules.

And recent years have seen many a hero athlete nabbed for taking performance-enhancing drugs.

So I find it hard to heap too much abuse on Middleton High School students accused of widespread cheating. They wouldn’t be wrong to point to the front page of almost any day’s newspaper and reprise a line from that old war-on-drugs public service announcement: “I learned it by watching you!”

Still, while we grown-ups have set some pretty bad examples, it would be a shame if Middleton’s grown-ups perpetuate that recent tradition by declining to dig too deeply into the cheating allegations.

Much more on Middleton, here (including 16% lower property taxes).

The Wisconsin State Journal offers a page to compare property taxes on a $200,000 home, here.

Related:

Madison’s 2013-2014 budget and commentary on Madison and Surrounding School Districts; Middleton’s lower Property Taxes.

Much more, here.

Madison spends about $15K per student, roughly double the national K-12 average, yet has long generated disastrous reading results.

WISTAX: On December property tax bill, statewide school levies up 0.8%, counties up 1.2%, technical colleges up 1.3%

— Matthew DeFour (@WSJMattD4) December 9, 2013

Madison’s school property taxes will increase by 3.38% after a 9% increase a few years ago. Meanwhile, Middleton’s property taxes are 16% less than Madison’s on a similar home.

The Middleton Education Association made one request to open negotiations with district officials in September and another request in October.

“We believe the recent Circuit Court ruling or the ruling Judge Colas made last year still allows us to bargain a complete or full master contract for the 2014-2015 school year. We also believe they are able to provide more of an increase,” Chris Bauman, MEA president, said.

The Board of Education voted unanimously to delay any talks.

“We’ve requested to delay negotiations on a base salary partly because of our budget unknowns, enrollment, a variety of other things in terms of our total budget expenditures that are required for 2014-2015,” MCPASD Superintendent Don Johnson said.

While the board decided to delay talks, some teachers at Middleton High School have begun circulating a petition in hopes of getting their message across.

Recently, the board approved an overall wage increase of $1,078 per year for teachers.

However, a number of teachers say the increase is not enough, considering their personal contributions to retirement and health care. In some people’s opinion, the increase penalizes teachers who have been around for years.

Related: Madison Schools’ Budget Updates: Board Questions, Spending Through 3.31.2013, Staffing Plan Changes, Middleton-Cross Plains School Board to appeal ruling on teacher fired for viewing porn at work and Commentary on Madison and Surrounding School Districts; Middleton’s lower Property Taxes.

Property taxes in the Madison School District will increase by about $67 for the average homeowner as part of the final $392 million 2013-14 budget approved by the school board on Monday.

The board voted 6-1 to approve this year’s amended budget and also to set the levy at $257.7 million, a 3.38 percent increase over last year.

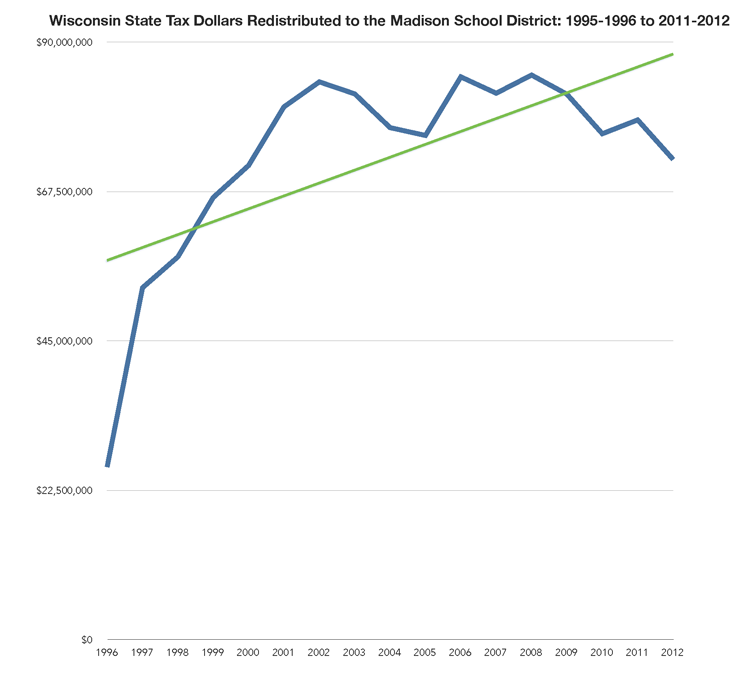

That increase is about 1 percentage point less than originally projected in July, before Gov. Scott Walker unveiled his two-year $100 million property tax relief bill that sent an additional $2.5 million in state aid to Madison schools.

Total property taxes will increase by $66.74 on average. That’s $39.24 less of an increase than originally expected earlier this year, according to district budget documents. A property tax bill for the average $231,000 Madison home is now estimated to be $2,739.66 for school purposes.

School board member Mary Burke, a candidate for governor, cast the lone votes against the final amended budget and against the levy, citing the desire to see a better balance between the needs of the district and the needs of taxpayers.

“Next year, as we look at this, we really need to look at how many people are struggling to make ends meet,” Burke said about the levy increase, noting the district and board should consider whether salary increases among district families are not keeping pace with property tax increases.

Much more on the 2013-2014 budget, here.

The City of Madison’s portion of local property tax will grow 2.2%.

Middleton’s property taxes are 16% less than Madison’s on a comparable home.

A cynic would be forgiven for wondering whether the press conference Minneapolis mayoral candidate Mark Andrew held Monday afternoon, flanked by five members of the school board, was at least partly an exercise in damage control.

At the session, held in the library at Windom Dual Immersion School in southwest Minneapolis, Andrew announced a three-pronged education agenda. At its center: a promise to convene a collaborative headed by education advocates with divergent philosophies, Mike Ciresi and Louise Sundin.

“The conversation about improving educational outcomes for kids of color has gotten extremely polarized and increasingly heated in the past several years,” Andrew explained in the plan. “The reformers vs. unions dichotomy is unproductive, and doesn’t serve the best interests of our children or find Minneapolis solutions to the problems in Minneapolis’ schools.”

Minneapolis plans to spend $524,944,868 (PDF budget book) during the 2013-2014 school year for 34,148 students or 15,364 per student, about the same as Madison.

Yet, property taxes are substantially lower in Minneapolis where a home currently on the market for $279,900 has a 2013 property tax bill of $3,433. A $230,000 Madison home pays $5,408.38 while a comparable Middleton home pays $4,648.18 in property taxes. Madison plans to increase property taxes 4.5% this year, after a 9% increase two years ago, despite a substantial increase in redistributed state tax dollar receipts. Yet, such history is often ignored during local tax & spending discussions. Madison Superintendent Cheatham offers a single data point response to local tax & spending policy, failing to mention the substantial increase in state tax receipts the year before:

When we started our budget process, we received the largest possible cut in state aid, over $8 million,” Cheatham said. “I’m pleased that this funding will make up a portion of that cut and help us accomplish what has been one of our goals all along: to reduce the impact of a large cut in state aid on our taxpayers.”

A bit more background.

More charts on Madison schools’ spending & property tax growth over the years, here.

Karen Rivedal:

The Madison School Board will hold a one-hour public hearing at 5 p.m. Monday on a preliminary $391 million budget proposal for the 2013-2014 school year, in the McDaniels Auditorium of the Doyle Administration Building at 545 W. Dayton St.

After the hearing, the board is to vote on the budget, which includes a $260.4 million property tax levy, increasing the tax bill on an average $230,831 Madison home by about $102. The board will take a final vote on the tax levy in October, after official state aid figures are known.

Related: Madison Schools’ 2013-2014 Budget Charts, Documents, Links, Background & Missing Numbers.

Finally, Rivedal’s article fails to mention this: Up, Down & Transparency: Madison Schools Received $11.8M more in State Tax Dollars last year, Local District Forecasts a Possible Reduction of $8.7M this Year. Local household income changes are unmentioned, as well (national data).

Much more on the 2013-2014 Madison schools’ budget, here.

A Middleton home paid $4,648.16 in 2012 while a Madison home paid 16% more, or $5,408.38. Local efforts to significantly increase property taxes may grow the gap with Middleton..

Rivedal’s article is unfortunately a classic “low information” piece. It would not take much effort to challenge the new Superintendent’s rhetoric on “state funding decline”. The prior year’s significant increase goes unmentioned.

Is it the State Journal’s policy to simply publish rhetoric without investigation?

I received a kind email from Madison School Board President Ed Hughes earlier today regarding the proposed property tax increase associated with the 2013-2014 District budget.

Ed’s email:

Jim —

Your comparison to the tax rates in Middleton is a bit misleading. The Middleton-Cross Plains school district that has a mill rate that is among the lowest in Dane County. I am attaching a table (.xls file) that shows the mill rates for the Dane County school districts. As you will see, Madison’s mill rate is lower than the county average, though higher than Middleton’s. (Middleton has property value/student that is about 10% higher than Madison, which helps explain the difference.)

The table also includes the expenses/student figures relied upon by DPI for purposes of calculating general state aid for the 2012-13 school year. You may be surprised to see that Madison’s per-student expenditures as measured for these purposes is among the lowest in Dane County. Madison’s cost/student expenditures went up in the recently-completed school year, for reasons I explain here: http://tinyurl.com/obd2wty

Ed

My followup email:

Hi Ed:

Thanks so much for taking the time to write and sending this along – including your helpful post.

I appreciate and will post this information.

That said, and as you surely know, “mill rate” is just one part of the tax & spending equation:

1. District spending growth driven by new programs, compensation & step increases, infinite campus, student population changes, open enrollment out/in,

2. ongoing “same service” governance, including Fund 80,

3. property tax base changes (see the great recession),

4. exempt properties (an issue in Madison) and

5. growth in other property taxes such as city, county and tech schools.

Homeowners see their “total” property taxes increasing annually, despite declining to flat income. Middleton’s 16% positive delta is material and not simply related to the “mill rate”.

Further, I continue to be surprised that the budget documents fail to include total spending. How are you evaluating this on a piecemeal basis without the topline number? – a number that seems to change every time a new document is discussed.

Finally, I would not be quite as concerned with the ongoing budget spaghetti if Madison’s spending were more typical for many districts along with improved reading results. We seem to be continuing the “same service” approach of spending more than most and delivering sub-par academic results for many students. (Note the recent expert review of the Madison schools Analysis: Madison School District has resources to close achievement gap.)

That is the issue for our community.

Best wishes,

Jim

Related: Middleton-Cross Plains’ $91,025,771 2012-2013 approved budget (1.1mb PDF) for 6,577 students, or $13,840.01 per student, roughly 4.7% less than Madison’s 2012-2013 spending.

July, 2013 Madison Schools 2013-2014 Budget Presentation (PDF). Notes:

The January, 2012 budget document mentioned “District spending remains largely flat at $369,394,753” (2012-2013), yet the “baseline” for 2013-2014 mentions planned spending of $392,807,993 “a decrease of $70,235 or (0.02%) less than the 2012-13 Revised Budget” (around $15k/student). The District’s budget generally increases throughout the school year, growing 6.3% from January, 2012 to April, 2013. Follow the District’s budget changes for the past year, here.

Finally, the document includes this brief paragraph:

Work will begin on the 2014-15 early this fall. The process will be zero-based, and every line item and FTE will be carefully reviewed to ensure that resources are being used efficiently. The budget development process will also include a review of benefit programs and procurement practices, among other areas.

One hopes that programs will indeed be reviewed and efforts focused on the most urgent issues, particularly the District’s disastrous reading scores.

Ironically, the recent “expert review” found that Analysis: Madison School District has resources to close achievement gap. If this is the case (and I agree with their conclusion – making changes will be extraordinarily difficult), what are students, taxpayers and citizens getting for the annual tax & spending growth?

I took a quick look at property taxes in Middleton and Madison on a $230,000 home. A Middleton home paid $4,648.16 in 2012 while a Madison home paid 16% more, or $5,408.38.

In each of the past three years, the city of Middleton tried to avoid raising property taxes as it paid for three new $18 million public safety buildings.

That will change if the city’s proposed 2012 budget, which calls for an 11.5 percent increase in total property taxes, is approved by the City Council Tuesday night. The increase would amount to about a $150 jump for a $250,000 home, according to city administrator Mike Davis. More specific figures were not available Friday.

“The jump is practically directly related to the debt service for the new public safety buildings,” Davis said.

Middleton opened new fire and EMS stations in 2008 and a new police station in 2010 at a total cost of $18 million, Davis said. The city’s 2011 borrowing costs were more than $3.5 million, and Davis said most of that bill was paid with previously raised money. The tab for 2012 will be $3.6 million.

“Now it’s being picked up mainly by property taxes,” Davis added.

Budget Hangs On Enrollment Middleton Watching Numbers

The Capital Times Tuesday, July 11, 2006

By Christopher Michaels

Increased enrollment in the weeks preceding the start of the school year could mean more state aid for the Middleton-Cross Plains School District. It also could mean an easing of planned staff reductions of special concern to one of the district’s elementary schools.

Teachers and parents from Park Elementary School in Cross Plains are asking the School Board to do what it can to avoid staff cuts at their school, which has a number of special needs students.

In a preliminary 2006-07 district budget approved by the School Board Monday, the tax rate remains unchanged from the 2005-06 school year. However, state revenue limits mean the district has had to reduce its budget by about $1.4 million compared to last year.

That reduction is taking its toll on programs and staffing with about 15 positions districtwide being eliminated, said Superintendent Bill Reis. Some of those positions, including two teachers and available hours for educational assistants, are at Park.

Thank you CapTimes for printing my OpEd. Interestingly, in a conversation with the Wisconsin Department of Public Instruction yesterday, state officials told us that we are legally obligated to count our students who are enrolled and present on the day of the pupil count (tomorrow, Friday). This is state law. They also told us we “should keep the money”.

As a side note, see a second article that I posted in the comment below about this. Our counting or not counting our Scholars will not have an impact on MMSD. What will impact them and other districts more is if our Scholars enroll with them or not. So, why did One City Schools get singled out and why do people expect us to do what NONE of the 423 traditional public school districts or 60 independent public charter school districts in Wisconsin do? One word answer: Politics.

It’s funny how in my home town (Madison), I am personally and constantly expected to go above and beyond everyone else and work magic with a too little funding. MMSD will receive and spend $23,000 per student, on average from the state, federal government and local property taxes. One City will only receive approximately $13,000 per student from the state and federal government, and not one dime of local property tax money, even though we operate “public schools” that educate the public’s children. Tell me if that’s fair. I have to raise $9,000 per student (multiplied by 400+ students) from private philanthropy, foundations, corporations and people like you in order to operate our schools.

This is totally not fair.

Public school districts like MMSD, Middleton, etc also get to count our charter school students in their annual property tax levy if our Scholars reside within their districts, and keep that money.

They do not “transfer” this money to us…but this wasn’t mentioned in any of the press releases or articles other organizations wrote about us. Why not?

Why not point out that traditional public school districts get to keep thousands of dollars per child for students they don’t educate and are not enrolled in their schools? It’s very disingenuous and unfair, and is only meant to draw negative public attention to public charter schools and One City. It’s sad, very sad.

Independent public charter schools like One City are also expected to produce dramatic test score improvements annually when each year we enroll many new students who are two or more years behind academically. We also had to alter our entire school model just 18 months after opening our first charter (elementary) school after the pandemic arrived in March 2020. Thankfully, this school year, we have been able to shift back to our original school design and are enjoying doing our work with our Scholars the way we always intended.

This is how innovators in education who go against the status quo in Dane County and Madison are treated. We get questioned, ridiculed and smacked for trying to do something new, despite 90 percent of Black and 80 percent of Brown students failing miserably in our public schools – EVERY YEAR.

BUT YOU DON’T SEE MANY ANY HEADLINES about that, or about the BUT YOU DON’T SEE MANY ANY HEADLINES about that, or about the fact that just 35 PERCENT OF ALL third graders in Wisconsin, including students from all racial backgrounds, can read to learn by the end of 3rd grade. That’s all – 35%…..and just 8% of all Black third graders and 18% of all Latino third graders in Wisconin.

The $250,000 One City Schools might receive for our Scholars is more important than addressing the massive failure of thousands of our children in Madison, Dane County and our state?

Our priorities continue to be jacked up and off-base, people. Our chickens will come home to roost, and in many ways, they already are.

No, schools are not solely at fault for the failure of our children BUT One City focuses holistically on the family, community, students and their habits of character), and our educators and school at the same time. We have expectations and supports for everyone. We go at these challenges head on and are transparent about our challenges and results so we and others can learn from them.

One City Schools is an asset to Madison, Dane County and Wisconsin, and should be treated and supported this way. Who else is trying to tackle the challenges the way we are? Onward.

2011: a majority of the taxpayer funded Madison School Board aborts the proposed Madison Preparatory Academy IB Charter School in a 5-2 vote.

The data clearly indicate that being able to read is not a requirement for graduation at (Madison) East, especially if you are black or Hispanic”

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

WEAC: $1.57 million for Four Wisconsin Senators

Friday Afternoon Veto: Governor Evers Rejects AB446/SB454; an effort to address our long term, disastrous reading results

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration.

No When A Stands for Average: Students at the UW-Madison School of Education Receive Sky-High Grades. How Smart is That?

Germany’s largest trade union, IG Metall, is proposing its members call for a four-day week to offset economic pressures heightened by the pandemic.

The proposal has had a mixed reception, with the German labour minister open to the possibility, while others are fundamentally opposed.

The idea of a reduced working week has already been raised in other countries – and coronavirus could make others willing to consider it.

At 34.2 hours, Germany already has one of the shortest average working weeks in Europe. And there are loud voices calling for it to be shorter still.

The country’s largest trade union, IG Metall, has proposed a four-day week to limit job losses in the automotive industry. Coronavirus woes are compounding economic pressure from existing structural shifts in the sector.

Let’s compare: Middleton and Madison Property taxes

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

An advocacy group of Black leaders is opposing the Madison School District’s $350 million ask of taxpayers this fall, arguing the proposals are under-developed and the district hasn’t done enough to support African American children to get their endorsement on the two November ballot referendums.

In a statement sent to some media members Tuesday, Blacks for Political and Social Action of Dane County said it’s concerned with the progress on closing wide racial achievement gaps; the cost of the referendums could be burdensome on fixed-income residents; and educational priorities in the COVID-19 pandemic have shifted since the referendums were first proposed more than a year ago.

“We have not been presented with evidence that links additional public expenditures with increasing the academic performance of African American students,” the organization said in the statement. “More of the same for African American students is unacceptable.”

Last month, the Madison School Board approved two referendums for the Nov. 3 ballot: A $317 million facilities referendum largely focused on renovating the high schools and a $33 million operating referendum that could permanently raise the budget by that amount within four years.

With only about 10% of Black elementary and middle school students scoring proficient or higher in reading and math on a state test, Blacks for Political and Social Action said “taxpayers have not received a fair return on investment.”

Let’s compare: Middleton and Madison Property taxes

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

The concentration of market power in a handful of companies lies behind several disturbing trends in the U.S. economy, like the deepening of inequality and financial instability, two Federal Reserve Board economists say in a new paper.

Isabel Cairo and Jae Sim identify a decline in competition, with large firms controlling more of their markets, as a common cause in a series of important shifts over the last four decades.

Those include a fall in labor share, or the chunk of output that goes to workers, even as corporate profits increased; and a surge in wealth and income inequality, as the net worth of the top 5% of households almost tripled between 1983 and 2016. This fueled financial risks and higher leverage, the economists say, as poorer households borrowed to make ends meet while richer ones shoveled their wealth into bonds — feeding the demand for debt instruments.

“The rise of market power of the firms may have been the driving force” in all of these trends, Cairo and Sim write in the paper. Published this month by the non-partisan Fed Board staff, which doesn’t reflect the views of governors, it’s the latest in a series examining the risks that weaker competition poses to a market economy.

That issue is increasingly prominent on the agenda of both America’s main political parties. Democrats said in a recent summary of policy priorities that they’re “concerned about the increase in mega-mergers and corporate concentration across a wide range of industries.” The Department of Justice under President Donald Trump is probing large technology platforms.

Madison’s taxpayer supported K-12 system has long resisted student and parent choice.

Let’s compare: Middleton and Madison Property taxes

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

Chris Stewart discusses our long term, disastrous reading results with Kaleem Caire.

2011: A majority of the Madison School Board aborted the proposed Madison Preparatory IB Charter school.

Kaleem Caire notes and links.

Let’s compare: Middleton and Madison Property taxes

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

What becomes of government credibility in the post-lockdown period? There are thousands of politicians in this country for whom this is a chilling question, even a taboo topic.

The reputation of government was already at postwar lows before the lockdowns, with only 17% of the American public saying that they trusted government to do the right thing. That was before the federal government and 43 state governors decided to turn a virus into a pretext for totalitarian closures, lockdowns, travel restrictions, and home quarantines of most people.

The lockdowns and random policy impositions by government will surely contribute to take the confidence number down to rock bottom. Already, loss of confidence has devastated consumer sentiment. No matter how many headlines blame the virus for all the carnage, the reality is all around us: it’s the government’s response that bears the responsibility.

In 2006, the great epidemiologist Donald Henderson warned that if government pursued coercive measures to control a virus, the result would be a “loss of confidence in government to manage the crisis.” The reason is that the measures do not work. Further, the attempt to make them work turns a manageable crisis into a catastrophe.

Let’s compare: Middleton and Madison Property taxes

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

Records released by the Madison Metropolitan School District show feedback from staff and community members included plenty of praise and criticism for the two finalists for the district’s superintendent position this summer.

Both Carlton Jenkins and Carol Kelley received positive feedback from many who filled out the forms, which asked respondents to answer two questions for each: strengths and areas of growth.

“I was not expecting much from a candidate that would be applying at this point in the year — but I really do feel as if Madison has found our next superintendent,” one person wrote about Jenkins.

That respondent was correct, as Jenkins, at the time the superintendent of Robbinsdale Area Schools in Minnesota, was ultimately chosen and began Aug. 4. Kelley remains the superintendent of the Oak Park Elementary School District 97 outside Chicago.

Let’s compare: Middleton and Madison Property taxes

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

After a spring of pandemic lockdowns and a summer of uncertainty as coronavirus infections surged, working parents with school-age children now face what could be a year of online schooling, presenting a buffet of bad options.

Sacrifice earnings and career advancement to stay home. Hire a nanny, if you can afford it. Lean on elderly relatives. Enroll kids in private schools or expensive day care programs and risk exposing them or others to the disease.

There are no good solutions, and every decision comes with trade-offs.

“There’s no solution that won’t harm someone,” said Hollis Rudiger, a teacher in the Madison School District and mother of two school-age children.

Let’s compare: Middleton and Madison Property taxes:

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

The district and the union have been discussing work expectations for this fall, sparring over the prospect of some instructors providing in-person services. This marks the third straight summer when bargaining talks have cast doubt over the first day of school.

Robinson denied that the idea of a delayed start was being explored because not enough teachers were trained in the spring and summer.

“There is no tie in to some sort of need to make up for deficiencies over the summer,” he wrote.

The district has offered some opportunities to brush up on skills since the closures. Since spring, over 1,400 educators took a course on Schoology, the district’s learning management system, according to a fall “reopening” plan the district submitted to the state. A few hundred more took different courses on topics like recording videos for the internet and digital citizenship. The union represents about 6,000 SPS employees.

Let’s compare: Middleton and Madison Property taxes:

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

There is no better time to make a change than right now, when public education is in chaos.

What’s that popping sound? Could it be a million figurative lightbulbs clicking on above public-school parents’ heads?

The vast majority of American families send their children to public schools. Only 11 percent of children attend private schools, and fewer than 5 percent are homeschooled. And as one school board after another gives the no go signal for the coming school year, families are being thrown into crisis. And yet, the great American entrepreneurial spirit is awakening as parents are forced to rethink education for their children. And that is to the benefit of children and the nation.

Even before the pandemic, American families had concerns about the quality of education their children were receiving from our public schools. Education Secretary Betsy DeVos called the latest national assessment “devastating.” Two-thirds of American students can’t read at grade level, and reading scores have worsened in 31 states.

The teaching of history has given way to the teaching of social studies, which is now morphing into lessons in civic action from a leftist perspective. A recent study of curriculum in American public schools found that the majority of civics classes teach students how to protest in favor of progressive political causes. Students are not free to disagree.

Let’s compare: Middleton and Madison Property taxes:

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

We must prepare and implement a plan of action to prevent violence and to stop this horrific rise in violence.”

Our word of the day is ‘Chutzpah’

(Yiddish for “what nerve!”)

This is the school board president who kicked cops out of

Madison’s troubled high schools

NEWS ALERT:

Detectives from the MPD’s Violent Crime Unit, the MPD’s Gang Unit, with assistance from many MPD officers, have arrested two Madison teens in the murder of 11-year-old Anisa Scott.

Andre P. Brown, age 16, was arrested on Northport Drive earlier today. Perion R. Carreon, age 19, was arrested Wednesday, for an unrelated crime, while driving a stolen car on Thierer Rd. Carreon had a loaded handgun in his waistband at the time of his apprehension.

‘Please protect my child from Andre Brown’

2½ years ago a parent asked Madison schools to refer

Brown to delinquency court.

The same André Brown, age 16, now in jail for his alleged part in the

08-11-2020 shooting death of Anisa Maria Scott, age 11.

Sat, August 15, 2020 at 3:36 PM

To: Kelly M Ruppel, MMSD Chief of Staff

Ms. Ruppel,

Below is an email string establishing that you were long aware that André Brown had perpetrated criminal acts upon my child and others in his classroom, that you were aware that Andre was an out-of-control thug, that you attempted to gaslight me, that you were aware that the so-called principal at Sherman wasn’t doing her job, that my family incurred very significant financial expense on the part of André Brown, and that your district’s so-called behavior-education plan wasn’t working.

As I stated to you two and a half years ago regarding André (whose behavior I had started reporting to the MMSD four and a half years ago: … A “Behavior” plan isn’t going to cure the conduct of a kid who has a brain problem and whose parents are ineffective.

Let’s compare: Middleton and Madison Property taxes:

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

More than twice as many Wisconsin families as a year ago have told the state they plan to homeschool for the 2020-21 school year.

According to data from the state Department of Public Instruction, 1,661 families filed forms to homeschool between July 1 and Aug. 6, up from 727 during the same period a year ago and 599 two years ago. The number of students in those families is up to 2,792 from 1,279 last year and 1,088 two years ago.

The same is true locally, as 122 Dane County families with 202 students filed forms in that period, up from 55 and 80 last year.

Michelle Yoo, the administrator of the Madison Area Homeschoolers Facebook page, said she’s seen evidence of the uptick in interest.

“When Madison announced they were doing online school, I think I had about 100 requests to join in about a two-week period,” Yoo said. “I can’t tell you what I used to get, but it was nowhere near 100.”

With those students go funding, as district revenue limits and state aid both depend on enrollment. The Madison Metropolitan School District discouraged parents from leaving to homeschool or attend a private school in its Aug. 7 family newsletter, citing that funding loss.

Let’s compare: Middleton and Madison Property taxes:

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

The coronavirus pandemic has a lot of people feeling boxed in. But for Michelle Possin it opened up a whole new realm of possibilities.

Before the COVID-19 crisis, the 54-year-old recruiter for TASC, a Madison-based administrative services company, spent half her time at home and the other half in the office. But now the company has nixed office work altogether, freeing employees to work from wherever they choose. So she sold her condo on the Isthmus and bought a house on Lake Wisconsin, giving her room for an office, a yard and, when the time comes, a place to retire.

“Living and working from a condo was not sustainable,” she said. “It was extremely small, and I felt very claustrophobic being there all the time.”

It was a life-changing decision to flee the city for more rural environs where Possin can spread out with twice the square footage of her condo, enjoy the lake and entertain at safe social distances outdoors, the kind of lifestyle that many crave, and more are finding within reach.

“There are quite a few people in my company who are moving because now they can work from anywhere,” she said. “One of my colleagues just moved to Colorado.”

Real estate agents across the country are noticing the trend. Untethered from the office and emboldened by historically low interest rates, telecommuters from the Bay Area to the East Coast are starting to look to the countryside, where they can have larger homes, bigger yards and a quieter life to raise their families.

Let’s compare: Middleton and Madison Property taxes:

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

Jane Belmore retired in 2005 after nearly three decades as a Madison teacher and principal. That wasn’t the end of her career with the Madison Metropolitan School District: She’s since been asked twice to lead when the district found itself between superintendents. Both turned out to be pivotal moments for the district.

Cap Times K-12 education reporter Scott Girard got an exclusive interview with Belmore as she was wrapping up her most recent year as interim superintendent. Today on the podcast, he talks about the expected and unexpected challenges this year brought, and why Belmore was willing to take them

Teachers have access to materials in their classrooms that are not available at home,” – despite million$ spent on Infinite Campus

Costs continue to grow for local, state and federal taxpayers in the K-12 space, as well:

Let’s compare: Middleton and Madison Property taxes:

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

Options at the new school under the recommendation would include designating it as a Community School — the district has four of those now — or creating specific programming like social-emotional learning, social justice or environmental education. Other ideas could still be added to that list as the planning process continues.

Teachers have access to materials in their classrooms that are not available at home,” – despite million$ spent on Infinite Campus

Costs continue to grow for local, state and federal taxpayers in the K-12 space, as well:

Let’s compare: Middleton and Madison Property taxes:

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration

Though Lee struggled with her online classes last semester, Garcia plans to keep her home again this fall. Lee has asthma, as does her nineteen-year-old sister, who contracted COVID-19 in June and narrowly avoided having to be admitted to the hospital as she struggled to breathe. Garcia has once again requested a hot spot from the district.

For those students whose needs are not met by the program, Rowe insists that this is just the beginning. “Those are the districts where we really need to dig deeper into the analytics and figure out who else has need,” Rowe said. “This isn’t going to be it. We won’t be done. We’ve just got to figure out how to peel back the next layer now.”

“Teachers have access to materials in their classrooms that are not available at home,” – despite million$ spent on Infinite Campus

Costs continue to grow for local, state and federal taxpayers in the K-12 space, as well:

Let’s compare: Middleton and Madison Property taxes:

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales.

Fall 2020 Administration Referendum slides.

(Note: “Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.)

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

– via a kind reader (July 9, 2020 update).

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration