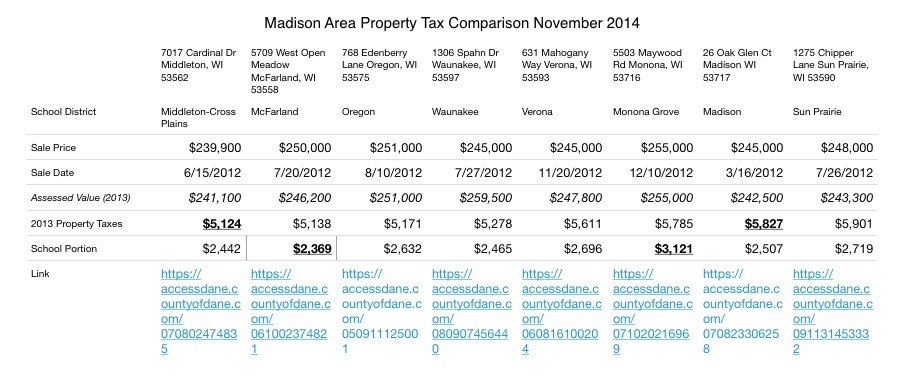

The arrival of Thanksgiving means local homeowners will soon see their annual property tax bills. The chart below compares Madison area homes sold in 2012, ranging in price from $239,900 to $255,000

Tap to view a larger version. Excel. A Middleton home’s property tax burden is about 13% less than a similar property in Madison (based on 2012 sales and 2013 assessments and payments). The Madison home noted in this analysis was assessed $1100 higher than the Middleton property. Taxes, spending growth and academic achievement over time are surely worth a much deeper dive.

SIS notes and links on Madison area property taxes.

Worth reading: Wisconsin Taxpayers Alliance:

The property tax is Wisconsin’s largest, oldest, and most confusing tax. At least five governments use the tax, and two different methods of valuing property are used to distribute taxes among property owners. One source of confusion arises when tax rates and levies move in opposite directions, a common occurrence over the past 20 years. In addition, property owners are often unaware of how changing property values, both within a municipality and among municipalities, can cause individual property tax bills to rise, even when levies are “frozen.”

Madison Mayor Paul Soglin:”(Property Tax) Delinquencies 30% more than we expect“.

Spending and adult employment.

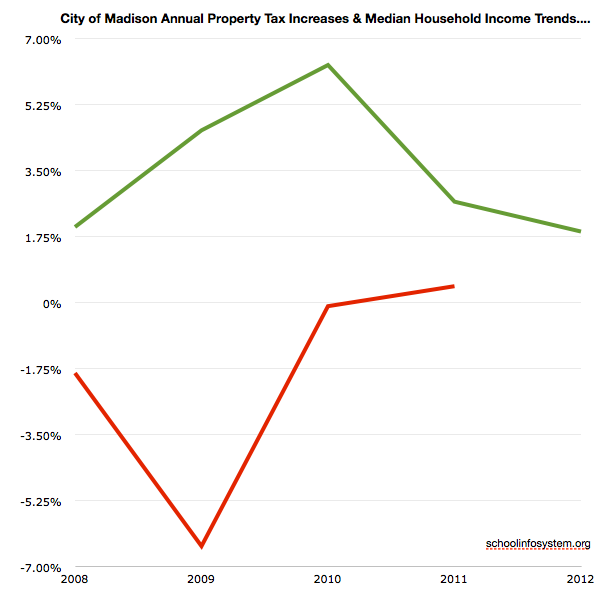

Property tax growth (along with other tax sources) is a manifestation of the challenges we see in our k-12 school districts.