Search Results for: redistributed state tax dollars

Redistributed State Tax Dollars and University of Wisconsin Ideology

Kimberly Wethal: “It’s not about cutting money. What it is is about getting some kind of reforms to the broken process that we currently have,” Vos said. “We don’t have enough respect for political diversity. Heaven forbid if you’re a student who’s Jewish or has a different viewpoint on campus where you feel like you’re […]

K-12 Tax & Spending Climate: Madison to receive 15% reduction in redistributed state tax dollars (property tax values and referendum spending are factors)

Jason Stein: Estimates for WI general school aids are out from DPI – not surprisingly given its increases in property values, Madison schools will see max 15% decrease (largest decrease in raw $s in the state). Milwaukee Public Schools expected to get a 2% increase: bit.ly/38lfSWQ Budget Brief, via the Wisconsin Policy Forum: But for […]

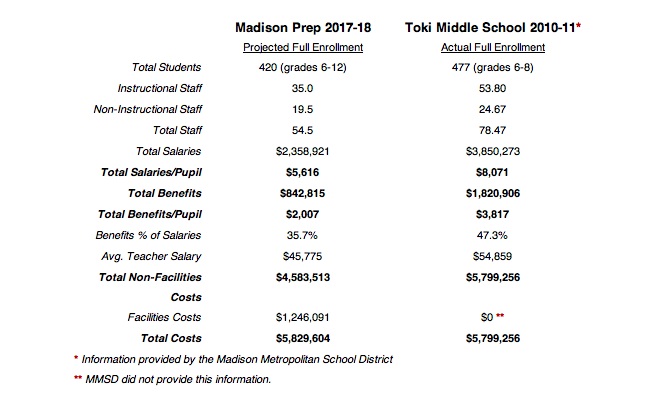

Commentary on Redistributed State Tax Dollars and Madison’s $450M+ School Budget ($18k/student)

Molly Beck: The law, known as Act 10, required local governments who offer a state health insurance plan to their employees to pay no more than 88 percent of the average premiums. Walker’s 2017-19 state budget will now require the same of all school districts, regardless of which health insurance plans they offer. That spells […]

A quick look at Dane County, WI K-12 Budgets and Redistributed State Tax Dollars

: Mahoney, director of business and technology services at the McFarland School District, said in an email to district staff that a budget deficit of between $500,000 and $1 million is likely for the next school year, which includes keeping a 3 percent wage increase and expecting a 7 percent health insurance cost increase. I […]

Wisconsin superintendent seeks an Increase in Redistributed State Tax Dollars to $12,800,000,000

Erin Richards & Kelly Meyerhoffer: State Superintendent Tony Evers wants to boost funding for Wisconsin’s K-12 schools by $613 million in the next biennial budget, combined with increases to the amount of money schools can raise in local taxes, and a new way of funding the Milwaukee voucher program. The Wisconsin Department of Public Instruction’s […]

Madison’s Planned Tax & Spending Growth Documents: Redistributed State Tax Dollars up 20.6% Since 2011!

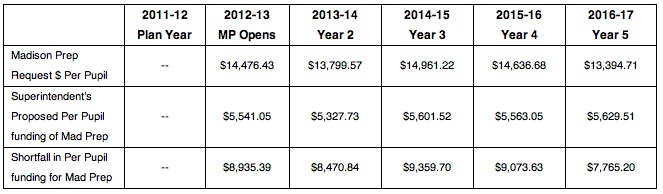

Madison School District PDF: For MMSD, the most important aspect of multi-year budget planning is the careful use of ‘unused tax levy authority’ which can be carried forward from one year to the next. For 2014-15, the budget has available just over $8.8 million of ‘unused tax levy authority’ which was carried forward from 2013-14.1 […]

Madison Schools’ 2014-2015 Budget Update; Assumes 16% Increase in Redistributed State Tax Dollars, 2.11% Property Tax Growth; About $400,000,000 for 27,186 students

The Madison School District (600K PDF): This is the fourth and final installment of the series of updates designed to keep the board informed during the 2014-15 MMSD budget development process. The first update reviewed the budget process, priorities, and expected revenues. The second update explained our goals for a school-based staffing process that was […]

Madison School Board Candidates Discuss Redistributed State Tax Dollars & Voucher Schools

Five candidates are competing for three seats on the Madison school board, with the general election on April 2, 2013.

The political context for the races is explosive, given Gov. Scott Walker’s revolutionary proposals for education in Wisconsin: cuts to public school funding, an expansion of the voucher program, and a revamping of teachers’ evaluations and bargaining rights.

In Madison, the issues are particularly complex, with the intense disagreements over the district’s achievement gap between white and minority students.

In the race for Seat 4, incumbent James Howard is running against Greg Packnett, a Democratic legislative aide.

In this competitive series of elections, there are numerous candidate forums and listening sessions under way, and we thought we’d pose our own questions to candidates.

For this fourth and final week of questions, we ask candidates to evaluate Gov. Scott Walker’s proposals for the Wisconsin’s 2013-15 budget, and consider how it would impact schools in the state. Along similar lines, we ask candidates to share their thoughts on the proposal to expand voucher schools in Wisconsin.

RSS Local Schools Madison schools losing $6.7 million in Redistributed State Tax Dollars

The Madison School District will lose $6.7 million in state aid next year — $2 million more than it anticipated — according to estimates released Friday by the Department of Public Instruction.

The 13.5 percent cut is third-highest in the state among K-12 districts and higher than the 10 percent cut the School Board used to calculate its preliminary budget last week.

The $43.2 million in aid is also nearly one-third less than the $60.8 million the district received from the state four years ago.

Superintendent Dan Nerad said continuous cuts in state aid are hurting the quality of public education.

“School districts like ours cannot continue to be in an environment like this with increased expectations for student performance, and yet we’re not willing to provide the resources,” Nerad said.Related: 1983-2007 Wisconsin K-12 Spending Growth via WISTAX:

Wisconsin Education Superintendent Seeks 2-4% annual increases in redistributed state tax dollars, introduction of a poverty formula and a shift in Property Tax Credits

Many links as the school finance jockeying begins, prior to Governor Scott Walker’s January, 2011 inauguration. Wisconsin’s $3,000,000,000 deficit (and top 10 debt position) makes it unlikely that the K-12 world will see any funding growth.

Matthew DeFourEvers plan relies on a 2 percent increase in school aid funding next year and a 4 percent increase the following year, a tough sell given the state’s $3 billion deficit and the takeover of state government by Republicans, who have pledged budget cuts.

One major change calls for the transfer of about $900 million in property tax credits to general aid, which Evers said would make the system more transparent while having a negligible impact on property taxes. That’s because the state imposes a limit on how much a district can raise its total revenue. An increase in state aid revenue would in most cases be offset by a decrease in the other primary revenue — property taxes.

Thus the switch would mean school districts wouldn’t have such large annual property tax increases compared to counties, cities and other municipalities, even though tax bills would remain virtually the same, said Todd Berry, executive director of the Wisconsin Taxpayers Alliance.

“Distributing the money through the school aid formula, from a pure policy sense, is probably more equitable than distributing it in its current tax credit form,” Berry said. “The money will tend to help districts that tend to be poorer or middle-of-the-road.”Inequities in the current system tend to punish public schools in areas like Madison and Wisconsin’s northern lake districts because they have high property values combined with high poverty and special needs in their school populations. The current system doesn’t account for differences in kids’ needs when it doles out state aid.

Education policy makers as well as politicians on both sides of the aisle have talked school funding reform for over a dozen years but it’s been a tough sell because most plans have created a system of winners and losers, pitting legislator against legislator, district against district.

Evers’ plan, which calls for a 2 percent increase in school aid funding next year and a 4 percent increase the following year, as well as a transfer of about $900 million in property tax credits to general aid, addresses that issue of winners and losers. Over 90 percent of districts are receiving more funding under his proposal. But there aren’t any district losers in Evers’ plan, either, thanks to a provision that requests a tenth of a percent of the total state K-12 schools budget — $7 million — to apply to districts facing a revenue decline.Wisconsin State and Local Debt Rose Faster Than Federal Debt During 1990-2009 Average Annual Increase in State Debt, 7.8%; Local Debt, 7.3%

Rewrite of Wisconsin school aid formula has cost

Wisconsin Department of Public Instruction:

The following printout provides school district level information related to the impact of State Superintendent Evers’ Fair Funding proposal.

Specifically, the attachment to this document shows what each school district is receiving from the state for the following programs: (1) 2010-11 Certified General Aid; (2) 2009-10 School Levy Tax Credit; and (3) 2010-11 High Poverty Aid.

This information is compared to the potential impact of the State Superintendent’s Fair Funding proposal, which is proposed to be effective in 2012-13, as if it had applied to 2010-11.

Specifically, the Fair Funding Proposal contains the following provisions:But the plan also asks for $420 million more over the next two years – a 2% increase in funding from the state for the 2011-’12 school year and 4% more for the following year – making it a tough sell in the Legislature.

State Sen. Alberta Darling (R-River Hills), who will co-chair the powerful Joint Finance Committee, said she considered the proposal pretty much dead on arrival in the state Legislature, which will be under Republican control next year, without further changes.

“I think those goals are very admirable,” said Darling, who has been briefed on the plan. “But, you know, it’s a $6 billion budget just for education alone and we don’t have the new money. I think we have to do better with less. That’s just where we are.”

On Friday, Governor-elect Scott Walker said his office had only recently received the proposal from the DPI and he had not had time to delve into its details or to speak with Evers. He said he hoped to use his budget to introduce proposals that would help school districts to control their costs, such as freeing them from state mandates and allowing school boards to switch their employees to the state health plan.

A Proposal To Rewrite Wisconsin’s $5,200,000,00 in Redistributed State Tax Dollars for K-12 Districts

The school levy credit shows up as a reduction on property tax bills mailed in December, and killing it would be difficult politically.

But according to Dale Knapp of the Wisconsin Taxpayers Alliance, the proposal would simply move money around and would have little effect on the problems schools face.

“Some districts will pay less, some will pay slightly more, but the schools will be in the same boat they were before,” he said.

The state uses the school levy tax credit to help reduce property taxes that provide local money for schools. It was created in 1996 and it has grown by more than 400 percent since.

Evers stressed that putting the tax credit money into the aid formula, then redistributing it to schools under a reworked formula, would not result in a net increase statewide in property taxes. It would, however, mean higher or lower taxes for individuals, depending on their school district.

notes on redistributed state taxpayer k-12 dollars

Chris Rickert: Under the state’s complicated formula for doling out state dollars to local districts, districts that have lower than average property values per-pupil and spend less per-pupil than other districts tend to receive more state aid as their expenses go up, according to Dan Rossmiller, executive director of the Wisconsin Association of School Boards. […]

Madison receives a 61% increase in  redistributed state taxpayer dollars

Abbey Machtig: This school year, the district will get about $61.3 million from the state, according to DPI’s final calculations. Last school year, Madison schools received about $37.9 million. Any increase in state aid typically lessens the burden on local property taxpayers. In Wisconsin’s complex school finance system, the two factors are directly related: When […]

61 percent of Wisconsin’s school districts will get more state redistributed tax dollars next year

Molly Beck: A majority of the state’s public school districts will receive more state general aid in the coming school year than they did the prior year, the latest state estimates show. Of the state’s 424 school districts, 61 percent — or 260 — are projected to receive more aid in the 2016-17 school year, […]

“Unexpected” $12,000,000 2012-2013 Increase in Madison’s Redistributed State of Wisconsin Tax Dollars

The 25.4 percent increase — from $43.3 million to $54.3 million — is the fifth-largest percent increase among the state’s 424 districts and by far the largest dollar amount increase.

Madison’s increase accounts for more than half of the $21.1 million increase in state aid for districts next school year.

School Board President James Howard said the development was good news, though he wouldn’t speculate whether the board would keep current spending levels or increase the preliminary $376.2 million budget when it takes up final approval of the tax levy in October.

…..

Howard, who was the only board member who voted against the preliminary budget, said he questions why the district was so far off in its state aid estimate, adding “there has always been discussion about why do we need to approve budgets so early.”Related: Notes and links on Madison’s 2012-2013 $374,700,000 budget.

notes on redistributed state taxpayer funds and the University of Wisconsin

Becky Jacobs and Andrew Bahl: The leader of Wisconsin’s 13 public universities said without additional funding in the next state budget, he expects more branch campus closures, decreased affordability for students, layoffs and program cuts. “All of which will hit hardest at our most vulnerable UWs,” Universities of Wisconsin President Jay Rothman said on social media. […]

Academic Litigation over Redistributed Federal Taxpayer “grants”

Andrew Jack: He called for “a never-ending compliance review to ensure that Harvard follows the law” banning positive discrimination. He also wrote: “To scare universities straight, McMahon should start by taking a prize scalp. She should simply destroy Columbia University” by freezing research grant funding or preventing it receiving subsidised student loans. His tactics have […]

litigation and redistributed federal taxpayer dollars

Mitchell Schmidt: The coalition argues it is Congress, and not the executive branch, that holds the legal authority to incapacitate or dismantle the department, and previous legal decisions have reflected “the uncontroversial understanding that only Congress may abolish an agency it created.” Throughout the week, Democratic lawmakers and the state Department of Public Instruction have […]

Notes on redistributed federal taxpayer funds

Molly Beck and Lawrence Andrea: Wisconsin Gov. Tony Evers is asking President Donald Trump to delay the implementation of a freeze on federal assistance, arguing Wisconsinites “are rightfully alarmed and concerned by this unprecedented decision” and are left scrambling. Trump’s order freezing federal grants sent shockwaves through Wisconsin government on Tuesday as officials sought to understand […]

Notes on Redistributed Wisconsin Taxpayer K-12 funds

Corrine Hess: But DPI spokesperson Chris Bucher said the department and MPS made sure all accounting errors were corrected to minimize any significant further adjustments. The state deducted $42.6 million in state aid from its payment to the district last month due to district reporting errors in the 2022-23 school year. “This took a tremendous […]

What did redistributed federal taxpayer Covid funds accomplish?

Will Flanders: During the COVID-19 pandemic, the federal government shelled out $189.5 billion to school districts across the country via Elementary and Secondary School Emergency Relief (ESSER) funding. Wisconsin was no exception. Across three rounds of ESSER funding, the state and school districts received more than $2.4 billion dollars. Despite federal requirements that ESSER money be used to […]

Higher Ed Bargaining over redistributed tax dollars and tuition inflation

Kimberly Wethal: Universities of Wisconsin schools would keep in-state undergraduate tuition steady for the next two academic years if lawmakers hike state aid by $855 million of state dollars as part of the upcoming budget cycle, UW system President Jay Rothman said in a budget request Monday. The proposed budget, which goes before the UW […]

Commentary on K-12 Taxpayer spending variation. (Excludes redistributed Federal tax and borrowed funds)

Mark Lieberman: In close to two dozen states, high-poverty schools get less money per student or just the same amount as low-poverty schools, a new report shows, despite abundant evidence that high-poverty schools benefit from more robust investment. A new analysis of U.S. Census Bureau data also shows wide disparities in how evenly school funding is distributed. […]

K-12 Tax & Spending Climate: So, Why Didn’t the 2009 Recovery Act Improve the Nation’s Highways and Bridges?

Bill Dupor: Although the American Recovery and Reinvestment Act of 2009 (the Recovery Act) provided nearly $28 billion to state governments for improving U.S. highways, the highway system saw no significant improvement. For example, relative to the years before the act, the number of structurally deficient or functionally obsolete bridges was nearly unchanged, the number […]

Commentary on federal redistributed taxpayer funds for K-12 school districts and charters

Libby Sobic: As Congress doles out billions of dollars for K–12 schools, charter schools already receive a much smaller portion of the education-funding pie. Currently Congress appropriates $440 million for the CSP, which is just 1 percent of U.S. Department of Education spending on K–12. However, the CSP has been critical to the growth and sustainability of charter […]

Wisconsin lawmakers should allow parents to direct redistributed K-12 billion$ from American Rescue Plan

Institute for Reforming Government, Wisconsin Manufacturers & Commerce, Wisconsin, Federation for Children School Choice, Wisconsin Action ExcelinEd in Action, Wisconsin Institute for Law & Liberty, The John K. MacIver Institute for Public Policy Badger Institute, FreedomWorks and Building Education for Students Together: Dear Governor Evers, Speaker Vos, Majority Leader LeMahieu, and State Superintendent Stanford Taylor, […]

K-12 Tax & Spending Climate: Redistributed Federal taxpayer funds and Wisconsin Schools

Kyle Koenen & Libby Sobic: The state has already received $2.0 billion in stimulus funding under the federal CARES Act and is expected to receive billions more in the latest round of stimulus. While the Department of Administration has developed a dashboard displaying CARES Act funding allocations, this tool fails to keep the public adequately […]

Madison’s taxpayer supported K-12 schools may receive an additional $3.9M in redistributed federal tax dollars amidst fall 2020 referendum plans

Logan Wroge: The Madison School District is eligible for up to $3.9 million. It’s the only district in Dane County that is eligible for money from this specific pot in the CARES Act. Costs continue to grow for local, state and federal taxpayers in the K-12 space, as well: Let’s compare: Middleton and Madison Property […]

Commentary on the growth of redistributed Wisconsin K-12 tax & spending

David Blaska: Governor Evers vetoed another middle class tax cut this week. The bill that passed with bipartisan support in the Assembly last week would have: • Reduced nearly $250 million in income taxes for middle and lower income levels by increasing the sliding scale standard deduction by 13.2% for each filer. This would have resulted […]

Gubernatorial Candidate Tony Evers Proposal: Spend 12.3% (10%?) more taxpayer funds on Wisconsin K-12 school districts; while killing substantive reading improvement efforts.

Jessie Opoien: Evers, a Democrat, is asking for $1.4 billion in additional funds for the state’s K-12 schools in the 2019-21 budget. The $15.4 billion request, submitted by Evers on Monday, comes less than two months before Walker and Evers will meet on the ballot — and Evers’ budget letter includes a swipe at the […]

Gubernatorial Candidate Tony Evers Proposal: Spend 12.3% more taxpayer funds on Wisconsin K-12 school districts; while killing substantive reading improvement efforts.

Kelly Meyerhofer: Walker proposed $13.7 billion in total state support for public schools for the 2017-19 biennium. That includes about $2.2 billion in property tax credits that are counted as K-12 funding, but don’t go directly into the classroom. Walker’s campaign spokesman Brian Reisinger touched on the record amount in a Saturday statement: “Scott Walker […]

Redistributed Wisconsin K-12 tax dollars grow in latest legislative plan

Molly Beck: Overall, Walker proposed $11.5 billion for schools, including the $649 million increase. A spokesman for budget committee co-chairwoman Sen. Alberta Darling, R-River Hills, said the Joint Finance Committee reduced the increase to $639 million because of reductions to funding proposed by Walker for rural school districts and for schools in the Milwaukee School […]

Wisconsin Redistributed Tax Dollars will help taxes, not classrooms

Erin Richards: About 60% of school districts will get a boost in state aid in 2016-’17, but the money will flow through to property tax relief instead of funding for classrooms, according to new state figures. Meanwhile, costs to taxpayers for the Milwaukee voucher program and costs to nearly all districts for the expense of […]

New state budget raises taxes while borrowing $325,000,000

Tulsa Beacon: Higher education will be cut by 7.66 percent. The Oklahoma Health Care Authority (the state Medicaid provider) will get a 9.24 percent increase. The Oklahoma Department of Mental Health and Substance Abuse Services will get a 2.18 percent increase. Government (redistributed tax dollars) health care spending growth has long crowded out other expenditures. […]

Commentary On Proposed Changes To Wisconsin’s Redistributed K-12 Tax Dollars

Molly Beck: While I do agree that there was some situations where some districts were gaming the system, and perhaps something needs to be done, it’s clear in talking with the Senate that there isn’t support to bring this bill all the way home,” he said, adding that he expected enough support for the original […]

Media Reality Check on Madison’s K-12 Tax & Spending

Molly Beck, writing for the Wisconsin State Journal: Madison schools could see a $2.6 million increase in state aid next school year, but that’s about $5.6 million less than what district officials assumed when the School Board passed its preliminary budget last month, according to state estimates released Tuesday. The Madison School District expected its […]

An Update On Redistributed Wisconsin Tax Dollars for K-12 Budgets

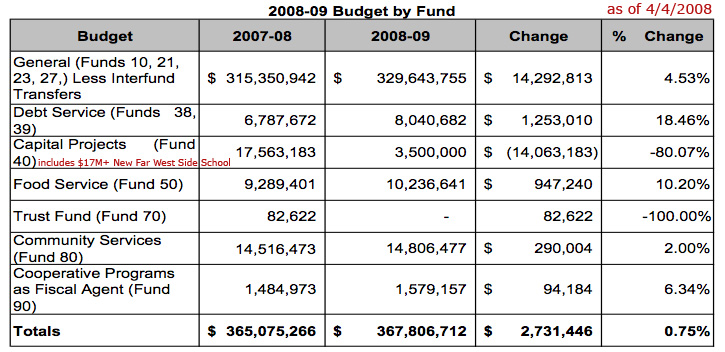

Molly Beck: Whether the district will need to scale back its planned spending for the 2014-15 school year is a “good question,” Howard said. “I’m not sure what it means.” McCarthy said Madison’s aid has only hit the $60 million mark once, during the 2008-09 school year when total state aid levels peaked at $4.7 […]

K-12 Tax & Spending Climate: States Grapple With Unpopular Property Taxes; Madison Seeks Continue Annual Increases; Chicago to Fund Pension Deficits

Elaine S. Povich State Sen. David Argall thinks Pennsylvania’s law to fund schools with property taxes, which dates from the 1830s, has outlived its usefulness. He is pushing a bill that would eliminate property taxes levied by school districts and replace the revenue with higher state income and sales taxes. For the first time, his […]

School Board Property Tax Increase Votes and State Politics

So I get why Burke was the only board member to vote against a tax-raising, 2013-2014 school district budget.

Still, just once I’d like to see a candidate throw caution to the wind and mount a data-based defense of good, if politically unwise, choices. If voters don’t buy it, well then they deserve what they get.

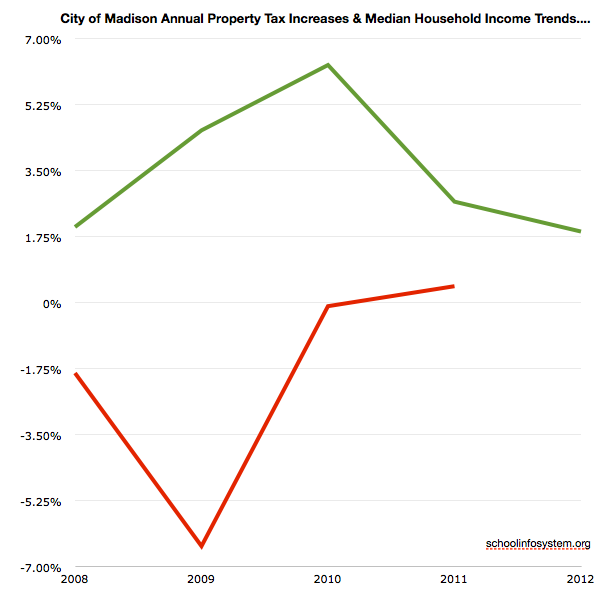

Burke explained her latest no vote on the budget last week by saying the district needs to consider whether salary increases for district residents are keeping up with school district tax increases.

To back up that concern, Burke provided me with a May 1 news release from the Bureau of Labor Statistics showing that in Dane County, residents saw a 3.9 percent drop in average weekly wages between the third quarter of 2011 and the third quarter of 2012.

I did a little more digging and found that wages also dropped by 0.1 percent between the second quarter of 2011 and the second quarter of 2012, and by 0.3 percent between the first quarters of 2012 and 2013.

Nevertheless, a broader view of the most recent available data suggests her concern is largely unfounded.

The BLS reported that wages were up 7.7 percent and 5.9 percent respectively, in the first and fourth quarters of last year – essentially wiping out, and then some, the wage decreases.

Plus, over the most recent 10 years for which data are available, personal income and per-capita income in Dane County rose, on an average annual basis, by 4.29 percent and 2.92 percent, respectively, according to the U.S. Bureau of Economic Analysis.

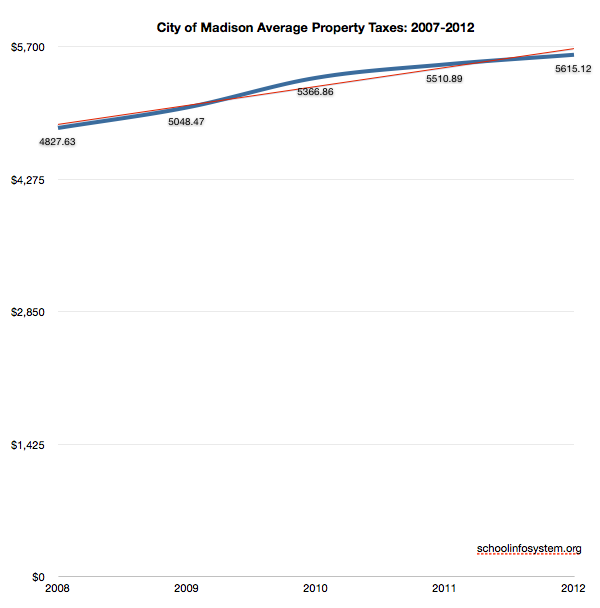

By contrast, next year’s school district budget raises taxes on the average homeowner by 2.5 percent, and over the past 10 years, the average annual school district tax increase has been 1.75 percent.

If anything, district tax increases aren’t keeping up with district residents’ ability to pay them.

Despite the old tax-and-spend myth frequently pinned on liberal Dane County, the school district isn’t unique, either, at least when it comes to Madison and county government.

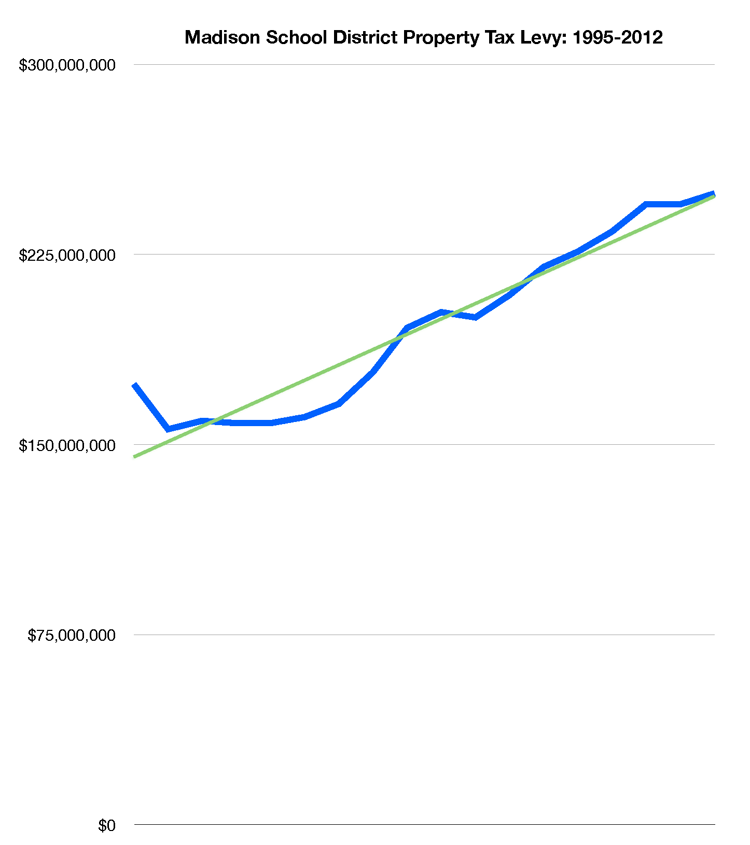

Mr. Rickert neglects to mention the changing composition of Wisconsin K-12 tax revenue sources. Redistributed state tax dollars grew substantially during the past few decades. That growth has now largely stopped. Absent a serious look at our agrarian era school organizations and practices, property tax & spending growth are going up annually.

Wisconsin School District Redistributed State Tax Dollar Receipts

Public schools will receive $4.26 billion in general state aid this school year, up $87.5 million or 2.1 percent from last year, the Department of Public Instruction announced Wednesday.

The aid figures are a revision from those released Oct. 15. Gov. Scott Walker signed a bill Sunday to increase aid by $100 million over two years. The bill did not include an increase in state-imposed limits on school district revenues, so school boards are expected to use the additional aid to lower property taxes.

The aid figures were marginally different than estimates released by the Legislative Fiscal Bureau last week as part of the discussion of the property tax relief bill. The Madison School District, for example, will receive $12,680 less than reported last week, a change of 0.02 percent.

Over all, Madison will get $52.2 million in state aid, a 10.7 percent decrease.Madison received an increase of $11,800,000 in redistributed state tax dollars last year…

Madison Schools’ 2013-2014 Budget Charts, Documents, Links, Background & Missing Numbers.

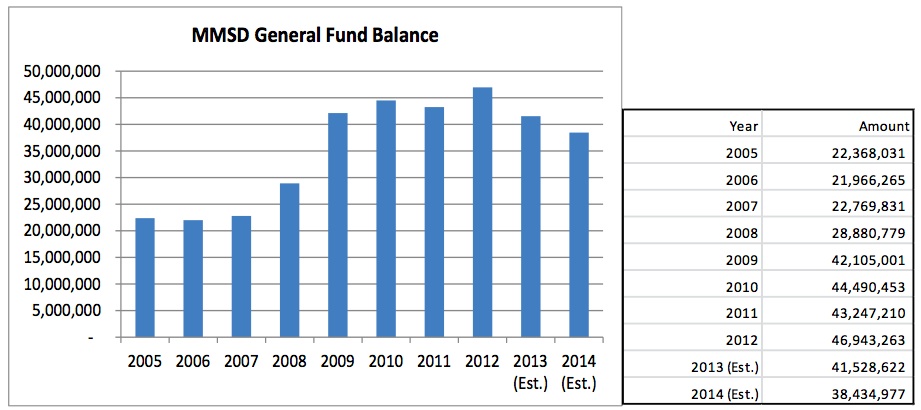

45% (!) Increase in Madison Schools’ Fund 80 Property Taxes from the 2011-2012 to 2012-2013 School Year; No Mention of Total Spending

July, 2013 Madison Schools 2013-2014 Budget Presentation (PDF). Notes:

- No mention of total spending…. How might the Board exercise its oversight obligation without the entire picture?

- The substantial increase in redistributed state tax dollars (due to 4K) last year is not mentioned. Rather, a bit of rhetoric: “The 2013-14 budget development process has focused on actions which begin to align MMSD resources with the Strategic Framework Priorities and strategies to manage the tax levy in light of a significant loss of state aid.” In fact, according to page 6, the District expects to receive $46,392,012 in redistributed state tax dollars, which is a six (6%) increase over the funds received two years ago.

- The District’s fund equity (financial cushion, or reserves) has more than doubled in the past eight years, from $22,368,031 in 2005 to $46,943,263 in 2012.

- Outbound open enrollment continues to grow, up 14% to 1,041 leavers in 2013 (281 inbound from other Districts).

- There is no mention of the local tax or economic base:

- The growth in Fund 80 (MSCR) property taxes and spending has been controversial over the years. Fund 80, up until recently was NOT subject to state imposed property tax growth limitations.

- Matthew DeFour briefly summarizes the partial budget information here. DeFour mentions (no source referenced or linked – in 2013?) that the total 2013-2014 budget will be $391,000,000. I don’t believe it:

The January, 2012 budget document mentioned “District spending remains largely flat at $369,394,753” (2012-2013), yet the “baseline” for 2013-2014 mentions planned spending of $392,807,993 “a decrease of $70,235 or (0.02%) less than the 2012-13 Revised Budget” (around $15k/student). The District’s budget generally increases throughout the school year, growing 6.3% from January, 2012 to April, 2013. Follow the District’s budget changes for the past year, here.

Finally, the document includes this brief paragraph:

Work will begin on the 2014-15 early this fall. The process will be zero-based, and every line item and FTE will be carefully reviewed to ensure that resources are being used efficiently. The budget development process will also include a review of benefit programs and procurement practices, among other areas.

One hopes that programs will indeed be reviewed and efforts focused on the most urgent issues, particularly the District’s disastrous reading scores.

Ironically, the recent “expert review” found that Analysis: Madison School District has resources to close achievement gap. If this is the case (and I agree with their conclusion – making changes will be extraordinarily difficult), what are students, taxpayers and citizens getting for the annual tax & spending growth?

I took a quick look at property taxes in Middleton and Madison on a $230,000 home. A Middleton home paid $4,648.16 in 2012 while a Madison home paid 16% more, or $5,408.38.

Stagnant School Governance; Tax & Spending Growth and the “NSA’s European Adventure”

The Madison School District’s recent rhetoric around annual property tax increases (after a significant increase in redistributed state tax dollars last year and a “return to normal” this year) is, to the ongoing observer, unsurprising. We appear to be in the Rainwater era “same service” approach to everything, from million$ spent on a partially implemented Infinite Campus to long-term disastrous reading scores.

Steve Coll’s 5 July 2013 New Yorker column nails it:The most likely explanation is that President Obama never carefully discussed or specifically approved the E.U. bugging, and that no cabinet-level body ever reviewed, on the President’s behalf, the operation’s potential costs in the event of exposure. America’s post-September 11th national-security state has become so well financed, so divided into secret compartments, so technically capable, so self-perpetuating, and so captured by profit-seeking contractors bidding on the next big idea about big-data mining that intelligence leaders seem to have lost their facility to think independently. Who is deciding what spying projects matter most and why?

Much more on annual local property tax increases, here:

The Madison School Board should limit the school property tax hike to the rate of inflation next year, even if that means scaling back a proposed 1.5 percent across-the-board salary increase for school district employees, says member Mary Burke.

“I think in an environment where we’ve seen real wages in Dane County decrease, and a lot of people are on fixed incomes, we have to work as hard as possible to limit any increase to the inflation rate,” Burke said Tuesday in an interview.

…

But School Board discussions have focused around reducing the proposed salary hike, and cutting back on facility maintenance to pare down the $392 million proposed budget enough to bring the property tax increase to 4 or 5 percent, board President Ed Hughes told me.

The district under state law could increase its levy by as much as $18,385,847 or 9 percent. Keeping the increase to around the rate of inflation would mean an increase of less 2 percent.

…

Board member TJ Mertz can’t vote on salaries because his wife is a teacher’s aide with the school district, he told me, but he has long been outspoken in his belief in good pay for teachers to ensure the best academic achievement for students.

“As a citizen, I understand our staff needs to be compensated,” he said, adding that teachers have taken losses in take-home pay since they were required to begin making contributions to their pensions in 2011. “If the state won’t invest in our children, it has to come from the property tax,” he said.

Mertz said he would prefer a tax increase steeper than the 4 percent or 5 percent the board as a whole is focusing on. “I firmly believe the most important thing we can do is invest in our students; the question should not be what property tax levy can we afford,” he said.I appreciate Schneider’s worthwhile questions, including a discussion of “program reviews”:

Several School Board members interviewed for this story stressed that the 2013-2014 budget will be a transitional one, before a broad re-evaluation of spending planned by Cheatham can be conducted.

Yet, it would be useful to ask if in fact programs will be reviewed and those found wanting eliminated. The previous Superintendent, Dan Nerad, discussed program reviews as well.

Madison Schools’ 2013-2014 Budget Charts, Documents, Links, Background & Missing Numbers.

The Madison School Board seat currently occupied by Mr. Hughes (Seat 7, and Seat 6 – presently Marj Passman) will be on the Spring, 2014 ballot (candidate information is available at the Madison City Clerk’s website).

Up, Down & Transparency: Madison Schools Received $11.8M more in State Tax Dollars last year, Local District Forecasts a Possible Reduction of $8.7M this Year

The Madison School District stands to lose millions of dollars in state aid under Gov. Scott Walker’s budget proposal, district officials said Wednesday.

The district is projecting an $8.7 million, 15 percent reduction in state aid, Superintendent Jane Belmore said in an interview.

She cautioned that the amount is a preliminary estimate based on the governor’s 2013-15 budget proposal, which could undergo changes by the Legislature.

The district is preparing its 2013-14 budget, and it’s unclear when a proposal will be finalized. School districts typically develop spending plans for the following year before knowing exactly how much money they’ll get in state aid.

Walker’s budget calls for a 1 percent increase in state aid, but Belmore said when district staff put the amount through the state’s complicated funding formula it resulted in the reduction. State Department of Public Instruction officials couldn’t verify the district’s estimate.

This year’s $394 million school budget included $249.3 million in property taxes, a 1.75 percent increase over the previous year.One would hope that any budget article should include changes over time, which DeFour unfortunately neglects. Madison received an increase of $11.8M in redistributed state tax dollars last year.

In addition, DeFour mentions that the current budget is 394,000,000. The most recent number I have seen is $385,886,990. where has the additional $8,113,010 come from? where is it being spent? was there a public discussion? Per student spending is now $14,541.42.

Related: Ed Hughes on School District numbers in 2005: in 2005::This points up one of the frustrating aspects of trying to follow school issues in Madison: the recurring feeling that a quoted speaker – and it can be someone from the administration, or MTI, or the occasional school board member – believes that the audience for an assertion is composed entirely of idiots.

Madison schools propose using $12M redistributed state tax windfall for tax relief, technology upgrades, achievement gap

That means the district’s property tax levy would increase 3.47 percent, down from the 4.95 percent increase the board approved in June. The tax rate would be $11.71 per $1,000 of assessed value, down from $11.88. For an average $232,024 home, the difference is about $40.

The board could use the remaining $8.1 million on property tax relief, but Belmore is recommending it be used in other ways, including:

$3.7 million held in reserves, in case the state overestimated additional aid.

$1.6 million to buy iPads for use in the classroom, $650,000 to upgrade wireless bandwidth in all schools and $75,000 for an iPad coach.

$1.2 million to account for a projected increase in the district’s contribution to the Wisconsin Retirement System.

About $800,000 geared toward closing achievement gaps including: three security assistants at Black Hawk, O’Keeffe and Hamilton middle schools; an assistant principal at Stephens Elementary, where the district’s Work and Learn alternative program caused parent concerns last year; two teacher leaders to assist with the district’s literacy program; a high school math interventionist; increasing the number of unassigned positions from 13.45 to 18.45 to align with past years; and a new student agricultural program.

$100,000 to fund the chief of staff position for one year.104K PDF Memo to the Madison School Board regarding redistribution of state tax dollars.

Madison plans to spend $376,200,000 during the 2012-2013 school year or $15,132 for each of its 24,861 students.

Wisconsin gets $10.5M in federal redistributed tax dollars for English learner assessment

Bill Novak: The Wisconsin Department of Public Instruction has been awarded a $10.5 million grant to develop technology-based assessments for students learning English. The four-year grant from the federal Department of Education will be used to develop an online assessment system to measure student progress in attaining the English language skills they need to be […]

A Simple Approach to Ending the State Budget Standoff

Madison School Board Member Ed Hughes:

Here’s an idea for resolving the state’s budget repair bill crisis. Governor Walker’s budget repair bill is designed to eviscerate public employee unions. But with a few changes it could actually lead to an innovative and productive way of addressing the legitimate concerns with the collective bargaining process, while preserving the most important rights of teachers and other public employees.

Background: A Tale of Two Unions

First, some background that highlights the two sides of the issue for me as a member of the Madison School Board. Early on Friday morning, February 25, our board approved a contract extension with our AFSCME bargaining units, which include our custodians and food service workers. The agreement equips the school district with the flexibility to require the AFSCME workers to make the contributions toward their retirement accounts and any additional contributions toward their health care costs that are required by the budget repair bill, and also does not provide for any raises. But the agreement does preserve the other collective bargaining terms that we have arrived at over the years and that have generally worked well for us.

AFSCME has stated that its opposition to the Governor’s bill is not about the money, and our AFSCME bargaining units have walked that talk.

Our recent dealings with MTI, the union representing our teachers and some other bargaining units, have been less satisfying. Because of teacher walk outs, we have to make up the equivalent of four days of school. An obvious way to get started on this task would be to declare Friday, February 25, which has been scheduled as a no-instruction day so that teachers can attend the Southern Wisconsin Educational Inservice Organization (SWEIO) convention, as a regular school day.Through a variety of circumstances, I’ve had an opportunity to recently visit with several Dane County (and Madison) businesses with significant blue collar manufacturing/distribution employment. In all cases, these firms face global price/cost challenges, things that affect their compensation & benefits. Likely reductions in redistributed State of Wisconsin tax dollars could lead to significantly higher property taxes during challenging economic times, if that’s the route our local school boards take.

Wisconsin State Senator Seeks to Stop 4K Funding Growth, Including Madison’s Planned Program

A Republican lawmaker wants to kill Madison’s fledgling 4-year-old kindergarten program before it even begins.

Sen. Glenn Grothman, R-West Bend, said Wednesday the state shouldn’t encourage new 4K programs — now in 85 percent of the state’s school districts and with three times as many students as a decade ago — because taxpayers can’t afford them.

“We have a very difficult budget here,” Grothman said in an interview. “Some of it is going to have to be solved by saying some of these massive expansions of government in the last 10 years cannot stand.”

Madison Superintendent Dan Nerad called Grothman’s proposal “very troubling.”

“I don’t know what the 4-year-olds in Madison did to offend the senator,” Nerad said. “There are plenty of studies that have indicated that it’s a good idea to invest as early as possible.”

Last month the Madison School Board approved a $12.2 million 4K program for next fall with registration beginning Feb. 7. Madison’s program is projected to draw $10 million in extra state aid in 2014 when the state’s funding formula accounts for the additional students. Overall this year, school districts are projected to collect $223 million in state aid and property taxes for 4K programs, according to the Legislative Fiscal Bureau.Much more on Madison’s planned 4K program, here.

It appears that redistributed state tax dollars for K-12 are destined to change due to a significant budget deficit, not to mention the significant growth in spending over the past two decades.The recent 9% increase in Madison property taxes is due in part to changes in redistributed state tax funds.

I spoke with a person active in State politics recently about 4K funding. Evidently, some lawmakers view this program as a method to push more tax dollars to the Districts.

K-12 Tax & Spending Climate: A View from China

Powerful interest groups have paralyzed China’s macro-economic policy, with ominous long-term consequences. Local governments consider high land prices their lifeline. State-owned enterprises don’t want interest rates to rise. Exporters are vehemently against currency appreciation. China’s macro policies have been reduced to psychotherapy, relying on sound bites and small technical moves to scare speculators. In the meantime, inflation continues to pick up momentum. Unless the central government bites the bullet and makes choices, the economy might experience a disruptive adjustment in the foreseeable future.

The first key point is that local governments have become dependent on the property sector for revenue as profits from manufacturing decline and spending needs to rise. Attracting industry has been the main means of economic development and fiscal revenue for two decades. Coastal provinces grew rich by nurturing export-oriented industries. But the economics has changed in the past five years. Rising costs have sharply curtailed manufacturers’ profits, and most local governments now offer subsidies to attract industries. The real revenue has shifted to property.The dependency on high land prices for property tax revenue is certainly not unique to China. Madison’s 2010-2011 budget will increase property taxes by about 10%, due to spending growth, declining redistributed state tax dollars and a decline in local property values.

Despite cost-cutting, most Phila.-area districts are planning tax increases for the coming school year.

In nine districts, taxes went up by more than double the state inflation rate, and in three – Upper Dublin, Southeast Delco, and Bristol Borough – they went up by more than 10 percent. The 2010-11 property-tax increase for all 63 suburban districts averaged slightly more than 4 percent, up from 2.9 percent in 2009-10, even though the education inflation rate for this year was higher, at 4.1 percent.

In Bucks County’s Bristol Borough district, one of the smallest in the area with an enrollment of about 1,225, taxes are going up 15 percent. School Board President Ralph DiGuiseppe III, who was elected in November, said almost the entire increase is because of a 2009-10 deficit, when the board did not raise taxes.

To keep from going even higher, DiGuiseppe said, the board has cut some teaching jobs, and will reduce administrative pay by having the superintendent double as high school principal for part of the coming school year. Another administrator will teach part time. Three sports teams also were eliminated.Locally, the 2010-2011 Madison School District budget will increase property taxes by about 10%. The increase is due to spending growth, a reduction in redistributed state tax dollars and a decline in property values (assessments).

K-12 Tax & Spending Climate: Wisconsin deficit for next two-year budget swells to $2.5 billion

The state’s yawning budget hole has swelled to $2.5 billion, underscoring the massive challenge that awaits the next governor and Legislature, a new report shows.

The projections by the Legislature’s non-partisan budget office show the expected shortfall for the 2011-2013 budget has grown by $462 million from the just over $2 billion that was expected a year ago.The Madison School District released a memorandum on expected redistributed state tax dollars last week 119K PDF. Superintendent Dan Nerad:

As you can see over the past five years, equalization aid for MMSD has been slightly erratic, increasing for two years and then decreasing drastically over the past 2 years as the State of Wisconsin removed $147 million of funding from the equalization aid formula.

The 2009-10 school year was the first time over the last 10 years that MMSD saw a maximum decrease in funding from the State of Wisconsin, which statutorily is set at 15%, For MMSD this was a decrease in the State’s connnitment to public education in Madison of over $9.2 million when compared with funds received in 2008-09.

When planning for the 20I0-11 school year budget, Administration openly planned for another reduction in equalization aid funding of 15% or approximately $7.8 million. The early aid estimate that was released on July I, 2010 shows MMSD in a better situation than was first projected through the budget process for one reason. The breakdown ofequalization aid for MMSD in 2010-11 as projected by the DPI is as follows:John Schmid: Study says state is a ‘C’ student

K-12 Tax & Spending Climate: Wisconsin Democrat Governor Candidate Barrett calls for $1 billion in state government cuts

Democratic candidate for governor Tom Barrett wants to get rid of the offices of the secretary of state and the state treasurer as part of a plan he says would cut more than $1 billion from Wisconsin’s budget.

Barrett said some of the savings could be achieved every year, while other cuts — such as eliminating those constitutional offices, an uncertain and arduous process — would represent one-time savings.

At a news conference outside the state Capitol on Monday, Barrett said his plans would include steps like combining workers statewide into pools to purchase lower-cost health insurance, cracking down on Medicaid fraud and other financial crimes, and cutting prisoner health care costs.

He also called for “right-sizing” the state employee work force but did not say if that would involve layoffs or simply not filling vacant jobs.

Barrett called it his plan for “putting Madison on a diet.”Related:

Wisconsin has seen substantial growth in redirected tax dollars devoted to K-12 public districts over the past 20+ years.

Madison School Board Vice President Beth Moss asked whether the State might further reduce redistributed tax dollars for K-12 spending in the next year, at the June 1, 2010 Budget meeting.

K-12 Tax & Spending Climate: The Future Of Public Debt, Bank for International Settlements Debt Projections

“Seeing that the status quo is untenable, countries are embarking on fiscal consolidation plans. In the United States, the aim is to bring the total federal budget deficit down from 11% to 4% of GDP by 2015. In the United Kingdom, the consolidation plan envisages reducing budget deficits by 1.3 percentage points of GDP each year from 2010 to 2013 (see eg OECD (2009a)).

“To examine the long-run implications of a gradual fiscal adjustment similar to the ones being proposed, we project the debt ratio assuming that the primary balance improves by 1 percentage point of GDP in each year for five years starting in 2012. The results are presented as the green line in Graph 4. Although such an adjustment path would slow the rate of debt accumulation compared with our baseline scenario, it would leave several major industrial economies with substantial debt ratios in the next decade.

“This suggests that consolidations along the lines currently being discussed will not be sufficient to ensure that debt levels remain within reasonable bounds over the next several decades.

“An alternative to traditional spending cuts and revenue increases is to change the promises that are as yet unmet. Here, that means embarking on the politically treacherous task of cutting future age-related liabilities. With this possibility in mind, we construct a third scenario that combines gradual fiscal improvement with a freezing of age-related spending-to-GDP at the projected level for 2011. The blue line in Graph 4 shows the consequences of this draconian policy. Given its severity, the result is no surprise: what was a rising debt/GDP ratio reverses course and starts heading down in Austria, Germany and the Netherlands. In several others, the policy yields a significant slowdown in debt accumulation. Interestingly, in France, Ireland, the United Kingdom and the United States, even this policy is not sufficient to bring rising debt under contro

[And yet, many countries, including the US, will have to contemplate something along these lines. We simply cannot fund entitlement growth at expected levels. Note that in the US, even by “draconian” estimates, debt-to-GDP still grows to 200% in 30 years. That shows you just how out of whack our entitlement programs are.

Sidebar: This also means that if we – the US – decide as a matter of national policy that we do indeed want these entitlements, it will most likely mean a substantial VAT tax, as we will need vast sums to cover the costs, but with that will come slower growth.]TJ Mertz reflects on the Madison School District’s 2010-2011 budget and discusses increased spending via property tax increases:

I was at a meeting of Wisconsin Alliance for Excellent Schools people yesterday. Some of the people there were amazed at the hundreds of Madisonians who came out to tell the Board of Education that they preferred tax increases to further cuts. Some of the people were also perplexed that with this kind of support the Board of Education is cutting and considering cutting at the levels they are. I’m perplexed too. I’m also disappointed.

We’ll likely not see significant increases in redistributed state and federal tax dollars for K-12. This means that additional spending growth will depend on local property tax increases, a challenging topic given current taxes.

Walter Russell Mead on Greece’s financial restructuring:What worries investors now is whether the Greeks will stand for it. Will Greek society resist the imposition of savage cuts in salaries and public services, and will the government’s efforts to reform the public administration and improve tax collection (while raising taxes) actually work?

The answer at this point is that nobody knows. On the plus side, the current Greek government is led by the left-wing PASOK party. The trade unions and civil service unions not only support PASOK; in a very real way they are the party. Although the party’s leader George Papandreou is something of a Tony Blair style ‘third way’ politician who is more comfortable at Davos than in a union hall, the party itself is one of Europe’s more old fashioned left wing political groups, where chain-smoking dependency theorists debate the shifting fortunes of the international class war. The protesters are protesting decisions made by their own political leadership; this may help keep a lid on things. If a conservative government had proposed these cuts, Greece would be much nearer to some kind of explosion.

On the minus side, the cuts are genuinely harsh, with pay cuts for civil servants of about 15% and the total package of government spending cuts set at 10 percent of GDP. (In the United States, that would amount to federal and state budget cuts totaling more than $1.4 trillion, almost one quarter of the total spending of all state and local governments plus the federal government combined.) The impact on Greek lifestyles will be even more severe; spending cuts that severe will almost certainly deepen Greece’s recession. Many Greeks stand to lose their jobs and, as credit conditions tighten, may face losing their homes and businesses as well.Much more on the Madison School District’s 2010-2011 budget here.

K-12 Tax & Spending Climate: New Jersey Governor Discusses Spending Growth Control

But there’s another line Christie likes to use to describe the fiscal situation he inherited: “The day of reckoning is here.” It’s difficult to argue his point. While nearly all states are in deep fiscal trouble, New Jersey is in deeper than most. Its deficit amounts to 37 percent of the entire state budget. Christie has responded by proposing to slash billions of dollars in state spending on everything from aid to municipalities to the normally sacrosanct K-12 education system. More than 1,300 state government positions would be eliminated.

The governor’s proposal — and his unapologetic defense of it — have made him a villain to mayors, teachers, superintendents and other public employees. But Christie, perhaps more than any other governor these days, has captured the imagination of conservatives who admire his eagerness to take on powerful public employee unions. Many Republicans believe that Christie’s tough stance on spending is hitting exactly the right political note in a major election year marked by anti-government anger and Tea Party activism.

Indeed, with the governorships of 37 states up for grabs in November — and state finances not expected to improve much anytime soon — Christie’s budget-cutting quest and all the hot rhetoric both for and against it may amount to much more than political theater. It may be a preview of how some new Republican governors will lead in states they win this year. In Pennsylvania, Attorney General Tom Corbett, the front-runner to become the GOP’s candidate for governor, says he’s been paying close attention to what’s going on in the state next door. Chris Christie, he told Stateline in an interview, “has made a very good example.”It is difficult to see growth in redistributed state and federal tax dollars for K-12 organizations over the next few years.

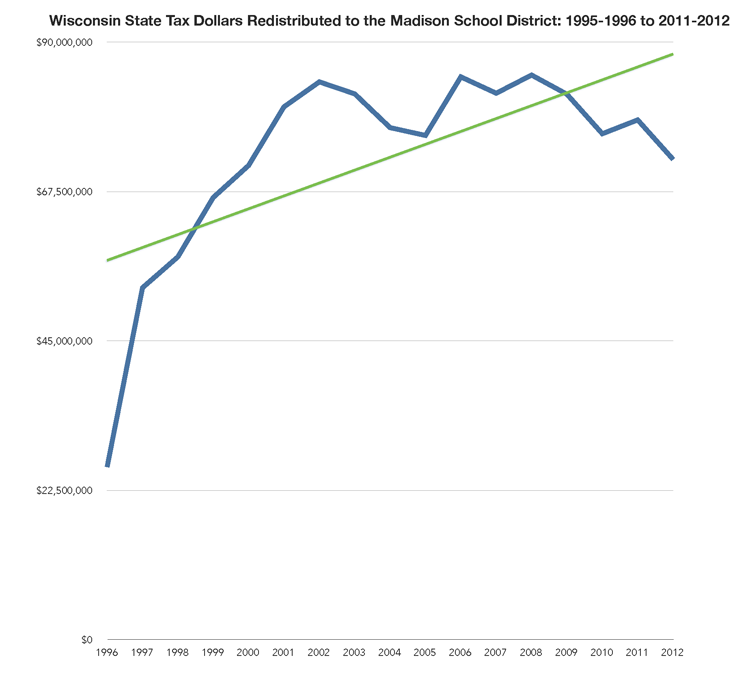

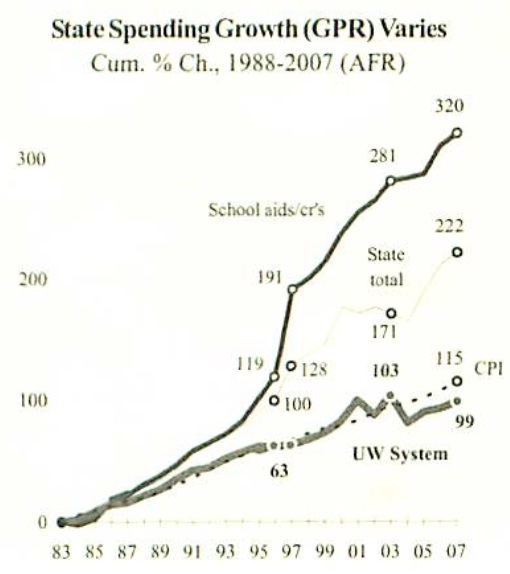

State of Wisconsin K-12 redistributed tax dollars have grown substantially over the past 25+ years, as this chart illustrates.

Redistributed state tax dollars are generated from personal & corporate income taxes and fees.

The Economist has more on New Jersey:I watched him campaign last year. His message was simple: he vowed to cut spending and red tape. He also stressed that he was not Jon Corzine, the unpopular Democratic governor. Mr Corzine, for his part, emphasised that Mr Christie was a) a Republican and b) fat. The first argument alone would usually be enough to win an election in New Jersey. But last year was a bad time to be a) an incumbent or b) a former boss of Goldman Sachs, and Gov. Corzine was both.

I wondered at the time if Mr Christie meant what he said about doing painful things to rescue New Jersey from its deep pit of debt. It seems that he did. In no time at all, he plugged a short-term budget gap by slashing spending. He has also set his sights on the outlandish benefits enjoyed by some public-sector workers, citing as an example a 49 year old retiree who paid $124,000 towards his retirement benefits and expects to get back $3.8m.

He proposed to balance the budget for fiscal 2011 by cutting a third from projected outlays. He suggested that teachers’ pay be frozen, rather than raised by 4-5%, and that they contribute a small amount (1.5% of salary) towards their health benefits.

K-12 Tax & Spending Climate: Democrat Controlled Assembly & Senate pass Bill that Reduces Madison’s SAGE Funding by $2M; District must be prepared for More Redistributed State Tax Dollar Changes

A bill that Madison School District officials say could take state funding from the district passed the state Senate on Thursday without changes and is headed to the desk of Gov. Jim Doyle.

The measure would increase the maximum class size in schools receiving funding under the Student Achievement Guarantee in Education program. The limit would become 18 students per class, up from the current maximum of 15, which would make SAGE more affordable for some school districts.4K proponents have argued that the “State” will pay for this service over time. Clearly, counting on redistributed State tax dollars should be done with a measure of caution.

K-12 Tax & Spending Climate: The Great Debt Bailout

This blog was created in late 2006 in order to “vent” my frustration over the huge debt bubble and what I perceived to be the risks it posed to the global economy. In summary, I claimed that the economy had become hooked on debt to create additional GDP growth – or “growth” in quotation marks – and that the finance “tail” was wagging the real economy “dog”.

Soon thereafter, the bubble burst – first in the U.S. and then everywhere else. What followed was the worst economic crisis since the Great Depression. And we are still in the midst of it, albeit in ever-mutating form, so today’s post is meant as a tour d’horizon, a quick summary of how I see things shaping up today.

I believe all that has happened so far is The Great Debt Bailout. Governments and central banks have issued trillions in new government-backed debt, some to replace private debt gone bad (bailouts for billionaires) and some to finance massive budget deficits (pennies for penniless). It is a policy mishmash produced by the combination of (a) Bernankean revulsion to monetary deflation and (b) Keynesian aversion to economic recession.As School Districts consider property tax increases to address spending growth and flat or reduced redistributed state and federal tax dollars, it may well be useful to keep local goodwill in reserve for future funding challenges.

Related: Peter Gorenstein: Pray For Inflation — It’s Our Only Hope and New Jersey’s K-12 Staffing growth.

Advocating a Wisconsin Sales Tax Increase for K-12 Public Schools

Tom Beebe has an idea for raising $850 million a year for Wisconsin schools, easing property taxes for homeowners and buying some time to devise a long-term solution to the state’s Byzantine school funding system — raise the state’s 5 percent sales tax by 1 percentage point.

It might not be politically viable. But supporters say at least it’s an idea.

“The conversation has to start somewhere,” said Dan Nerad, Madison School District superintendent. “There needs to be a public policy discussion about important questions around the school funding formula.”

The executive director of the Wisconsin Alliance for Excellent Schools, Beebe is the driving force — literally — behind the “A Penny for Kids” campaign. Since summer, he has logged nearly a thousand miles a month, he said, in a low-key, grass-roots campaign focused mainly in rural areas of the state. An online petition has garnered about 1,760 signatures.Wisconsin k-12 redistributed tax dollars grew substantially over the past two decades as the chart below indicates:

. More here.

Federal Tax Receipts Decline 18%, Dane County (WI) Tax Delinquencies Grow

The recession is starving the government of tax revenue, just as the president and Congress are piling a major expansion of health care and other programs on the nation’s plate and struggling to find money to pay the tab.

The numbers could hardly be more stark: Tax receipts are on pace to drop 18 percent this year, the biggest single-year decline since the Great Depression, while the federal deficit balloons to a record $1.8 trillion.

Other figures in an Associated Press analysis underscore the recession’s impact: Individual income tax receipts are down 22 percent from a year ago. Corporate income taxes are down 57 percent. Social Security tax receipts could drop for only the second time since 1940, and Medicare taxes are on pace to drop for only the third time ever.

The last time the government’s revenues were this bleak, the year was 1932 in the midst of the Depression.

“Our tax system is already inadequate to support the promises our government has made,” said Eugene Steuerle, a former Treasury Department official in the Reagan administration who is now vice president of the Peter G. Peterson Foundation.Channel3000.com recently spoke with Dane County Treasurer Dave Worzala on the growing property tax delinquencies:

While there aren’t any figures for this year, property tax delinquencies have been on a steep climb the last few years, WISC-TV reported.

Delinquencies increased 11 percent in 2006, 34 percent in 2007 and 45 percent in 2008, where there is now more than $16 million in unpaid taxes in the county.

“It affects us in that we have to be sure that we have enough resources to cover county operations throughout the year even though those funds aren’t here. And we do that, we are able to do that, but 40 percent increases over time become unsustainable,” said Dane County Treasurer David Worzala.

“I can see that there are probably some people that either lost their jobs or were laid off, they’re going to have a harder time paying their taxes,” said Ken Baldinus, who was paying his taxes Thursday. “But I’m retired, so we budget as we go.”

Big portions of those bills must go to school districts and the state. Worzala said the county is concerned about the rise in delinquencies because if the jumps continue the county could run into a cash flow issue in paying bills.Resolution of the Madison School District – Madison Teachers, Inc. contract and the District’s $12M budget deficit will be a challenge in light of the declining tax base. Having said that, local schools have seen annual revenue increases for decades, largely through redistributed state and to a degree federal tax dollars (not as much as some would like) despite flat enrollment. That growth has stopped with the decline in State tax receipts and expenditures. Madison School District revenues are also affected by the growth in outbound open enrollment (ie, every student that leaves costs the organization money, conversely, programs that might attract students would, potentially, generate more revenues).

Wisconsin State Tax Based K-12 Spending Growth Far Exceeds University Funding

via WISTAX

WISTAX published a fascinating chart in their most recent issue of FOCUS [Page 1, Page 2]:However, the state pledge to provide two-thirds of schools revenues in 1996-97 changed the budget landscape. By 2006-07, state-tax support for the UW System had almost doubled during Ihe 25 years prior. However, inflation (CPI, up 115%). school aids/credits (320%). and overall slate GPR expenditures (222%) rose more.

Related:

- Referendum Climate: Charts – Enrollment; Local, State, Federal and Global Education Spending

- Property Tax Effect – Madison School District

- K-12 Tax & Spending Climate

- The subject of local property taxes, state and federal income taxes and fees vis a vis school spending was discussed at Madison Superintendent Dan Nerad’s recent appearance at the Dane County Public Affairs Council

Further proof that there is no free lunch. The ongoing calls for additional state redistributed tax dollars for K-12 public education will likely have an effect on other programs, as this information illustrates. I do think that there should be a conversation on spending priorities.

Ho-Chunk Miss Gambling Payment to the State of Wisconsin

The Ho-Chunk tribe missed an initial deadline Monday to pay an estimated $72 million in gambling money that state officials are counting on to help balance an already stressed state budget.

It’s now been more than two years since the tribe, locked in a legal battle with the state over its gambling compact, has made any payments on its casino operations.

The lingering dispute raises the question of whether the state will receive nearly $100 million in estimated payments expected by June 2009 in time to prevent a gaping hole in a budget that could force lawmakers to raise taxes, cut services or borrow money to make up the difference.Patrick Marley & Stacy Forster:

The tribe continues to offer expanded games such as poker and roulette that were agreed to in the 2003 compact, but it has stopped making the payments that were also required under that deal.

Doyle said the tribe owes the payments and that state officials will continue to pursue enforcement efforts in federal court — the only recourse available to Wisconsin under federal Indian gaming laws.

“Every other tribe in the state has paid it, and the fact (is) the Ho-Chunk just haven’t, but we believe it’s owed,” Doyle said.

Thomas Springer, a lobbyist for the tribe, said the Ho-Chunk have been trying to resolve the matter ever since the Supreme Court ruled on another tribe’s casino agreement. That decision in effect invalidated the Ho-Chunk’s agreement with the state, he said.Another item to ponder with respect to potential changes in redistributed state tax dollars for education.

Texas School District Challenges State “Robin Hood” Finance System

Protests from this small school district nestled in the Texas Hill Country are reverberating across the state’s school finance landscape.

School board members – backed by parents and local business owners – have decided to say “no” when their payment comes due next month under the state’s “Robin Hood” school funding law.

Wimberley is one of more than 160 high-wealth school districts – including several in the Dallas area – that are required to share their property tax revenue with other districts. But residents here insist that their students will suffer if they turn the money over to the state.

“We’re not going to pay it,” said Gary Pigg, vice president of the Wimberley school board and a small-business owner. “Our teachers are some of the lowest-paid in the area. Our buildings need massive repairs. We keep running a deficit – and they still want us to give money away.

“It’s unconstitutional – and I’m ready to go to jail if I have to.”

Mr. Pigg and the rest of the Wimberley school board voted last fall to withhold the payment of an estimated $3.1 million in local property taxes – one-sixth of the district’s total revenue – that was supposed to be sent to the state under the share-the-wealth school finance law passed in 1993. The law was passed in response to a series of court orders calling for equalized funding among school districts.Wisconsin’s school finance system takes a similar approach: High property assessement values reduce state aids. Unlike Texas, Wisconsin simply redistributes fewer state tax dollars to Districts with “high” property values, such as Madison. Texas requires Districts to send some of their property tax receipts to the state to be redistributed to other districts. School finance has many complicated aspects, one of which is a “Robin Hood” like provision. Another is “Negative Aid“: If Madison increases spending via referendums, it loses state aid. This situation is referenced in the article:

Regarding the possibility of a tax hike, Mr. York noted that an increase would require voter approval – something that is not likely to happen with residents knowing that a big chunk of their money will be taken by the state.

One of the many ironies in our school finance system is that there is an incentive to grow the tax base, or the annual assessment increases. The politicians can then point to the flat or small growth in the mill rate, rather than the growth in the total tax burden.

Finally, those who strongly advocate for changes in Wisconsin’s school finance system must be ready for unintended consequences, such as reduced funding for “rich” districts, like Madison. Madison’s spending has increased at an average rate of 5.25% over the past 20 years, while enrollment has remained essentially flat (though the student population has changed).

Wisconsin State Tax Receipt Growth Slows from 3% to 1%

Collections of the three most important Wisconsin taxes increased less than 1% in the second half of 2007 – falling far short of the 3% assumed growth needed to cover state expenditures this year and raising fears that deep spending cuts will be necessary.

Preliminary state Department of Revenue totals show the personal and corporate income tax and the sales tax brought in $5.13 billion from July through December, an increase of only 0.8% over the same period in 2006.

Those three taxes account for $9 out of every $10 in general-fund taxes.

Every unexpected 1% drop in collections from those taxes means state government will have $120 million less a year to spend. If tax collections don’t pick up, the shortfall would quickly wipe out the projected $67 million surplus Capitol leaders had hoped for this fiscal year and force reductions across state government.

Democratic Gov. Jim Doyle said he will warn of the economic downturn in his sixth “state of the state” message Wednesday. Many states are facing economic slowdowns, and California must fix a $14.5 billion shortfall, Doyle noted.

In his speech, Doyle said, “I’m going to talk pretty directly that this is a challenge that we have ahead of us, and we have to face up to it. Unless the national economy just totally goes into the tank, this is something we can manage and get through. But it’s going to be pretty tough.”A reduction in the rate of State tax receipt increases makes it unlikely that there will be meaningful reform in redistributed state tax dollars flowing back to local school districts.

Wisconsin K-12 Tax & Spending Outlook

Milwaukee Journal-Sentinel Editorial:

Another year and deeper in debt.

No, that’s not some sad-eyed, old country ballad. It’s the state of Wisconsin’s long-term finances.

To pay for highways, buildings and environmental programs over the past decade, the state has increased long-term debt by 87%, a trend that if left unchecked will surely mean increasingly difficult budget decisions down the road.

The Journal Sentinel’s Steven Walters noted in a recent report that the Legislative Fiscal Bureau says the state had $8.28 billion in such debt in 2006, up from $4.41 billion in 1996 (www.jsonline.com/689757). The period studied covered the leadership of Gov. Jim Doyle, a Democrat, and Republicans Scott McCallum and Tommy G. Thompson.

In effect, the governors, with legislative acquiescence, have made politically advantageous decisions to have their favorite programs and pay for them later. It’s basically credit card budgeting.

But the bill always comes due.

As Todd Berry, president of the Wisconsin Taxpayers Alliance, told Walters, the growing debt is a risk. Principal and interest payments on general-obligation bonds will exceed $700 million for the first time this year. Payments on transportation bonds will cost $174 million.

While state officials say the debt load is manageable, a major bond agency, Standard & Poor’s Ratings Services, last week changed its rating outlook from “positive” to “stable.”

Other long-term trends make such budget moves all the more troublesome. Per-capita income in Wisconsin is about $4,000 a year less than in Minnesota, for example, a gap that has widened. And the number of elderly is expected to jump 90% from 702,000 in 2000 to near 1.34 million by 2030 while the percentage of working age people is expected to decline from 61% to 57%, meaning fewer taxpayers supporting more people in need of services. Add to that the need to replace aging roads, bridges and sewers.Clearly, we are unlikely to see significant increases in redistributed state tax dollars to “rich” school districts like Madison [2007-2008 Citizen’s Budget].

Related: K-12 Tax & Spending Climate:According to the Wisconsin DPI, per student spending in Wisconsin has increased by 5.1% annually, since 1987. The Madison School District increased at a 5.25% rate during that time. Clearly, our public schools are attempting to address more issues than ever, from academics to breakfast, special education and health care.

Madison teachers union ratify contract for 2014-15

Madison School District teachers and staff will be covered under a collective bargaining agreement through the 2014-15, pending approval by the Madison School Board.

Madison Teachers Inc. members gathered Wednesday evening at Madison Marriott West in Middleton to ratify a one-year contract extension with the district. MTI’s five bargaining units, which include teachers, education assistants, clerical and security staff, and other district employees, all ratified the deal.

The Madison School Board will vote on the agreement Monday.

John Matthews, executive director of the union, said that pending school board approval, MTI would be the only teachers’ union in Wisconsin with a contract through the 2014-15 school year.Related: Proposed City of Madison budget raises property taxes by 1.5%, while the Madison School District’s 2013-2014 budget increases taxes by 4.5%, after a 9% increase two years ago (and a substantial jump in redistributed state tax dollars last year).

Oconomowoc & Madison

I read with interest Madison School Board President Ed Hughes’ blog post on local spending, redistributed state tax dollars & property tax increases. Mr. Hughes mentioned Oconomowoc:

Superintendent Cheatham and new Assistant Superintendent for Business Services Mike Barry (recently arrived from the Oconomowoc school district to replace Erik Kass) promise a zero-based approach to budgeting for the 2014-15 school year, so the budgeting process promises to be more lively next year.

Mr. Hughes, writing on May 3, 2012: Budget Cuts: We Won’t Be as Bold and Innovative as Oconomowoc, and That’s Okay..

Alan Borsuk recently followed up on the changes (fewer, but better paid teachers) in Oconomowoc.

Rocketship and Avenues are also worth looking into.

Madison Schools’ 2013-2014 Budget Charts, Documents, Links, Background & Missing Numbers

Sources:

- General and Categorical Aid – Payments to School Districts

- WISTAX Facts & Figures

- Madison Schools 2013-2014 June 10, 2013 Budget Discussion Document (PDF)

- Wisconsin State Tax Based K-12 Spending Growth Far Exceeds University Funding

- Up, Down & Transparency: Madison Schools Received $11.8M more in State Tax Dollars last year, Local District Forecasts a Possible Reduction of $8.7M this Year – March, 2013. The June 10, 2013 District budget document (PDF) fails to mention the previous year’s large increase in redistributed State of Wisconsin tax dollars:

Like all Wisconsin school districts, MMSD relies upon a state-local funding partnership. The actions of one partner greatly impact the other partner. The 2013-14 MMSD budget anticipates a major funding loss for MMSD (a loss of $8.7 in equalization aid) which shifts the funding burden onto the local property taxpayer.

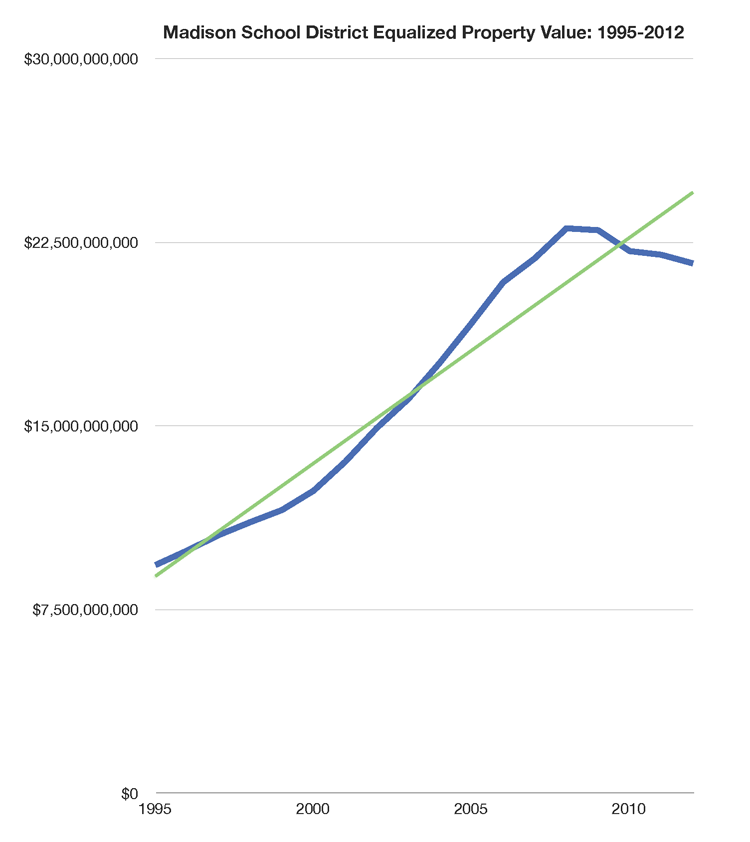

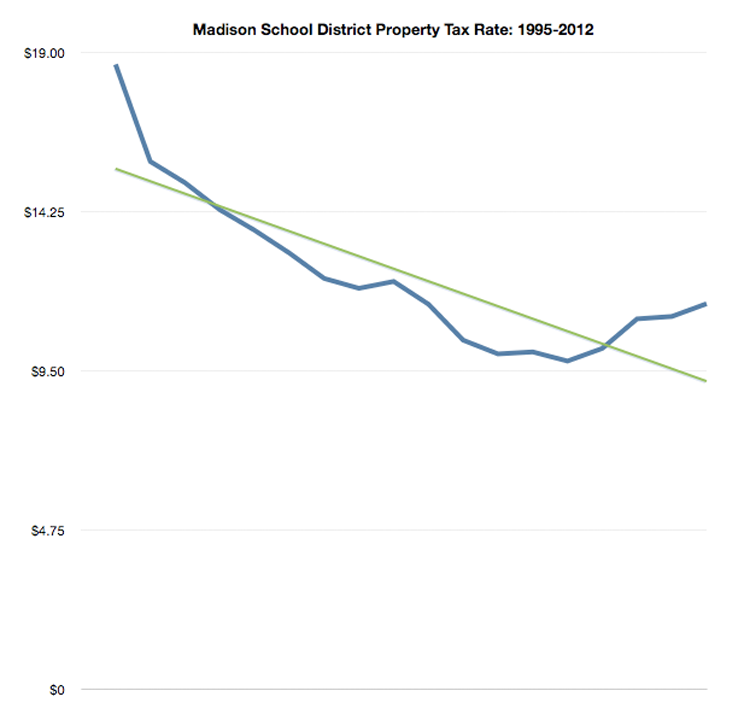

The charts reveal several larger stories:

First, the State of Wisconsin “committed” to 2/3 K-12 funding in the mid-1990’s. The increase in redistributed state tax dollars is apparent. [Wisconsin Legislative Fiscal Bureau: State Aid to School Districts (PDF)]

Second, Madison’s substantial real estate growth during the 2000’s supported growing K-12 spending while reducing the property tax rate (the overall pie grew so the “rate” could fall somewhat). The real estate music stopped in the late 2000’s (“Great Recession) and the tax rate began to grow again as the District consistently raised property taxes. *Note that there has been justifiable controversy over Madison’s large number of tax exempt properties. Fewer exemptions expands the tax base and (potentially) reduces individual homeowner’s taxes.

Third, Madison has long spent more per student than most public schools.

Fourth, the District’s June 10, 2013 budget document fails to address two core aspects of its mission: total spending and program effectiveness. The most recent 2012-2013 District budget number (via a Matthew DeFour email) is $392,789,303. This is up 4.4% from the July, 2012 District budget number: $376,200,000. The District’s budget has always – in my nine years of observation – increased throughout the school year. The late, lamented “citizen’s budget” was a short lived effort to create a standard method to track changes over time.

Fifth, the June 10, 2013 document does not include the District’s “Fund balance” or equity. The balance declined during the 2000’s, somewhat controversially, but it has since grown. A current number would be useful, particularly in light of Madison’s high property taxes.