Search Results for: Middleton property taxes

Madison Schools 2016 Property Tax Increase Referendum – Let’s Compare: Madison and Middleton Property Taxes

The Madison School District is considering another property tax increase referendum for the upcoming November election. We’ve long spent more than most districts (“plenty of resources”), despite challenging academic outcomes. I thought it might be useful to revisit the choices homeowners and parents make. I’ve compared two properties, one in Middleton (2015 assessment: $257,500.00) and […]

Let’s Compare: Middleton and Madison Property Taxes

Madison property taxes are 22% more than Middleton’s for a comparable home, based on this comparison of 2017 sales. xlsx file. Related links: Madison’s taxpayer supported K-12 tax and spending history. Madison spends around 18.5 to 20K per student, depending on the district documents reviewed (some include all referendum spending). Middleton taxpayers spent $90,989,198 for […]

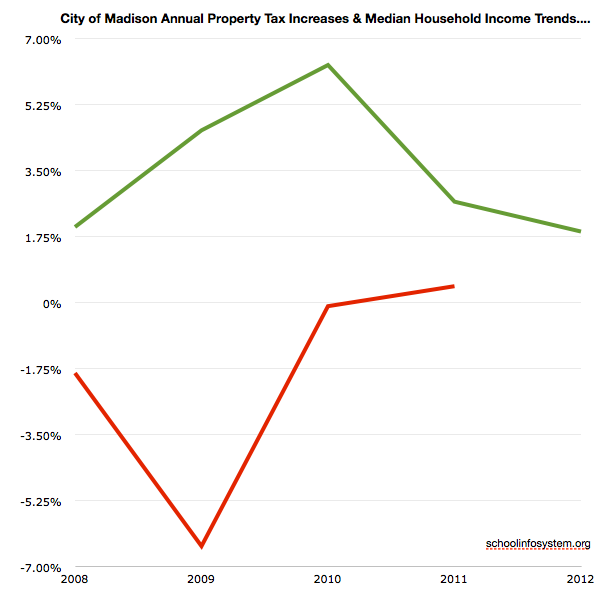

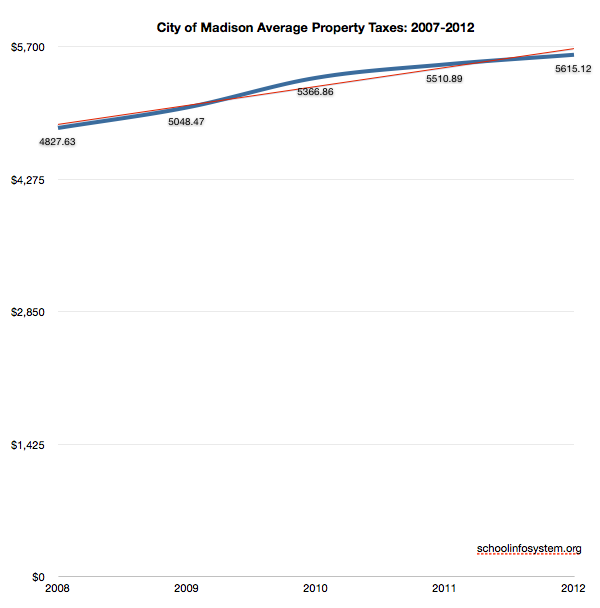

A Look at Property Taxes Around the World and Madison’s 16% increase since 2007; Median Household Income Down 7.6%; Middleton’s 16% less

Sources:

Department of Numbers.

City of Madison Assessor Reports

Related:

August, 2006 (Deja-vu): Property Taxes Outstrip Income.

Budget Cuts: We Won’t Be as Bold and Innovative as Oconomowoc, and That’s Okay.

Madison Schools’ 2013-2014 Budget Charts, Documents, Links, Background & Missing Numbers.

Madison’s long-term disastrous reading results.

The Hated Property Tax: Salience, Tax Rates, and Tax Revolts.

Levying the Land.

Revenue Potential and Implementation

Challenges (IMF PDF).

Tax Policy Reform and Economic Growth (OECD).

Stagnant School Governance; Tax & Spending Growth and the “NSA’s European Adventure”.

Analysis: Madison School District has resources to close achievement gap.

A Middleton home paid $4,648.16 in 2012 while a Madison home paid 16% more, or $5,408.38. Local efforts to significantly increase property taxes may grow the gap with Middleton..

Commentary on Madison and Surrounding School Districts; Middleton’s lower Property Taxes

Madison School Board Member Ed Hughes:

Here in Madison, our attention is primarily focused on our troubling achievement gaps, and those gaps are achingly apparent in the new WKCE scores. Under new superintendent Jen Cheatham’s leadership, we’ll continue to pursue the most promising steps to accelerate the learning of our African-American, Latino and Hmong students who have fallen behind.

At the same time, we also need to continue to meet the needs of our students who are doing well. I am going to focus on the latter groups of students in this post.

In particular, I want to take a look at how our Madison students stack up against those attending schools in other Dane County school districts under the new WKCE scoring scale. The demographics of our Madison schools are quite a bit different from those of our surrounding school districts. This can skew comparisons. To control for this a bit, I am going to compare the performance of Dane County students who do not fall into the “economically disadvantaged” category. I’ll refer to these students as “non-low income.”I took a quick look at property taxes in Middleton and Madison on a $230,000 home. A Middleton home paid $4,648.16 in 2012 while a Madison home paid 16% more, or $5,408.38. Local efforts to significantly increase property taxes may grow the gap with Middleton.

Property Taxes in and Around Madison (2022 Sales)

4602 Deerpath Rd Middleton, WI $605,000.00 7/25/2022 $7,517.55 548 Big Stone Tr Middleton, WI $617,500.00 5/31/2022 $10,841.01 1206 Fritz Rd Verona, WI $7,409.64 10239 Meandering Way Verona, WI $600,000.00 5/5/2022 $10,963.12 3004 Wyndwood Way Sun Prairie, WI $605,000.00 10/4/2022 $9,205.83 178 N Legacy Way Sun Prairie, WI $613,500.00 12/28/2022 $11,113.25 821 Hiawatha Dr […]

K-12 Tax & Spending Climate: How Lower-Income Americans Get Cheated on Property Taxes

NY Times: Local governments are failing at the basic task of accurately assessing property values, and there is a clear and striking pattern: More expensive properties are undervalued, while less expensive properties are overvalued. The result is that wealthy homeowners get a big tax break, while less affluent homeowners are paying a higher price for […]

K-12 Tax, Referendum & Spending Climate: Local governments want to defund the police, shut down the schools, and raise taxes.

Daniel Greenfield: The police aren’t policing and the teachers aren’t teaching. While many vital services aren’t functioning, the useless machinery of the bureaucracy grinds on with no one to pay for it. Locked down businesses don’t generate revenues and the unemployed aren’t a tax base. Tax revenues in New York City fell 46% in June. […]

Middleton-Cross Plains School District extends contract for police in schools

Emily Hamer: Breaking away from Madison’s recent decision to remove police officers from its schools, the Middleton-Cross Plains School Board on Monday voted to extend its contract for school resource officers. Citing the need for relationship building between officers and students and protection from school shootings, the board voted unanimously to re-approve the contract with […]

Madison School District has largest property tax increase in dollars in state for 2019-20

Scott Girard: “This level of increase, though absent in recent years, is not new to Wisconsin. School district levies increased by more than 4.5% in eight out of the 10 years from 2000 to 2009,” the report states. Dane County districts are a major contributor to the increase in dollars, according to the report, with […]

Madison increases property taxes by 7.2%, despite tolerating long term, disastrous reading results

Ron Vetterkind: The Policy Forum report found just eight of the state’s 421 school districts account for more than a third of the $224 million increase in levies this year. Five of those districts with the largest dollar increases in taxes are the Madison, Sun Prairie, Middleton-Cross Plains, DeForest and Verona school districts. Wisconsin policy […]

Property Tax Explosion Stunts Chicago Real Estate Market

AK Thomson: Bryce Hill, research analyst at the independent Illinois Policy think-tank, says that the annual property-tax take in Cook County, which includes Chicago, increased 76 per cent more than median home values between 1996 and 2016. “Both the city and the state are wrestling with unbalanced budgets, massive amounts of pension debt, and limited […]

K-12 Tax& Spending Climate: Are Property Taxes a “Wealth Tax” on the (Mostly) Non-Wealthy?

Charles Hugh Smith: entry Dear Homeowner: If You’re Paying $260,000 in Property Taxes Over 20 Years, What Exactly Do You “Own”?, I questioned the consequences of high property taxes. Some readers wondered if I was saying all property taxes should be abolished. The short answer is no–what I was questioning is local government reliance on […]

Compare Property Taxes Around Madison

Dean Mosiman: In Madison, the tax bill for a fair market home valued at $200,000 was $4,690. Outside Madison, the tax bill for a fair market home with the same value ranged from $2,815 in the town of Christiana in the Stoughton School District to $4,736 in the village of Brooklyn in the Oregon School […]

Property Tax Season: Comparing Madison Area Burdens in light of quarterly payments

The arrival of Thanksgiving means local homeowners will soon see their annual property tax bills. The chart below compares Madison area homes sold in 2012, ranging in price from $239,900 to $255,000 Tap to view a larger version. Excel. A Middleton home’s property tax burden is about 13% less than a similar property in Madison […]

Ongoing Increases in Madison Property Taxes: “Delinquencies 30% More Than We Expect” (!); Schools up 4.2% this year

Bill Novak Madison property owners will soon be able to pay their taxes in four installments, beginning with the 2014 tax bill coming in December. The Mayor’s Office said on Tuesday the four-payment plan could help taxpayers avoid penalties by spreading out the taxes owed over a seven-month period. “At the height of the recession, […]

Madison Plans 4.2% Property Tax Increase

Molly Beck: The Madison School District property tax levy would increase by 4.2 percent under the district’s final budget proposal. That’s up from a 2 percent increase contained in the district’s preliminary budget approved in June. The final 2014-15 district budget, which must be adopted by the School Board by Nov. 1, also includes a […]

Property Tax Increase Climate: Madison’s Proposed 2015 Spending Referendum

A variety of notes and links on the planned 2015 Madison School District Property Tax Increase referendum: Madison Schools’ PDF Slides on the proposed projects. Ironically, Madison has long supported a wide variation in low income distribution across its schools. This further expenditure sustains the substantial variation, from Hamilton’s 18% low income population to Black […]

K-12 Tax & Spending Climate: Madison/Dane County Property Taxes Highest in Wisconsin, 61st in USA

Nick Heynen: Using data from the Census Bureau’s American Community Survey, the report’s authors examined residential property taxes in every U.S. county from 2007 to 2011, looking at how much homeowners were paying on average and how that average compared to average home sale prices over the same time period. The data contained some interesting, […]

Trial Balloon on Raising Madison’s Property Taxes via another School Referendum? Homeowners compare communities…..

Molly Beck There’s been little movement since mid-March when Madison School District Superintendent Jennifer Cheatham proposed asking voters in November for $39.5 million in borrowing to upgrade facilities and address crowding. The proposed referendum’s annual impact on property taxes on a $200,000 Madison home could range from $32 to $44, according to the district. After […]

Madison’s Property Taxes Per Capita 2nd Highest in WI; 25% of 2014-2015 $402,464,374 Budget Spent on Benefits

Tap the chart to view a larger version. A few slides from the School District’s fourth 2014-2015 budget presentation to the Board: I am surprised to see Physician’s Plus missing from the healthcare choices, which include: GHC, Unity or Dean. The slides mention that the “Budget Proposal Covers the First 5% of Health Insurance Premium […]

Middleton good enough, smart enough to get to bottom of cheating

The U.S. government has arguably run far afoul of international and national law by torturing terrorism suspects and collecting private citizens’ phone records.

We’re just coming out of a recession caused largely by heretofore respectable banking, real estate and other moneyed interests who played fast and loose with the rules.

And recent years have seen many a hero athlete nabbed for taking performance-enhancing drugs.

So I find it hard to heap too much abuse on Middleton High School students accused of widespread cheating. They wouldn’t be wrong to point to the front page of almost any day’s newspaper and reprise a line from that old war-on-drugs public service announcement: “I learned it by watching you!”

Still, while we grown-ups have set some pretty bad examples, it would be a shame if Middleton’s grown-ups perpetuate that recent tradition by declining to dig too deeply into the cheating allegations.Much more on Middleton, here (including 16% lower property taxes).

Compare Madison Area Property Taxes

The Wisconsin State Journal offers a page to compare property taxes on a $200,000 home, here.

Related:

Madison’s 2013-2014 budget and commentary on Madison and Surrounding School Districts; Middleton’s lower Property Taxes.

Much more, here.

Madison spends about $15K per student, roughly double the national K-12 average, yet has long generated disastrous reading results.

December Wisconsin Property Tax Increases vs. Madison

WISTAX: On December property tax bill, statewide school levies up 0.8%, counties up 1.2%, technical colleges up 1.3%

— Matthew DeFour (@WSJMattD4) December 9, 2013

Madison’s school property taxes will increase by 3.38% after a 9% increase a few years ago. Meanwhile, Middleton’s property taxes are 16% less than Madison’s on a similar home.

Middleton teachers argue for new contract, more pay Board of Education decides to delay talks; teachers circulate petition

The Middleton Education Association made one request to open negotiations with district officials in September and another request in October.

“We believe the recent Circuit Court ruling or the ruling Judge Colas made last year still allows us to bargain a complete or full master contract for the 2014-2015 school year. We also believe they are able to provide more of an increase,” Chris Bauman, MEA president, said.

The Board of Education voted unanimously to delay any talks.

“We’ve requested to delay negotiations on a base salary partly because of our budget unknowns, enrollment, a variety of other things in terms of our total budget expenditures that are required for 2014-2015,” MCPASD Superintendent Don Johnson said.

While the board decided to delay talks, some teachers at Middleton High School have begun circulating a petition in hopes of getting their message across.

Recently, the board approved an overall wage increase of $1,078 per year for teachers.

However, a number of teachers say the increase is not enough, considering their personal contributions to retirement and health care. In some people’s opinion, the increase penalizes teachers who have been around for years.Related: Madison Schools’ Budget Updates: Board Questions, Spending Through 3.31.2013, Staffing Plan Changes, Middleton-Cross Plains School Board to appeal ruling on teacher fired for viewing porn at work and Commentary on Madison and Surrounding School Districts; Middleton’s lower Property Taxes.

Madison School Board Grows Taxes & Spending: 6-1 vote

Property taxes in the Madison School District will increase by about $67 for the average homeowner as part of the final $392 million 2013-14 budget approved by the school board on Monday.

The board voted 6-1 to approve this year’s amended budget and also to set the levy at $257.7 million, a 3.38 percent increase over last year.

That increase is about 1 percentage point less than originally projected in July, before Gov. Scott Walker unveiled his two-year $100 million property tax relief bill that sent an additional $2.5 million in state aid to Madison schools.

Total property taxes will increase by $66.74 on average. That’s $39.24 less of an increase than originally expected earlier this year, according to district budget documents. A property tax bill for the average $231,000 Madison home is now estimated to be $2,739.66 for school purposes.

School board member Mary Burke, a candidate for governor, cast the lone votes against the final amended budget and against the levy, citing the desire to see a better balance between the needs of the district and the needs of taxpayers.

“Next year, as we look at this, we really need to look at how many people are struggling to make ends meet,” Burke said about the levy increase, noting the district and board should consider whether salary increases among district families are not keeping pace with property tax increases.Much more on the 2013-2014 budget, here.

The City of Madison’s portion of local property tax will grow 2.2%.

Middleton’s property taxes are 16% less than Madison’s on a comparable home.

Minneapolis Property Taxes are over 50% less than Madison’s on a Similar Home; Mayoral Election Education Commentary

A cynic would be forgiven for wondering whether the press conference Minneapolis mayoral candidate Mark Andrew held Monday afternoon, flanked by five members of the school board, was at least partly an exercise in damage control.

At the session, held in the library at Windom Dual Immersion School in southwest Minneapolis, Andrew announced a three-pronged education agenda. At its center: a promise to convene a collaborative headed by education advocates with divergent philosophies, Mike Ciresi and Louise Sundin.

“The conversation about improving educational outcomes for kids of color has gotten extremely polarized and increasingly heated in the past several years,” Andrew explained in the plan. “The reformers vs. unions dichotomy is unproductive, and doesn’t serve the best interests of our children or find Minneapolis solutions to the problems in Minneapolis’ schools.”Minneapolis plans to spend $524,944,868 (PDF budget book) during the 2013-2014 school year for 34,148 students or 15,364 per student, about the same as Madison.

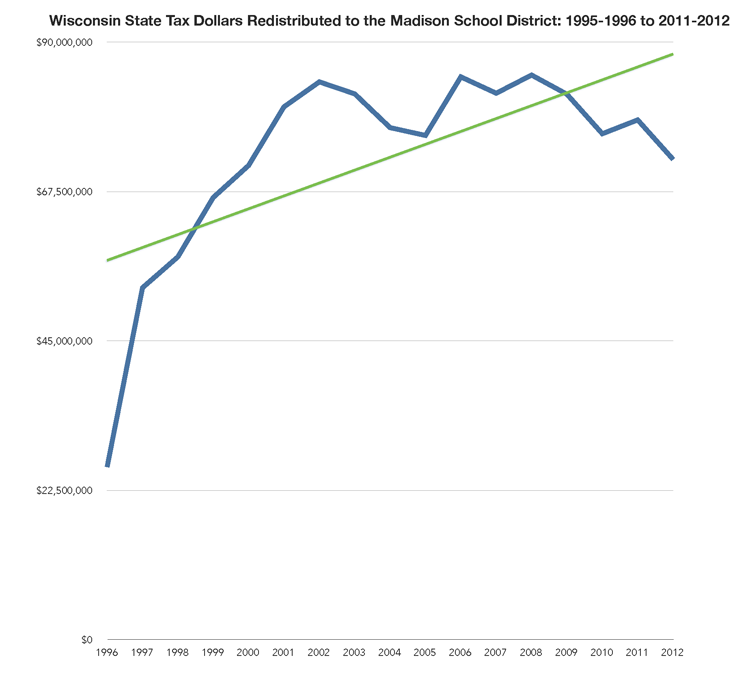

Yet, property taxes are substantially lower in Minneapolis where a home currently on the market for $279,900 has a 2013 property tax bill of $3,433. A $230,000 Madison home pays $5,408.38 while a comparable Middleton home pays $4,648.18 in property taxes. Madison plans to increase property taxes 4.5% this year, after a 9% increase two years ago, despite a substantial increase in redistributed state tax dollar receipts. Yet, such history is often ignored during local tax & spending discussions. Madison Superintendent Cheatham offers a single data point response to local tax & spending policy, failing to mention the substantial increase in state tax receipts the year before:When we started our budget process, we received the largest possible cut in state aid, over $8 million,” Cheatham said. “I’m pleased that this funding will make up a portion of that cut and help us accomplish what has been one of our goals all along: to reduce the impact of a large cut in state aid on our taxpayers.”

A bit more background.

A Public Hearing on the Madison Schools’ Proposed 4.5% Property Tax Increase Monday, No Mention of Last Year’s Significant State Tax Dollar Funding Increase

More charts on Madison schools’ spending & property tax growth over the years, here.

Karen Rivedal:The Madison School Board will hold a one-hour public hearing at 5 p.m. Monday on a preliminary $391 million budget proposal for the 2013-2014 school year, in the McDaniels Auditorium of the Doyle Administration Building at 545 W. Dayton St.

After the hearing, the board is to vote on the budget, which includes a $260.4 million property tax levy, increasing the tax bill on an average $230,831 Madison home by about $102. The board will take a final vote on the tax levy in October, after official state aid figures are known.Related: Madison Schools’ 2013-2014 Budget Charts, Documents, Links, Background & Missing Numbers.

Finally, Rivedal’s article fails to mention this: Up, Down & Transparency: Madison Schools Received $11.8M more in State Tax Dollars last year, Local District Forecasts a Possible Reduction of $8.7M this Year. Local household income changes are unmentioned, as well (national data).

Much more on the 2013-2014 Madison schools’ budget, here.

A Middleton home paid $4,648.16 in 2012 while a Madison home paid 16% more, or $5,408.38. Local efforts to significantly increase property taxes may grow the gap with Middleton..

Rivedal’s article is unfortunately a classic “low information” piece. It would not take much effort to challenge the new Superintendent’s rhetoric on “state funding decline”. The prior year’s significant increase goes unmentioned.

Is it the State Journal’s policy to simply publish rhetoric without investigation?

Madison’s Proposed Property Tax Increase: Additional links, notes and emails

I received a kind email from Madison School Board President Ed Hughes earlier today regarding the proposed property tax increase associated with the 2013-2014 District budget.

Ed’s email:Jim —

Your comparison to the tax rates in Middleton is a bit misleading. The Middleton-Cross Plains school district that has a mill rate that is among the lowest in Dane County. I am attaching a table (.xls file) that shows the mill rates for the Dane County school districts. As you will see, Madison’s mill rate is lower than the county average, though higher than Middleton’s. (Middleton has property value/student that is about 10% higher than Madison, which helps explain the difference.)

The table also includes the expenses/student figures relied upon by DPI for purposes of calculating general state aid for the 2012-13 school year. You may be surprised to see that Madison’s per-student expenditures as measured for these purposes is among the lowest in Dane County. Madison’s cost/student expenditures went up in the recently-completed school year, for reasons I explain here: http://tinyurl.com/obd2wty

EdMy followup email:

Hi Ed:

Thanks so much for taking the time to write and sending this along – including your helpful post.

I appreciate and will post this information.

That said, and as you surely know, “mill rate” is just one part of the tax & spending equation:

1. District spending growth driven by new programs, compensation & step increases, infinite campus, student population changes, open enrollment out/in,

2. ongoing “same service” governance, including Fund 80,

3. property tax base changes (see the great recession),

4. exempt properties (an issue in Madison) and

5. growth in other property taxes such as city, county and tech schools.

Homeowners see their “total” property taxes increasing annually, despite declining to flat income. Middleton’s 16% positive delta is material and not simply related to the “mill rate”.

Further, I continue to be surprised that the budget documents fail to include total spending. How are you evaluating this on a piecemeal basis without the topline number? – a number that seems to change every time a new document is discussed.

Finally, I would not be quite as concerned with the ongoing budget spaghetti if Madison’s spending were more typical for many districts along with improved reading results. We seem to be continuing the “same service” approach of spending more than most and delivering sub-par academic results for many students. (Note the recent expert review of the Madison schools Analysis: Madison School District has resources to close achievement gap.)

That is the issue for our community.

Best wishes,

Jim

Related: Middleton-Cross Plains’ $91,025,771 2012-2013 approved budget (1.1mb PDF) for 6,577 students, or $13,840.01 per student, roughly 4.7% less than Madison’s 2012-2013 spending.

45% (!) Increase in Madison Schools’ Fund 80 Property Taxes from the 2011-2012 to 2012-2013 School Year; No Mention of Total Spending

July, 2013 Madison Schools 2013-2014 Budget Presentation (PDF). Notes:

- No mention of total spending…. How might the Board exercise its oversight obligation without the entire picture?

- The substantial increase in redistributed state tax dollars (due to 4K) last year is not mentioned. Rather, a bit of rhetoric: “The 2013-14 budget development process has focused on actions which begin to align MMSD resources with the Strategic Framework Priorities and strategies to manage the tax levy in light of a significant loss of state aid.” In fact, according to page 6, the District expects to receive $46,392,012 in redistributed state tax dollars, which is a six (6%) increase over the funds received two years ago.

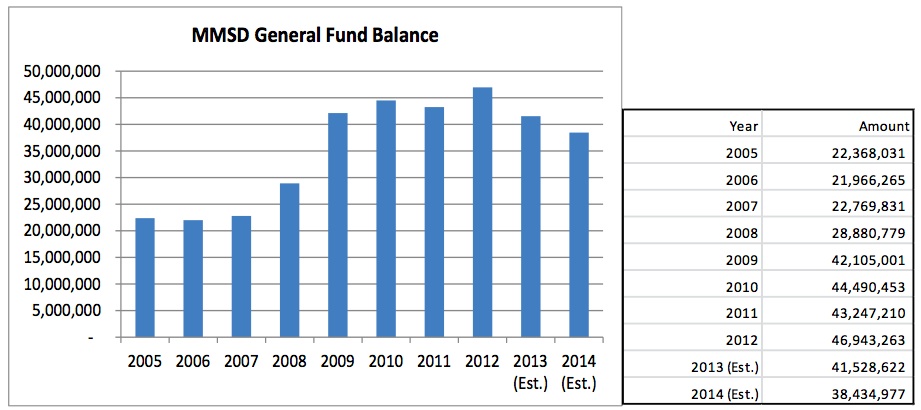

- The District’s fund equity (financial cushion, or reserves) has more than doubled in the past eight years, from $22,368,031 in 2005 to $46,943,263 in 2012.

- Outbound open enrollment continues to grow, up 14% to 1,041 leavers in 2013 (281 inbound from other Districts).

- There is no mention of the local tax or economic base:

- The growth in Fund 80 (MSCR) property taxes and spending has been controversial over the years. Fund 80, up until recently was NOT subject to state imposed property tax growth limitations.

- Matthew DeFour briefly summarizes the partial budget information here. DeFour mentions (no source referenced or linked – in 2013?) that the total 2013-2014 budget will be $391,000,000. I don’t believe it:

The January, 2012 budget document mentioned “District spending remains largely flat at $369,394,753” (2012-2013), yet the “baseline” for 2013-2014 mentions planned spending of $392,807,993 “a decrease of $70,235 or (0.02%) less than the 2012-13 Revised Budget” (around $15k/student). The District’s budget generally increases throughout the school year, growing 6.3% from January, 2012 to April, 2013. Follow the District’s budget changes for the past year, here.

Finally, the document includes this brief paragraph:

Work will begin on the 2014-15 early this fall. The process will be zero-based, and every line item and FTE will be carefully reviewed to ensure that resources are being used efficiently. The budget development process will also include a review of benefit programs and procurement practices, among other areas.

One hopes that programs will indeed be reviewed and efforts focused on the most urgent issues, particularly the District’s disastrous reading scores.

Ironically, the recent “expert review” found that Analysis: Madison School District has resources to close achievement gap. If this is the case (and I agree with their conclusion – making changes will be extraordinarily difficult), what are students, taxpayers and citizens getting for the annual tax & spending growth?

I took a quick look at property taxes in Middleton and Madison on a $230,000 home. A Middleton home paid $4,648.16 in 2012 while a Madison home paid 16% more, or $5,408.38.

Middleton seeks 11.5 percent increase in property tax levy

In each of the past three years, the city of Middleton tried to avoid raising property taxes as it paid for three new $18 million public safety buildings.

That will change if the city’s proposed 2012 budget, which calls for an 11.5 percent increase in total property taxes, is approved by the City Council Tuesday night. The increase would amount to about a $150 jump for a $250,000 home, according to city administrator Mike Davis. More specific figures were not available Friday.

“The jump is practically directly related to the debt service for the new public safety buildings,” Davis said.

Middleton opened new fire and EMS stations in 2008 and a new police station in 2010 at a total cost of $18 million, Davis said. The city’s 2011 borrowing costs were more than $3.5 million, and Davis said most of that bill was paid with previously raised money. The tab for 2012 will be $3.6 million.

“Now it’s being picked up mainly by property taxes,” Davis added.

Revenue Caps Affect Middleton

Budget Hangs On Enrollment Middleton Watching Numbers The Capital Times Tuesday, July 11, 2006 By Christopher Michaels Increased enrollment in the weeks preceding the start of the school year could mean more state aid for the Middleton-Cross Plains School District. It also could mean an easing of planned staff reductions of special concern to one […]

Why is One City Charter School Facing Legacy Madison Media Blowback?

Kaleem Caire: Thank you CapTimes for printing my OpEd. Interestingly, in a conversation with the Wisconsin Department of Public Instruction yesterday, state officials told us that we are legally obligated to count our students who are enrolled and present on the day of the pupil count (tomorrow, Friday). This is state law. They also told […]

K-12 Tax, Spending, Referendum and School Climate: Germany eyes a four-day week to help prevent mass layoffs

Charlotte Edmond: Germany’s largest trade union, IG Metall, is proposing its members call for a four-day week to offset economic pressures heightened by the pandemic. The proposal has had a mixed reception, with the German labour minister open to the possibility, while others are fundamentally opposed. The idea of a reduced working week has already […]

Group of Black leaders opposing $350M Madison schools referendums

Logan Wroge: An advocacy group of Black leaders is opposing the Madison School District’s $350 million ask of taxpayers this fall, arguing the proposals are under-developed and the district hasn’t done enough to support African American children to get their endorsement on the two November ballot referendums. In a statement sent to some media members […]

Monopoly Power Lies Behind Worst Trends in U.S., Fed Study Says

Craig Torres: The concentration of market power in a handful of companies lies behind several disturbing trends in the U.S. economy, like the deepening of inequality and financial instability, two Federal Reserve Board economists say in a new paper. Isabel Cairo and Jae Sim identify a decline in competition, with large firms controlling more of […]

“The Shame of Progressive Cities, Madison edition”

Chris Stewart discusses our long term, disastrous reading results with Kaleem Caire. mp3 audio transcript 2011: A majority of the Madison School Board aborted the proposed Madison Preparatory IB Charter school. Kaleem Caire notes and links. Let’s compare: Middleton and Madison Property taxes Madison property taxes are 22% more than Middleton’s for a comparable home, […]

K-12 Tax, Referendum and spending climate: What Will Not Recover: Government

Jeffrey Tucker: What becomes of government credibility in the post-lockdown period? There are thousands of politicians in this country for whom this is a chilling question, even a taboo topic. The reputation of government was already at postwar lows before the lockdowns, with only 17% of the American public saying that they trusted government to […]

A summary of community feedback (website) on Madison’s recent Superintendent candidates

Scott Girard: Records released by the Madison Metropolitan School District show feedback from staff and community members included plenty of praise and criticism for the two finalists for the district’s superintendent position this summer. Both Carlton Jenkins and Carol Kelley received positive feedback from many who filled out the forms, which asked respondents to answer […]

K-12 Tax, Spending & Referendum climate: Parents and closed schools

Chris Hubbach: After a spring of pandemic lockdowns and a summer of uncertainty as coronavirus infections surged, working parents with school-age children now face what could be a year of online schooling, presenting a buffet of bad options. Sacrifice earnings and career advancement to stay home. Hire a nanny, if you can afford it. Lean […]

“That is all tied up in the bargaining so there’s nothing I can say about it,” Robinson wrote in an email.

Dahlia Bazzaz: The district and the union have been discussing work expectations for this fall, sparring over the prospect of some instructors providing in-person services. This marks the third straight summer when bargaining talks have cast doubt over the first day of school. Robinson denied that the idea of a delayed start was being explored […]

Rather Than Reopen, It’s Time to Rethink Government Education

Cathy Ruse & Tony Perkins: There is no better time to make a change than right now, when public education is in chaos. What’s that popping sound? Could it be a million figurative lightbulbs clicking on above public-school parents’ heads? The vast majority of American families send their children to public schools. Only 11 percent […]

Madison School Board President’s Rhetoric on growing gun violence

Gloria Reyes: We must prepare and implement a plan of action to prevent violence and to stop this horrific rise in violence.” David Blaska: Our word of the day is ‘Chutzpah’ (Yiddish for “what nerve!”) This is the school board president who kicked cops out of Madison’s troubled high schools NEWS ALERT: Detectives from the […]

Wisconsin Homeschooling requests more than double last year

Scott Girard: More than twice as many Wisconsin families as a year ago have told the state they plan to homeschool for the 2020-21 school year. According to data from the state Department of Public Instruction, 1,661 families filed forms to homeschool between July 1 and Aug. 6, up from 727 during the same period […]

K-12 Tax, Referendum and Spending Climate: Freed from the office, Madison telecommuters are snapping up rural homes

Steven Elbow: The coronavirus pandemic has a lot of people feeling boxed in. But for Michelle Possin it opened up a whole new realm of possibilities. Before the COVID-19 crisis, the 54-year-old recruiter for TASC, a Madison-based administrative services company, spent half her time at home and the other half in the office. But now […]

A chat with Jane Belmore

Scott Girard: Jane Belmore retired in 2005 after nearly three decades as a Madison teacher and principal. That wasn’t the end of her career with the Madison Metropolitan School District: She’s since been asked twice to lead when the district found itself between superintendents. Both turned out to be pivotal moments for the district. Cap […]

2020 Referendum: Commentary on adding another physical Madison School amidst flat/declining enrollment..

Scott Girard: Options at the new school under the recommendation would include designating it as a Community School — the district has four of those now — or creating specific programming like social-emotional learning, social justice or environmental education. Other ideas could still be added to that list as the planning process continues. Teachers have […]

Texas Education Association online education Commentary

Brittney Martin: Though Lee struggled with her online classes last semester, Garcia plans to keep her home again this fall. Lee has asthma, as does her nineteen-year-old sister, who contracted COVID-19 in June and narrowly avoided having to be admitted to the hospital as she struggled to breathe. Garcia has once again requested a hot […]

K-12 Tax, Referendum and Spending Climate: Most Americans don’t have enough assets to withstand 3 months without income

Oregon State University: A new study from Oregon State University found that 77% of low- to moderate-income American households fall below the asset poverty threshold, meaning that if their income were cut off they would not have the financial assets to maintain at least poverty-level status for three months. The study compared asset poverty rates […]

K-12 Tax, Referendum & spending climate: California’s state budget has big benefits for a Teacher unions, stifles charter schools and funds phantom students

Mike Antonucci: Students of civics might think the California state budget is crafted by the elected representatives of the citizenry, who debate and amend proposals working their way through various committees, ultimately leading to a spending plan with majority support and the signature of the governor. All that happens, of course, but no budget makes […]

New taxpayer supported Madison K-12 superintendent to prioritize students’ mental, emotional health

Scott Girard: The new Madison Metropolitan School District superintendent stressed the importance of community buy-in during his introductory press conferenceWednesday. Carlton Jenkins, hired in early July, began in the role Aug. 4. He said he will focus on improving reading abilities, improving student mental health and rebuilding trust during his first year on the job, stressing the […]

K-12 Tax, Referendum & Spending Climate: In Coronavirus Bill, Democrats Push Massive Tax Cut For The Rich

Elle Reynolds: As the White House and House and Senate leaders continue trying to decide how to distribute more deficit spending on items tagged “coronavirus,” Democrats have come under fire for pushing a $137 billion tax break for the wealthy. The proposal, which was also part of a 1,800-page bill the Democrat-led House passed in […]

Waunakee school board reverses decision on all-virtual start to school year

WKOW-TV: The Waunakee Community School District Board of Education voted to reverse its decision on an all-virtual start to the school year. During a meeting Monday night [video], members of the board talked about recent coronavirus numbers and learning options that would best fit the community. In a 4-3 vote, the board was in favor […]

School teachers from across the state protest for a virtual fall semester

Tamia Fowlkes: Protesters from four of Wisconsin’s largest cities gathered Monday in a National Day of Resistance caravan to demand that legislators and superintendents make the fall 2020 academic semester completely virtual. Educator unions, community organizations and advocates from Kenosha, Madison, Milwaukee and Racine traveled to the Capitol, the state Department of Public Instruction and […]

Madison’s Taxpayer Supported K-12 Schools’ fall plan includes Sept. 8 virtual start, MSCR child care for up to 1,000 kids

Scott Girard: District administrators outlined the latest updates to the “Instructional Continuity Plan” Monday night for the School Board’s Instruction Work Group. Board members expressed appreciation to staff for their efforts and asked questions about engaging students and ensuring they get some social experiences despite the restrictions of the virtual environment. The district announced July 17 it […]

Many (Madison) area private schools offering in-person learning this fall

Scott Girard: As the 2020-21 school year approaches, private schools are taking advantage of smaller enrollments and fewer buildings to plan in-person learning while area public schools are focusing on virtual learning. And since the Madison Metropolitan School District announced July 17 it would start the year entirely virtually, some private schools are seeing an increase in […]

K-12 Tax, Referendum & Spending Climate: U.S. Gets a Debt Warning From Fitch as Stimulus Battle Rages

Benjamin Purvis: One of the world’s major credit-rating companies fired a warning shot regarding the U.S.’s worsening public finances on Friday, just as lawmakers in Washington contemplate spending more to combat the economic fallout from the coronavirus pandemic. Fitch Ratings revised its outlook on the country’s credit score to negative from stable, citing a “deterioration […]

Commentary on The taxpayer supported Madison School District’s online Teacher Effectiveness

Emily Shetler: Almost immediately after the Madison School District joined other districts across the country in announcing a return to online instruction instead of bringing students back to the classroom for the fall semester, posts started popping up on Facebook groups, Craigslist, Reddit and the University of Wisconsin-Madison student job board seeking in-home academic help. Parents […]

Madison School District to use some federal COVID-19 relief funds for online math instruction (Fall 2020 Referendum tax & Spending increase plans continue)

Logan Wroge: The Madison School District will spend close to $500,000 out of the $8.2 million the district estimates it will receive from the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act to shore up its mathematics instruction for elementary and middle school students. Using CARES Act money, the district plans to: • Purchase […]

Madison’s taxpayer supported K-12 schools may receive an additional $3.9M in redistributed federal tax dollars amidst fall 2020 referendum plans

Logan Wroge: The Madison School District is eligible for up to $3.9 million. It’s the only district in Dane County that is eligible for money from this specific pot in the CARES Act. Costs continue to grow for local, state and federal taxpayers in the K-12 space, as well: Let’s compare: Middleton and Madison Property […]

La La Land Congress Wants To Give Billions To Public Schools To Stay Closed

Joy Pullman: When schools shut down this spring, Congress sent them $31 billion — nearly half its annual schools outlay — for sanitation and online learning, even though students weren’t in schools to theoretically contaminate them and online learning barely happened for millions of children. The vast majority of this money has not even reached schools yet. Nevertheless, […]

Online classes are not worth cost of full tuition

Hope Mahood: University life is going to look very different this fall, and as faculty scramble to work social distancing into their “campus culture,” students will be left paying the price for a half-baked education. With exceptions for science labs, fine arts studios and a few small tutorials — Ontario’s university courses will run online […]

Nordic Study Suggests Open Schools Don’t Spread Virus Much

Kati Pohjanpalo and Hanna Hoikkala: Scientists behind a Nordic study have found that keeping primary schools open during the coronavirus pandemic may not have had much bearing on contagion rates. There was no measurable difference in the number of coronavirus cases among children in Sweden, where schools were left open, compared with neighboring Finland, where […]

Commentary on 2020 K-12 Governance and opening this fall

Wisconsin State Journal: Unfortunately, the Madison School District announced Friday it will offer online classes only this fall — despite six or seven weeks to go before the fall semester begins. By then, a lot could change with COVID-19, the disease caused by the novel coronavirus. Dane County recently and wisely implemented a mask requirementfor inside […]

K-12 Tax, Referendum & Spending Climate: Flight to suburbs boosts U.S. homebuilding

Lucia Mutukani: “The numbers also verify that many people are leaving, or planning to leave, big cities as telecommuting becomes the norm for many businesses.” Housing starts increased 17.3% to a seasonally adjusted annual rate of 1.186 million units last month, the Commerce Department said. The percentage gain was the largest since October 2016. Data […]

K-12 Tax & Spending Climate: State lawmakers will ask New Yorkers for input regarding state’s population decrease

Sarah Darmanjian: “When enough people who can afford to leave New York State are gone, who will be left to pay for the infrastructure, health care, schools and other necessities?” said Sen. Tedisco. “This is a bi-partisan effort to shine the light on this problem that’s causing people to leave our Upstate communities and to […]

Madison 2020 Referendum Climate: Taxpayers decide some states aren’t worth it

Ben Eisen and Laura Kusisto: The average property tax bill in the U.S. in 2018 was about $3,500, according to Attom Data Solutions, a real-estate data firm. But many residents in New York, New Jersey, Connecticut and California had been deducting well over $10,000 a year. In Westchester County, N.Y., the average property-tax bill was […]

Commentary (seems to lack data…) on Madison’s K-12 Tax & Spending Increase Referendum

It is unfortunate two recent articles on the upcoming Madison School District tax & spending increase referendum lack data, such as: Total Spending for the current budget ($449,482,373.22 more) – about $18,000/student. Chicago spends about $14,336/student, Boston $20,707 and Long Beach $12,671/student. Historic Spending Changes (spending increases every year) Academic Outcomes vs. Spending Comparison with […]

Madison School District’s 2015-2016 Budget Goals & Priorities (Publish Total Spending?)

Madison School District (PDF): A. Alignment to Strategic Framework- In our vision to make every school a thriving school that prepares every student to be ready for college, career and community, these budget resources support the district’s goals and priorities as defined in our Strategic Framework. B. More equitable use of resources- As opposed to […]

K-12 Tax & Spending Climate: How to Get Rich Just by Moving

Ben Steverman: What if you could get a 20 percent discount on everything from beer to real estate? You can. You just have to move to Danville, Illinois. And that’s assuming you live in a town with average prices. Residents of Honolulu and New York, the two most expensive cities in the U.S., would see […]

Madison Schools’ 2014-2015 $402,464,374 Budget Document (April, 2014 version)

The Madison School District (3MB PDF): Five Priority Areas (just like the “Big 10”) but who is counting! – page 6: – Common Core – Behavior Education Plan – Recruitment and hiring – New educator induction – Educator Effectiveness – Student, parent and staff surveys – Technology plan 2014-2015 “budget package” 3MB PDF features some […]

Elementary Data: Madison’s Proposed $39,500,000 Maintenance & Expansion Referendum

Madison Schools’ March, 2014 Facility Plan (PDF):: Shorewood Elementary: In conjunction with building an elevator tower, add a four-classroom addition. The additional classrooms are a relatively easy gain based on the building design. Shorewood’s 2013-2014 Low Income Population: 33.8%; All Madison Elementary Schools: 52.1% 2012-2013 Basic & Minimal Reading Proficiency: 34.3% Madison School District: 62.5% […]

Madison teachers union ratify contract for 2014-15

Madison School District teachers and staff will be covered under a collective bargaining agreement through the 2014-15, pending approval by the Madison School Board.

Madison Teachers Inc. members gathered Wednesday evening at Madison Marriott West in Middleton to ratify a one-year contract extension with the district. MTI’s five bargaining units, which include teachers, education assistants, clerical and security staff, and other district employees, all ratified the deal.

The Madison School Board will vote on the agreement Monday.

John Matthews, executive director of the union, said that pending school board approval, MTI would be the only teachers’ union in Wisconsin with a contract through the 2014-15 school year.Related: Proposed City of Madison budget raises property taxes by 1.5%, while the Madison School District’s 2013-2014 budget increases taxes by 4.5%, after a 9% increase two years ago (and a substantial jump in redistributed state tax dollars last year).

Wisconsin school spending grew 10.2% during 2008-11, compared to 2.9% nationally, according to newly available Census figures

Despite cuts to state school aid in 2010, and slower growth of school revenue limits in 2010 and 2011, Wisconsin per student spending increased 2.6% in 2010 and 3.6% in 2011. Wisconsin school spending averaged $11,774 per student in 2011, 15th highest nationally and 11.5% above the national average ($10,560).

What is not yet known (since federal data have a two year lag) is how Wisconsin will stack up with other states in light of state budget actions in 2011-13. However, researchers from the Wisconsin Taxpayers Alliance (WISTAX) estimate that the 5.5% cut in 2012 Wisconsin school revenue limits will trim spending to $11,126 per student, potentially shrinking the gap between school spending here and nationally. WISTAX is a nonpartisan, nonprofit research organization dedicated to policy research and citizen education.

The new federal figures for 2011 show that, unlike Wisconsin, many states saw declining combined aid (state and federal) to schools during 2009-11; 11 states in 2009, 17 in 2010, and 22 in 2011. By contrast, state-federal support in Wisconsin rose 3.3% in 2009, 0.4% in 2010, and 2.7% in 2011.

The difference in aid trends between Wisconsin and the nation was reflected in per pupil expenditures. U.S. school spending grew 2.3% in 2009 and 1.1% in 2010, before falling 0.5% in 2011. In Wisconsin, however, per student spending during those years rose 3.7%, 2.6%, and 3.6%, respectively.

Many states trimmed school spending during 2009-11. Two states made cuts in all three years, and another seven cut spending in both 2010 and 2011. As national figures have already suggested, retrenchment did not occur in Wisconsin until 2012.Related: A Look at Property Taxes Around the World and Madison’s 16% increase since 2007; Median Household Income Down 7.6%; Middleton’s 16% less and Madison School Board Passes 2013-2014 Budget, including a 4.5% Property Tax Increase.

Madison Schools 2013-2014 “Supplemental Budget” Document

1.1MB PDF: Background information on the Madison School District’s 2013-2014 budget (PDF District Overview), which includes a 4.5% property tax increase, after 9% two years ago.

Middleton’s property taxes on a “typical” $230,000 home is 16% less than Madison’s.

Much more on the 2013-2014 Madison School District budget, here.

Madison Schools’ 2013-2014 Budget Charts, Documents, Links, Background & Missing Numbers

Sources:

- General and Categorical Aid – Payments to School Districts

- WISTAX Facts & Figures

- Madison Schools 2013-2014 June 10, 2013 Budget Discussion Document (PDF)

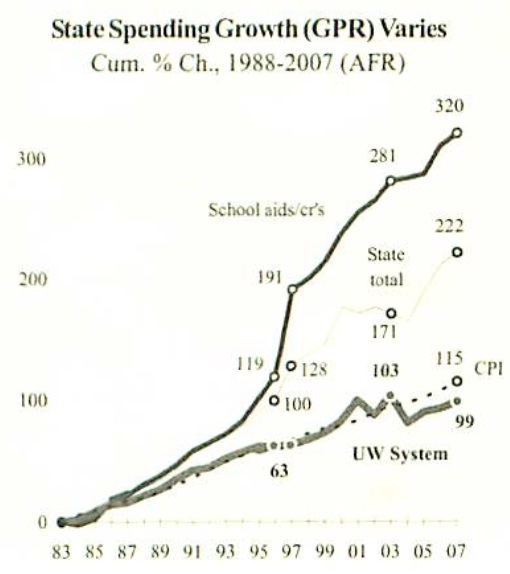

- Wisconsin State Tax Based K-12 Spending Growth Far Exceeds University Funding

- Up, Down & Transparency: Madison Schools Received $11.8M more in State Tax Dollars last year, Local District Forecasts a Possible Reduction of $8.7M this Year – March, 2013. The June 10, 2013 District budget document (PDF) fails to mention the previous year’s large increase in redistributed State of Wisconsin tax dollars:

Like all Wisconsin school districts, MMSD relies upon a state-local funding partnership. The actions of one partner greatly impact the other partner. The 2013-14 MMSD budget anticipates a major funding loss for MMSD (a loss of $8.7 in equalization aid) which shifts the funding burden onto the local property taxpayer.

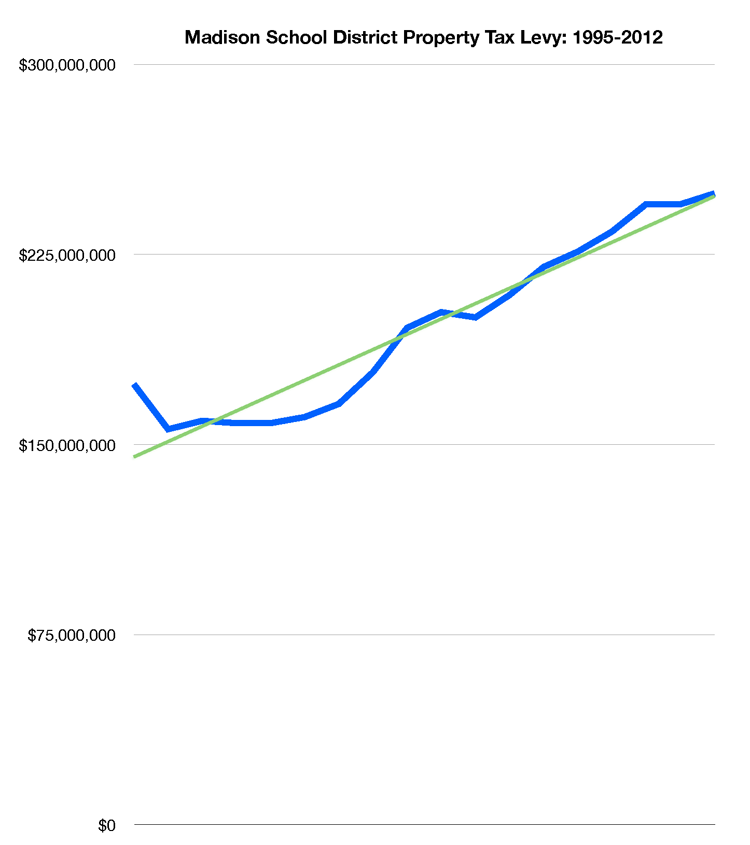

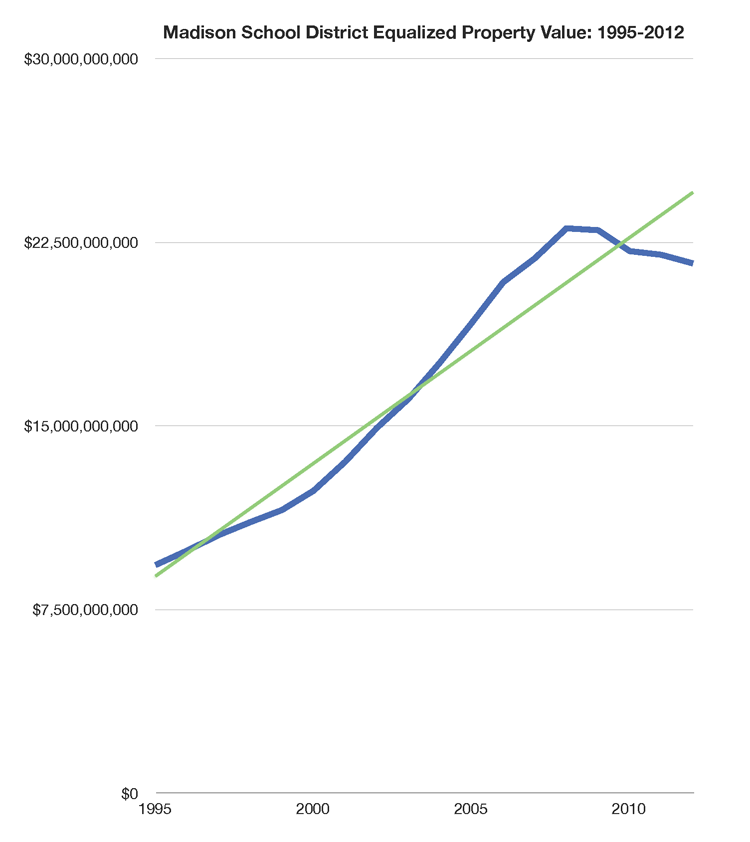

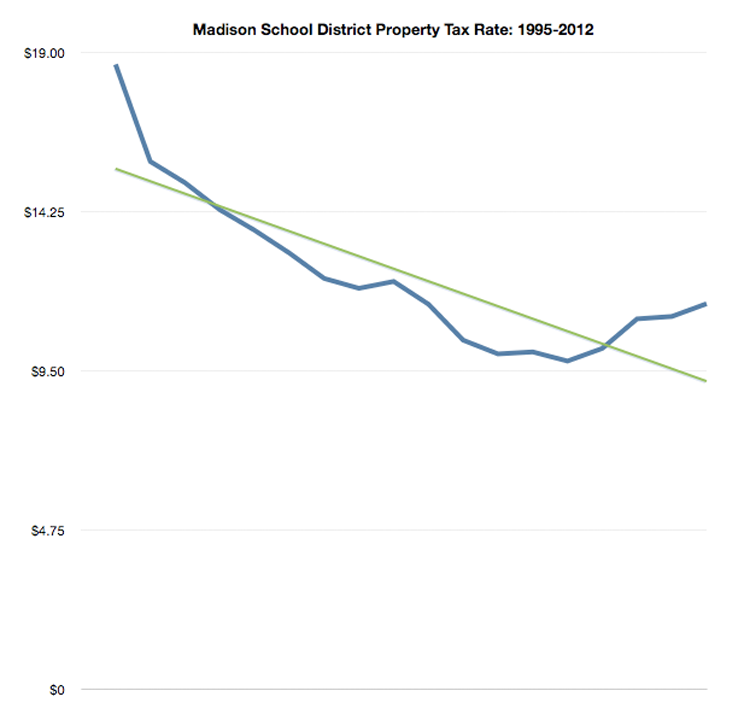

The charts reveal several larger stories:

First, the State of Wisconsin “committed” to 2/3 K-12 funding in the mid-1990’s. The increase in redistributed state tax dollars is apparent. [Wisconsin Legislative Fiscal Bureau: State Aid to School Districts (PDF)]

Second, Madison’s substantial real estate growth during the 2000’s supported growing K-12 spending while reducing the property tax rate (the overall pie grew so the “rate” could fall somewhat). The real estate music stopped in the late 2000’s (“Great Recession) and the tax rate began to grow again as the District consistently raised property taxes. *Note that there has been justifiable controversy over Madison’s large number of tax exempt properties. Fewer exemptions expands the tax base and (potentially) reduces individual homeowner’s taxes.

Third, Madison has long spent more per student than most public schools.

Fourth, the District’s June 10, 2013 budget document fails to address two core aspects of its mission: total spending and program effectiveness. The most recent 2012-2013 District budget number (via a Matthew DeFour email) is $392,789,303. This is up 4.4% from the July, 2012 District budget number: $376,200,000. The District’s budget has always – in my nine years of observation – increased throughout the school year. The late, lamented “citizen’s budget” was a short lived effort to create a standard method to track changes over time.

Fifth, the June 10, 2013 document does not include the District’s “Fund balance” or equity. The balance declined during the 2000’s, somewhat controversially, but it has since grown. A current number would be useful, particularly in light of Madison’s high property taxes.

Sixth, I took a quick look at property taxes in Middleton and Madison on a $230,000 home. A Middleton home paid $4,648.16 in 2012 while a Madison home paid 16% more, or $5,408.38. Local efforts to significantly increase property taxes may grow the gap with Middleton.

Finally, years of spending and tax growth have not addressed the District’s long term-disastrous reading results. Are we doing the same thing over and over?

UW Ed School Dean and WPRI President on the Recent School Choice Results

The release of the results of the Wisconsin Knowledge and Concepts Exam, the standardized test that every state public school is required to give, is a rite of spring for Wisconsin schools.

Distributed every year, the WKCEs provide educators, parents and community members with information about how well schools and districts are performing, broken down by subject and grade level.

The WKCEs are used alongside other measures to determine where schools are falling short and what is working well. For parents with many different types of educational options from which to choose, the WKCEs allow them to make informed choices about their child’s school. For taxpayers, the tests provide a level of transparency and demonstrate a return on investment.

But while state law requires all public schools to give the WKCEs, not all publicly funded schools are required do to so. Since its inception 20 years ago, the Milwaukee Parental Choice Program has been virtually without any kind of meaningful accountability measures in place. Choice schools have not been required to have students take the WKCEs. That is, until this school year.We have all done it at one time or another — opened our mouth before engaging our brain.

State Rep. Sondy Pope-Roberts, D-Middleton, just had one of those moments. In reacting to the news that, on average, students attending schools in the Milwaukee Parental Choice program performed about the same or slightly below students in Milwaukee Public Schools, she said taxpayers are being “bamboozled” and the program is “a disservice to Milwaukee students.”

Whoa! Had she taken a moment to think before she spoke, here are a few things that should have occurred to her:

• Those private schools are performing about as well at educating Milwaukee children as the public schools — at half the cost. Public funding for each child in the choice program costs taxpayers $6,442 while each child in Milwaukee Public Schools receives taxpayer support of over $15,000. If all of the 21,000 choice students moved back into Milwaukee Public Schools, that would require a $74 million increase in local property taxes across the state, according to the Legislative Fiscal Bureau.

Sloppy Wisconsin K-12 budget hits Madison, other schools hard

It’s not just Madison schools getting hit with a much bigger cut in state aid than expected.

Middleton-Cross Plains is in the same leaky boat. So are schools in Adams-Friendship, Green Lake, Markesan, Montello, Princeton, Westfield and Wisconsin Dells.

State lawmakers had said no school district in Wisconsin should experience a state aid cut of more than 10 percent, under the state budget just signed into law.

But more than 90 school districts, including all of those listed above, just learned they’re facing cuts greater than 15 percent. In addition, school districts including Lodi and Cambridge are facing cuts of more than 12 percent.

It’s a stunning blow to local schools.

In Madison, it means the worst-case scenario of a 10 percent cut of $6 million next school year just became a much bigger reduction of more than $9 million.

That’s likely to trigger higher local property taxes and cuts to instruction — despite last fall’s referendum that was supposed to steady Madison schools for three years.

School Finance: K-12 Tax & Spending Climate

School spending has always been a puzzle, both from a state and federal government perspective as well as local property taxpayers. In an effort to shed some light on the vagaries of K-12 finance, I’ve summarized below a number of local, state and federal articles and links. The 2007 Statistical Abstract offers a great deal […]

Work to change school funding already begun

A story by Kayla Bunge in The Monroe Times reports: MADISON — With a new legislative session beginning in just about a week, the issue of school funding is certain to receive more attention. And two local legislators — 17th District Sen. Dale Schultz, R-Richland Center, and 27th District Sen. Jon Erpenbach, D-Middleton — already […]

School Tax Relief Plan “all but dead”?

Amy Hetzner notes the interesting paradox to the current situation: Residents in more than half of Wisconsin school districts could have ended up paying more under an all-but-dead idea to raise sales taxes to provide $1.44 billion in property tax relief, a new study says. Milwaukee residents, in particular, could have paid $1 more in […]