Erin Richards:

Of the 50 largest school districts by enrollment in the United States, Milwaukee Public Schools spent more per pupil than all but three East Coast districts in the 2009-’10 school year, according to public-school finance figures released by the Census Bureau on Thursday.

MPS ranked near the top among large districts by spending $14,038 per pupil in the 2010 fiscal year. It was outspent by the New York City School District, with the highest per-pupil spending among large districts – $19,597 – followed by Montgomery County Public Schools near Washington, D.C., and Baltimore City Public Schools in Maryland, which spent $15,582 and $14,711, respectively, per pupil that year.

MPS officials on Thursday acknowledged Milwaukee’s high per-pupil costs in comparison with other large districts, but they also pointed to unique local factors that drive up the cost, particularly the city’s high rate of poverty, the district’s high rate of students with special needs and other long-term costs, such as aging buildings and historically high benefit rates for MPS employees that the district is working to lower.

“The cost of doing business for Milwaukee Public Schools and Wisconsin is relatively high,” Superintendent Gregory Thornton said. “But because of legacy and structural costs, we were not geared toward driving those dollars back into the classroom.”

“What we have to be is more effective and efficient,” he said.

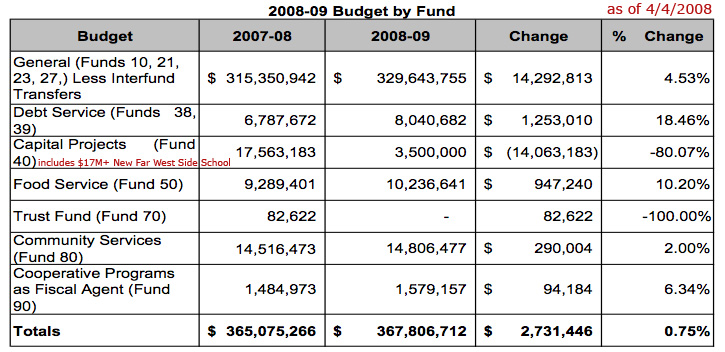

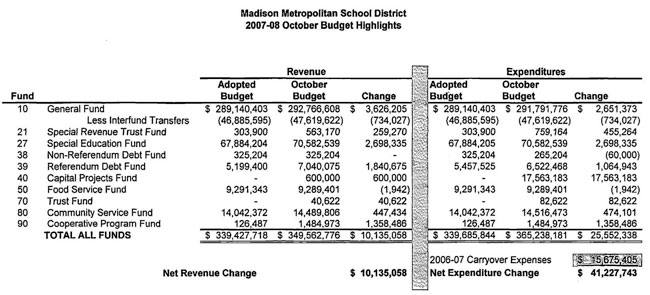

Madison’s 2009-2010 budget was $370,287,471, according to the now defunct Citizen’s Budget, $15,241 per student (24,295 students).

Why Milwaukee Public Schools’ per student spending is high by Mike Ford:

To the point, why is MPS per-pupil spending so high? There are two simple explanations.

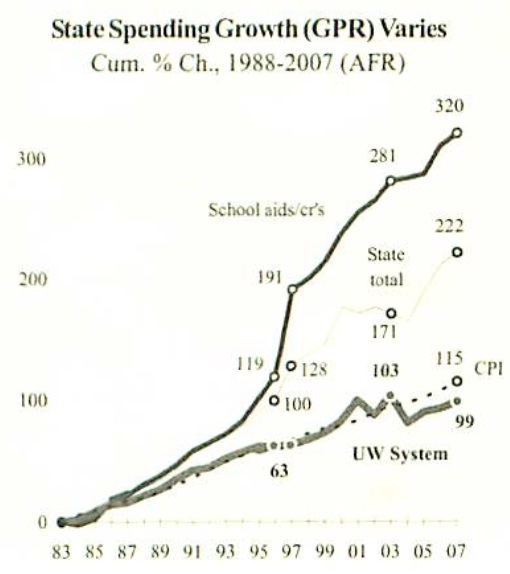

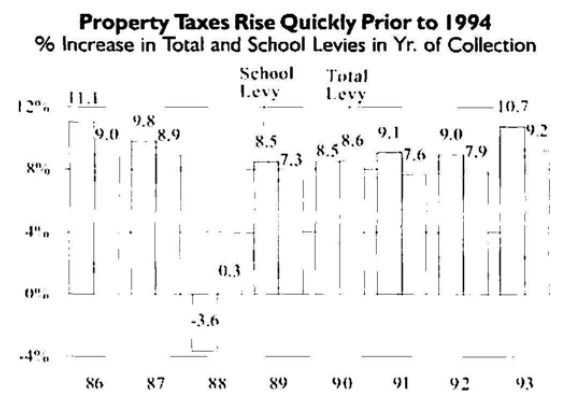

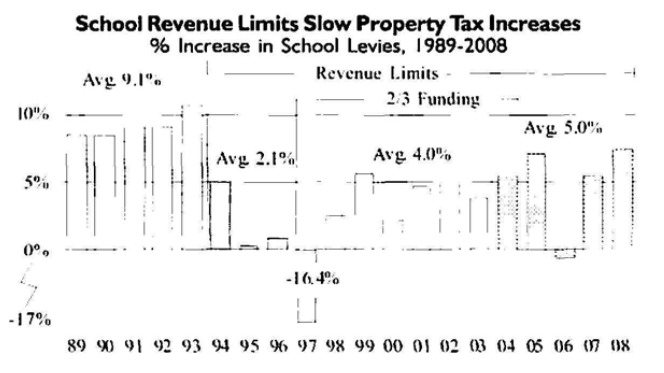

First, as articulated by Dale Knapp of the Wisconsin Taxpayer’s Alliance in today’s story, MPS per-pupil spending is high because it has always been high. Since Wisconsin instituted revenue limits in the early 90s the amount of state aid and local tax revenue a district can raise (and correspondingly spend) per-pupil has been indexed to what a district raised in the prior year. In every state budget legislators specify the statewide allowable per-pupil revenue limit increase amount. Because MPS had a high base to begin with, the amount of revenue the district raises and spends per-pupil is always on the high side. Further, because annual increases are indexed off of what a district raised in the prior year, there is a built-in incentive for districts to raise and spend as much as allowed under revenue limits.

Second, categorical funding to MPS has increased dramatically since 2001. Categorical funds are program specific funds that exist outside of the state aid formula and hence are not capped by revenue limits. In 2001 MPS received $1,468 in categorical funding per-pupil, in 2012 it received $2,318 per-pupil (A 58% increase).

State and local categorical funding to MPS has gone up since 2001, but the bulk of the increase in per-pupil categorical funding is federal. Federal categorical funds per-pupil increased 73% since 2001. Included in this pot of federal money is title funding for low-income pupils, and funding for special needs pupils. The focal year of the study that spurred the Journal Sentinel article, 2010, also is important because of the impact of federal stimulus funding.

Comparing Milwaukee Public and Voucher Schools’ Per Student Spending

Note I am not trying to calculate per-pupil education funding or suggest that this is the amount of money that actually reaches a school or classroom; it is a simple global picture of how much public revenue exists per-pupil in MPS. Below are the relevant numbers for 2012, from MPS documents:

…….

Though not perfect, I think $13,063 (MPS) and $7,126 (MPCP) are reasonably comparative per-pupil public support numbers for MPS and the MPCP.

Spending more is easy if you can simply vote for tax increases, or spread spending growth across a large rate base, as a utility or healthcare provider might do. Over time, however, tax & spending growth becomes a substantial burden, one that changes economic decision making. I often point out per student spending differences in an effort to consider what drives these decisions. Austin, TX, a city often mentioned by Madison residents in a positive way spends 45% less per student.

Ripon Superintendent Richard Zimman’s 2009 speech to the Madison Rotary Club:

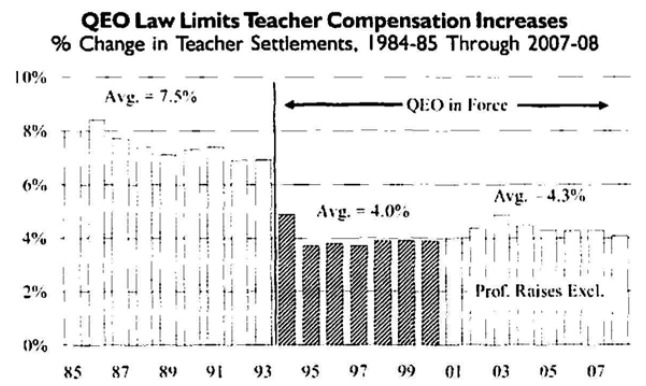

“Beware of legacy practices (most of what we do every day is the maintenance of the status quo), @12:40 minutes into the talk – the very public institutions intended for student learning has become focused instead on adult employment. I say that as an employee. Adult practices and attitudes have become embedded in organizational culture governed by strict regulations and union contracts that dictate most of what occurs inside schools today. Any impetus to change direction or structure is met with swift and stiff resistance. It’s as if we are stuck in a time warp keeping a 19th century school model on life support in an attempt to meet 21st century demands.” Zimman went on to discuss the Wisconsin DPI’s vigorous enforcement of teacher licensing practices and provided some unfortunate math & science teacher examples (including the “impossibility” of meeting the demand for such teachers (about 14 minutes)). He further cited exploding teacher salary, benefit and retiree costs eating instructional dollars (“Similar to GM”; “worry” about the children given this situation).

Finally, there’s this: Paul Geitner:

The Court of Justice had previously ruled that a person who gets sick before going on vacation is entitled to reschedule the vacation, and on Thursday it said that right extended into the vacation itself.