So I get why Burke was the only board member to vote against a tax-raising, 2013-2014 school district budget.

Still, just once I’d like to see a candidate throw caution to the wind and mount a data-based defense of good, if politically unwise, choices. If voters don’t buy it, well then they deserve what they get.

Burke explained her latest no vote on the budget last week by saying the district needs to consider whether salary increases for district residents are keeping up with school district tax increases.

To back up that concern, Burke provided me with a May 1 news release from the Bureau of Labor Statistics showing that in Dane County, residents saw a 3.9 percent drop in average weekly wages between the third quarter of 2011 and the third quarter of 2012.

I did a little more digging and found that wages also dropped by 0.1 percent between the second quarter of 2011 and the second quarter of 2012, and by 0.3 percent between the first quarters of 2012 and 2013.

Nevertheless, a broader view of the most recent available data suggests her concern is largely unfounded.

The BLS reported that wages were up 7.7 percent and 5.9 percent respectively, in the first and fourth quarters of last year – essentially wiping out, and then some, the wage decreases.

Plus, over the most recent 10 years for which data are available, personal income and per-capita income in Dane County rose, on an average annual basis, by 4.29 percent and 2.92 percent, respectively, according to the U.S. Bureau of Economic Analysis.

By contrast, next year’s school district budget raises taxes on the average homeowner by 2.5 percent, and over the past 10 years, the average annual school district tax increase has been 1.75 percent.

If anything, district tax increases aren’t keeping up with district residents’ ability to pay them.

Despite the old tax-and-spend myth frequently pinned on liberal Dane County, the school district isn’t unique, either, at least when it comes to Madison and county government.

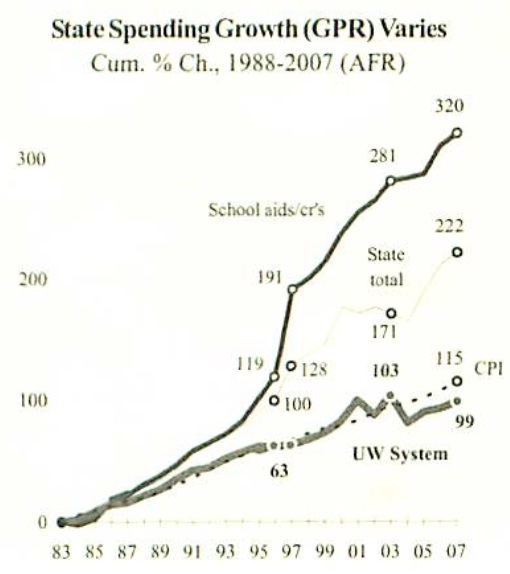

Mr. Rickert neglects to mention the changing composition of Wisconsin K-12 tax revenue sources. Redistributed state tax dollars grew substantially during the past few decades. That growth has now largely stopped. Absent a serious look at our agrarian era school organizations and practices, property tax & spending growth are going up annually.